Limited Liability Partnership In Ethiopia

Description

How to fill out Limited Partnership Agreement Between Limited Liability Company And Limited Partner?

Identifying a reliable source to obtain the latest and suitable legal templates is a significant part of dealing with administration. Securing the correct legal documents requires accuracy and careful consideration, highlighting the necessity of sourcing Limited Liability Partnership samples in Ethiopia exclusively from reputable platforms, such as US Legal Forms. An incorrect document can lead to unnecessary delays and consume valuable time.

With US Legal Forms, you can rest assured about your choices. You can access and verify all pertinent information regarding the document’s applicability and significance for your situation and within your jurisdiction.

Once you have the document on your device, you can modify it using the editor or print it out to fill it in manually. Remove the stress associated with your legal documentation. Dive into the comprehensive US Legal Forms library where you can find legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the library navigation or search function to find your template.

- Examine the form’s details to confirm it meets the specifications of your state and locality.

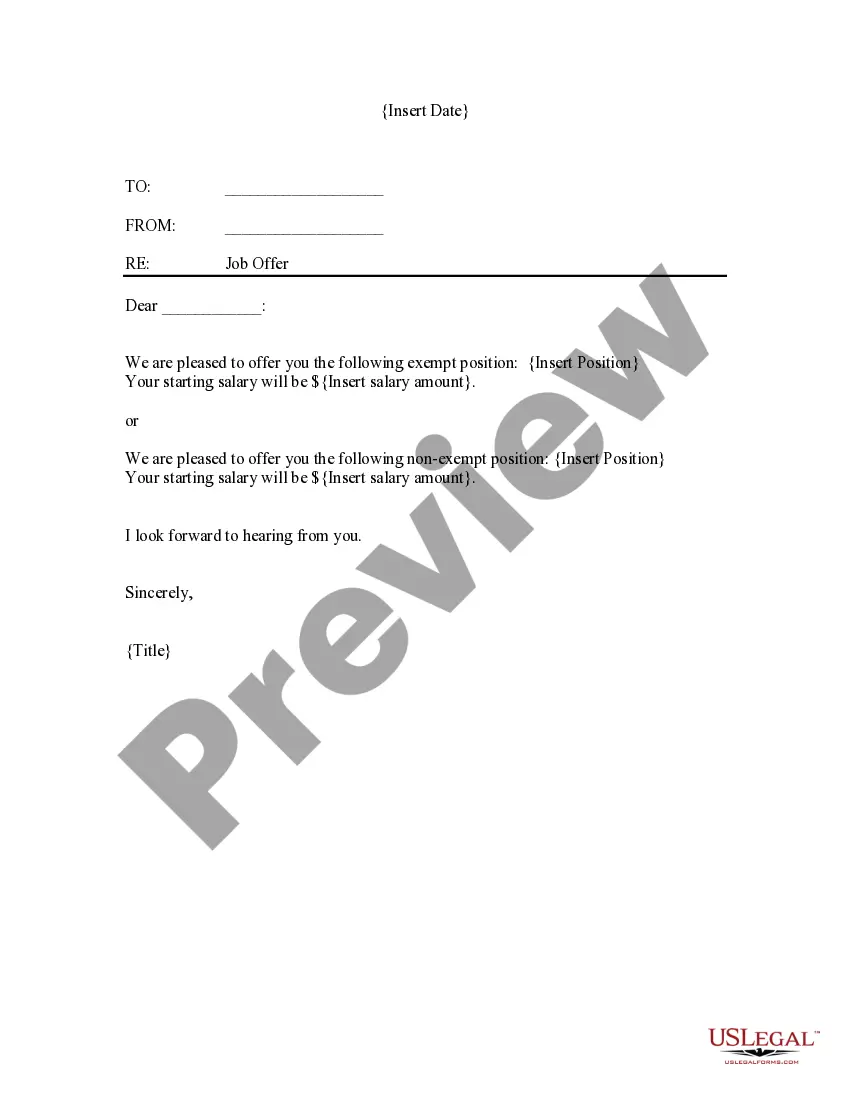

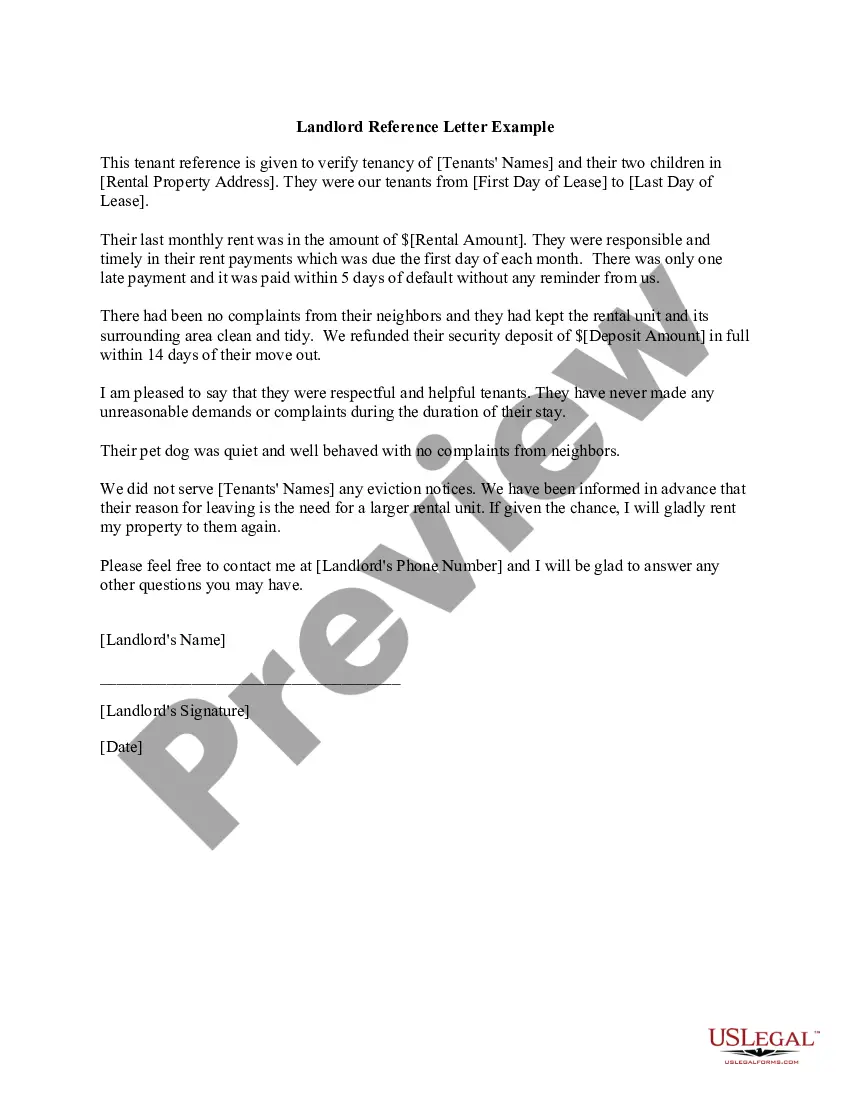

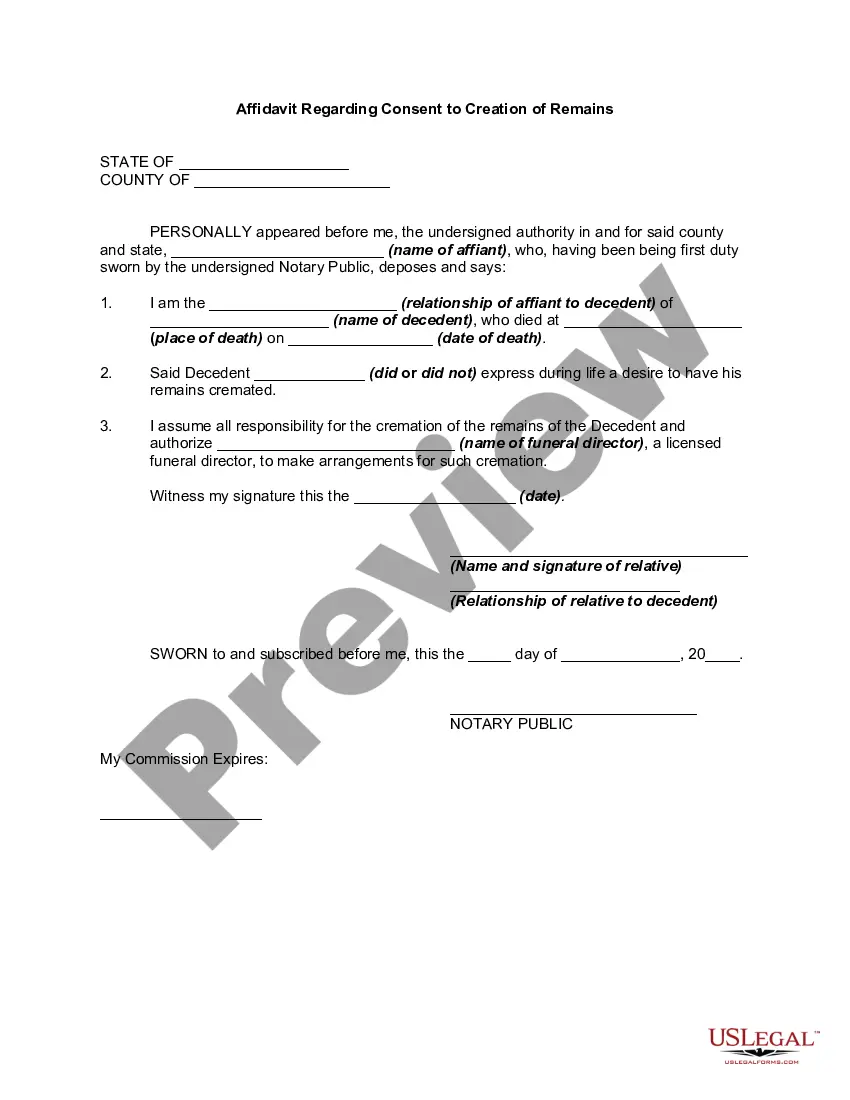

- Preview the form, if available, to ensure the template is indeed the correct one.

- Return to the search results to find the appropriate template if the Limited Liability Partnership in Ethiopia does not fulfill your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to obtain the document.

- Choose the pricing option that suits your requirements.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Limited Liability Partnership in Ethiopia.

Form popularity

FAQ

The main difference between a PLC and a share company in Ethiopia lies in their structure and ownership. A PLC, or Limited Liability Partnership, typically consists of partners who share management responsibilities and profits. Conversely, a share company allows for ownership through shares, where shareholders have limited liability based on their investment. Understanding these distinctions is essential, and US Legal Forms can help clarify these terms and assist you in creating the right business structure for your goals.

