Artisan Lien For Business

Description

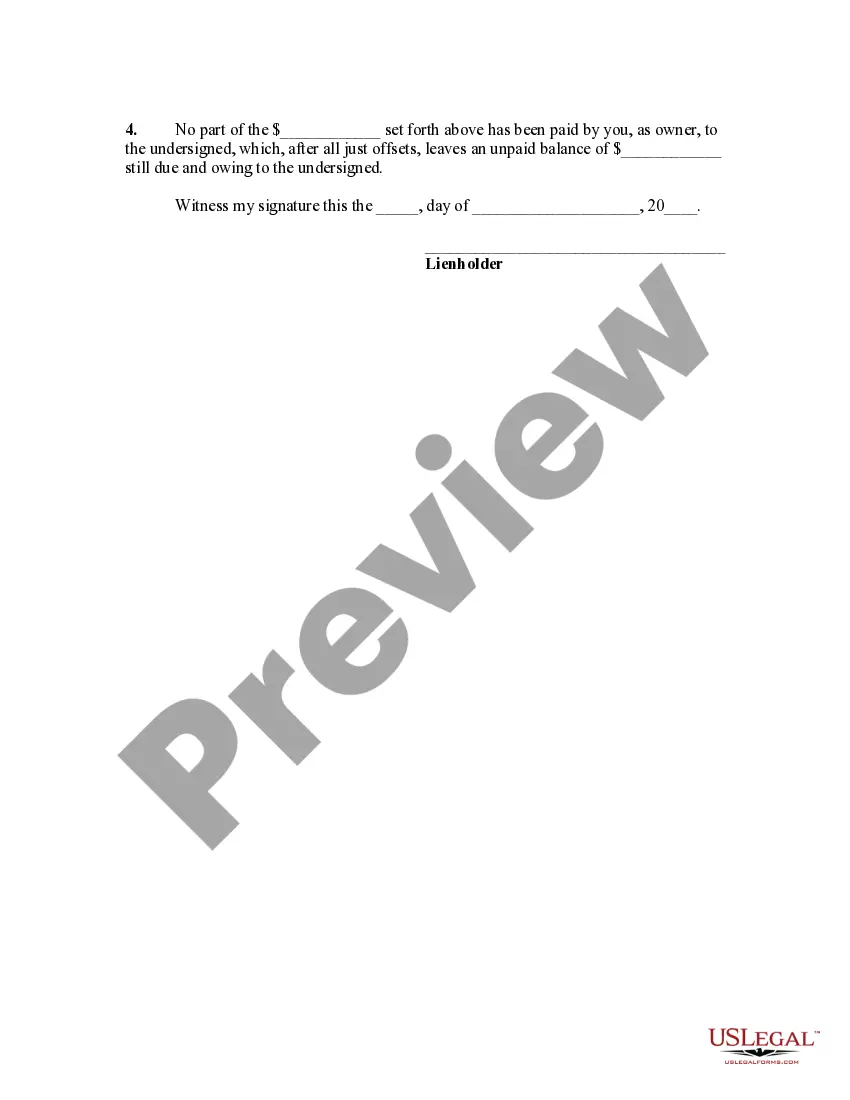

How to fill out Notice Of An Artisans Common Law Lien?

Finding a go-to place to take the most current and appropriate legal samples is half the struggle of dealing with bureaucracy. Finding the right legal papers calls for precision and attention to detail, which is why it is important to take samples of Artisan Lien For Business only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and see all the details concerning the document’s use and relevance for your situation and in your state or county.

Take the listed steps to complete your Artisan Lien For Business:

- Use the catalog navigation or search field to find your sample.

- View the form’s description to ascertain if it fits the requirements of your state and county.

- View the form preview, if there is one, to make sure the template is the one you are looking for.

- Go back to the search and locate the correct document if the Artisan Lien For Business does not fit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Select the pricing plan that suits your requirements.

- Go on to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the document format for downloading Artisan Lien For Business.

- Once you have the form on your gadget, you may change it using the editor or print it and finish it manually.

Eliminate the inconvenience that accompanies your legal paperwork. Discover the extensive US Legal Forms collection where you can find legal samples, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

A lien must be recorded by the county auditor's office where the project itself took place; if the project spanned across county lines, the lien must be filed in all associated county auditors' offices.

You must file the lien foreclosure action in a court that has jurisdiction over the property where you supplied materials or work. You will likely need to consult an attorney to file a foreclosure action. Such actions are expensive and time-intensive so make every effort to settle the matter first!

The lien generally allows the craftsperson to retain possession of the item they worked on until their invoice is paid, or, if physical possession is impossible to retain, it may allow them to put their lien on record on the title.

Notice of Intent to Lien 10 days prior to filing lien. Written consent from residential owner before work. Lien must be filed within 6 months of last work. An action to enforce a Missouri mechanics lien must be initiated within 6 months from filing.

A mechanic's lien is also known as an artisan's lien or a materialmen's lien. The owner of a property may feel compelled to resolve a mechanic's lien as soon as possible because a property typically cannot be sold while a lien is in effect.