Parent Child Support With Garnishment

Description

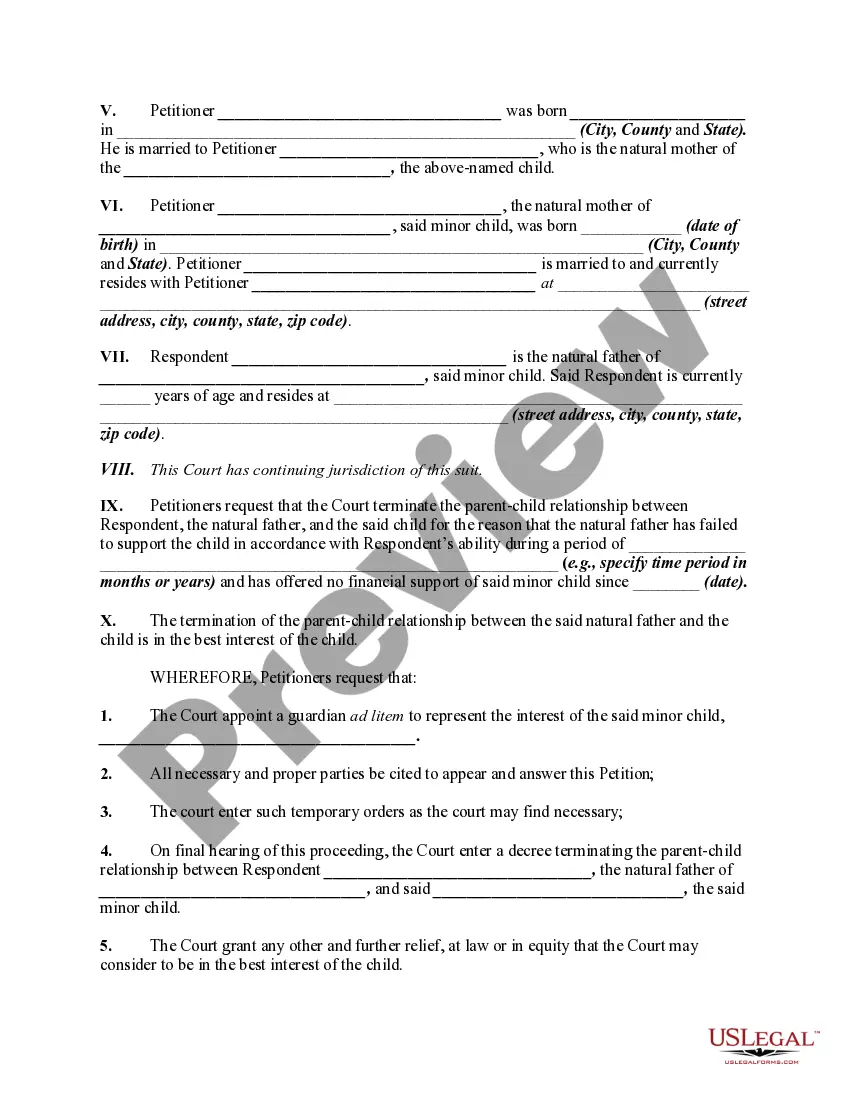

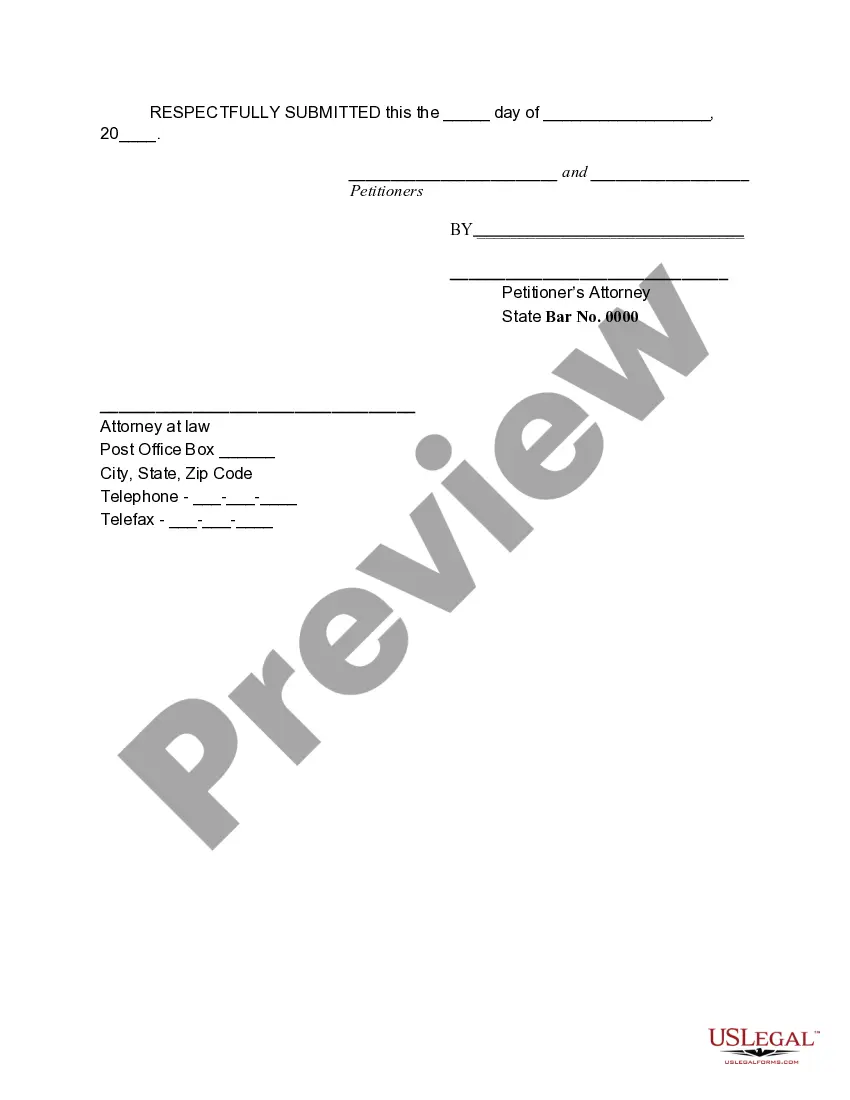

How to fill out Petition By Stepfather And Natural Mother To Terminate Natural Fathers Parent / Child Relationship For Failure To Support Child - Release Of Parental Rights?

Acquiring legal forms that comply with both federal and state regulations is essential, and the web provides numerous alternatives to choose from.

However, why spend time searching for the right Parent Child Support With Garnishment template online when the US Legal Forms digital library already has these forms consolidated in one location.

US Legal Forms is the largest online legal resource featuring over 85,000 editable templates created by legal professionals for various business and personal circumstances. The documents are easy to navigate, categorized by state and intended use.

All forms accessible through US Legal Forms are reusable. To retrieve and complete previously purchased documents, visit the My documents section in your account. Experience the most comprehensive and user-friendly legal document service!

- Our team stays updated with legal changes, ensuring your document is current and compliant when you acquire a Parent Child Support With Garnishment from our platform.

- Getting a Parent Child Support With Garnishment is straightforward and quick for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document template you want in your chosen format.

- For new visitors, follow the steps below.

- Review the template using the Preview function or the text outline to confirm it suits your needs.

Form popularity

FAQ

If a parent falls severely behind on payments, state or federal prosecutors may become involved in the case. This could result in a criminal warrant being issued for the individual's arrest. Criminal contempt of court is a misdemeanor offense in California that can result in one year in jail or longer.

Continued contempt of court for parents who fail to pay child support may escalate the consequences from a civil arrest warrant to: A criminal warrant if the defendant owes $2,500 or more in unpaid child support. Felony charges and up to 2 years in prison for $10,000 or more in unpaid child support.

Garnishment Limits for Specific Debt Types If the spouse or child is part of the order, up to 60% of your income can be garnished. If you have more than 12 weeks of payments in arrears, an additional 5% can be added to the garnishment.

Title III also limits the amount of earnings that may be garnished pursuant to court orders for child support or alimony. The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not.

In Texas, up to 50% of your disposable earnings can be garnished to pay domestic child support obligations. Disposable earnings refer to the money left over after an employer has made deductions required by law. This includes taxes, union dues, medical payments, and nondiscretionary retirement deductions.