Yes, you need to file for a limited partnership in Ethiopia. This process entails submitting registration documents to the appropriate regulatory body to ensure legal recognition. This step is crucial, as it protects both the partnership's and the partners' interests. With tools like US Legal Forms, you can easily access required forms and get assistance with the filing process for your limited liability partnership in Ethiopia.

To establish a Limited Liability Partnership in Ethiopia, you must first choose a unique name for your business that complies with local regulations. Next, prepare necessary documents like a partnership agreement and application forms, which outline the roles and responsibilities of partners. Additionally, register your PLC with the relevant government authority. Utilizing resources like US Legal Forms can simplify this process by providing templates and guidance tailored to establishing a limited liability partnership in Ethiopia.

To create a Limited Partnership, first, you need at least one general partner and one limited partner. Both partners must agree on the terms, which should be documented in a Partnership Agreement detailing the roles, contributions, and profit-sharing structure. After that, you will need to register your Limited Partnership with relevant authorities, ensuring compliance with local laws. Moreover, if you are considering a Limited liability partnership in Ethiopia, the process shares similarities, but it offers distinct advantages, such as limited liability protection for partners.

To form a Private Limited Company (PLC) in Ethiopia, you must first choose a unique name and prepare the necessary documents, including the Memorandum and Articles of Association. Next, you should register your business with the Ethiopian Trade Registration and Business Licensing Authority. Following registration, you need to obtain a tax identification number and consider additional permits depending on your business type. Lastly, if you're interested in creating a Limited liability partnership in Ethiopia, the steps may differ slightly, so it's wise to consult with local experts.

