Admin Dissolution For Annual Report Reinstatement

Description

How to fill out Sample Letter For Certificate Of Administrative Dissolution - Revocation?

Locating a reliable source to obtain the latest and suitable legal templates is a significant part of navigating bureaucratic processes. Selecting the appropriate legal documents demands accuracy and meticulousness, which is why it's essential to obtain samples of Admin Dissolution For Annual Report Reinstatement solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong the issue you are dealing with. With US Legal Forms, you have minimal concerns. You can review and verify all details regarding the document’s application and significance for your circumstances and within your state or region.

To complete your Admin Dissolution For Annual Report Reinstatement, follow these steps.

Simplify the complexities associated with your legal paperwork. Explore the extensive US Legal Forms library to find legal samples, verify their relevance to your situation, and download them immediately.

- Utilize the library navigation or search bar to locate your template.

- Examine the form’s description to determine if it meets the requirements of your state and county.

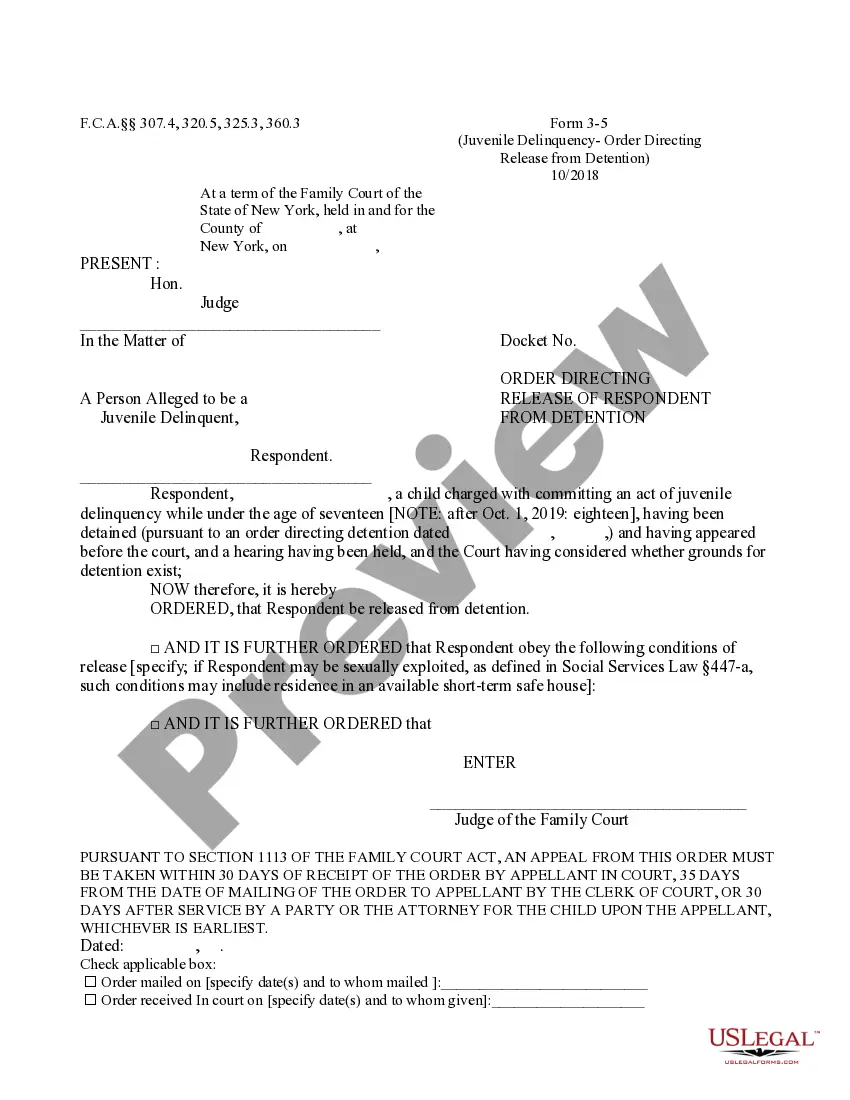

- View the form preview, if available, to confirm that it is the correct form you need.

- Return to the search and find the appropriate document if the Admin Dissolution For Annual Report Reinstatement does not suit your requirements.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Select the pricing option that suits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Admin Dissolution For Annual Report Reinstatement.

- After you have the form on your device, you can edit it using the editor or print it and fill it out manually.

Form popularity

FAQ

In Florida, 'administratively dissolved' means that your LLC has lost its legal status due to failure to comply with state requirements, often related to filing annual reports or paying fees. This situation necessitates taking action for admin dissolution for annual report reinstatement, allowing the business to regain its standing. If you're unsure about your status or need guidance, platforms like US Legal Forms can provide detailed information and resources. They help ensure that you understand your options clearly.

To create a valid trust under Colorado law, the settlor must express an intent to create a trust and have adequate capacity (measured under the same standard applying to wills). Alternatively, a valid trust can be created through authorization provided under a statute, judgment, or decree.

The cost of setting up a trust in Colorado varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

To make a living trust in Colorado, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Colorado has a statute which says the trustee of a trust having its principal place of administration in Colorado shall, within thirty days after his or her acceptance of the trust, register the trust in the court of this state at the principal place of administration.

The cost of setting up a trust in Colorado varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.

Living trusts in Colorado You name a trustee, the person who will manage the assets. It can be anyone and many people name themselves (with a successor trustee in place for after your death). The trust directs that the assets be maintained and used for the trustmaker's benefit during life by the trustee.

The state uses the Uniform Probate Code, though, so unless your estate is particularly large or complex, it may not be needed in Colorado. You can make a living trust by yourself, but if you want to use one it may make sense to find an attorney to help you do it right.