Limited liability in a partnership means that each partner’s financial risk is limited to their investment in the business. This structure protects personal assets from legal claims or debts incurred by the partnership. In the context of a limited liability partnership in Ethiopia, this feature is particularly beneficial as it allows partners to engage in business activities without risking their personal wealth. For detailed information and documentation, consider checking the UsLegalForms platform to find tailored solutions for establishing a limited liability partnership.

Partnerships in Ethiopia are formed when two or more individuals come together to conduct business with a shared goal. The parties involved must create a partnership agreement that outlines the operational structure, roles, and responsibilities. This agreement is essential for defining the terms of the partnership and must comply with local regulations. To ensure a smooth formation process, you can explore resources available on the UsLegalForms platform, which provides templates specifically for limited liability partnerships in Ethiopia.

An LLC, or limited liability company, in Ethiopia is a popular business structure that combines the benefits of a corporation and a partnership. It protects owners by limiting their liability while allowing for flexible management options. Forming an LLC can simplify tax obligations and increase credibility with clients and partners. If you're considering starting a business, understanding the differences between an LLC and a limited liability partnership in Ethiopia can help you make the best choice for your needs.

A limited liability partnership in Ethiopia is a business structure where partners share management duties while also limiting their personal liability. This type of partnership allows investors to participate in profit generation without risking personal assets beyond their investment. The partnership must adhere to specific legal guidelines, including registration and annual reporting requirements. Such structure encourages collaboration while providing protection for individual partners.

To form a limited liability partnership in Ethiopia, you must first select a unique name for your partnership that complies with local laws. Then, you should draft a partnership agreement that outlines the roles, responsibilities, and profit-sharing among partners. Additionally, it is essential to register your partnership with the relevant government authority and obtain any required permits or licenses. Overall, understanding these requirements can help streamline the formation process.