Form Child Support With Taxes

Description

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

Creating legal documents from the beginning can occasionally be somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more economical method of preparing Form Child Support With Taxes or any other paperwork without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

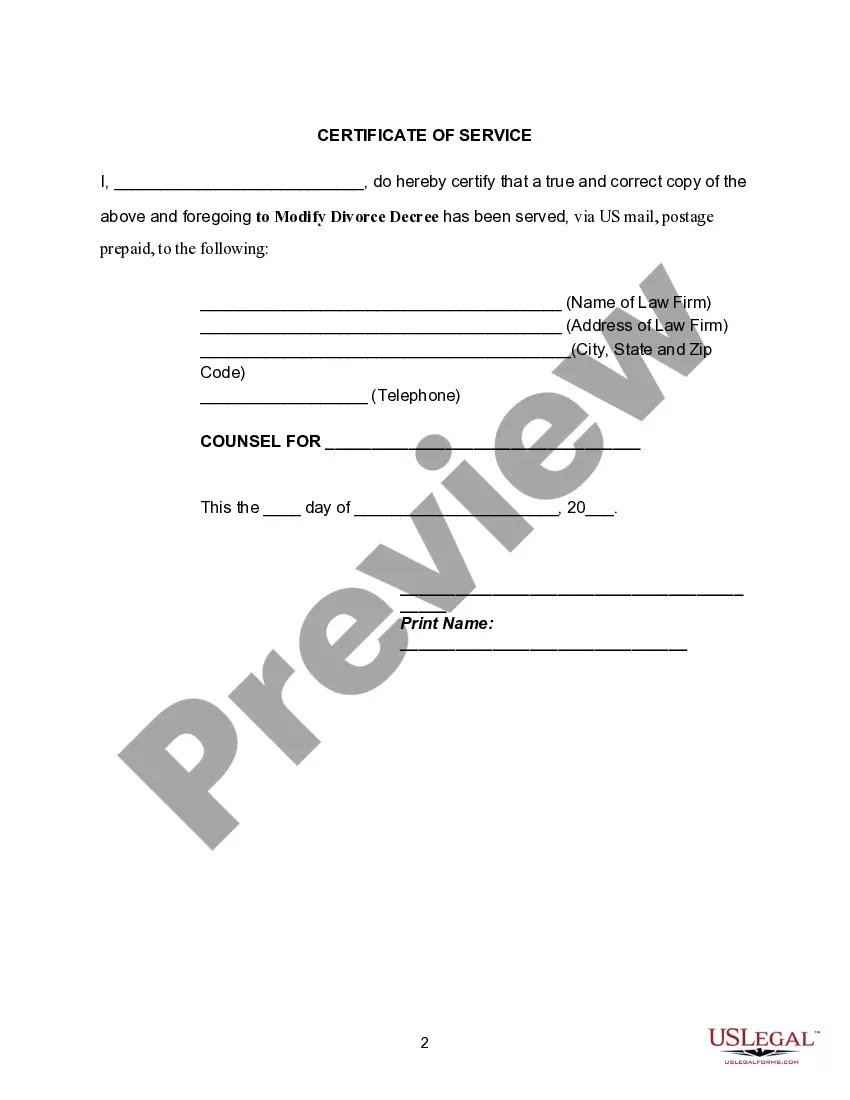

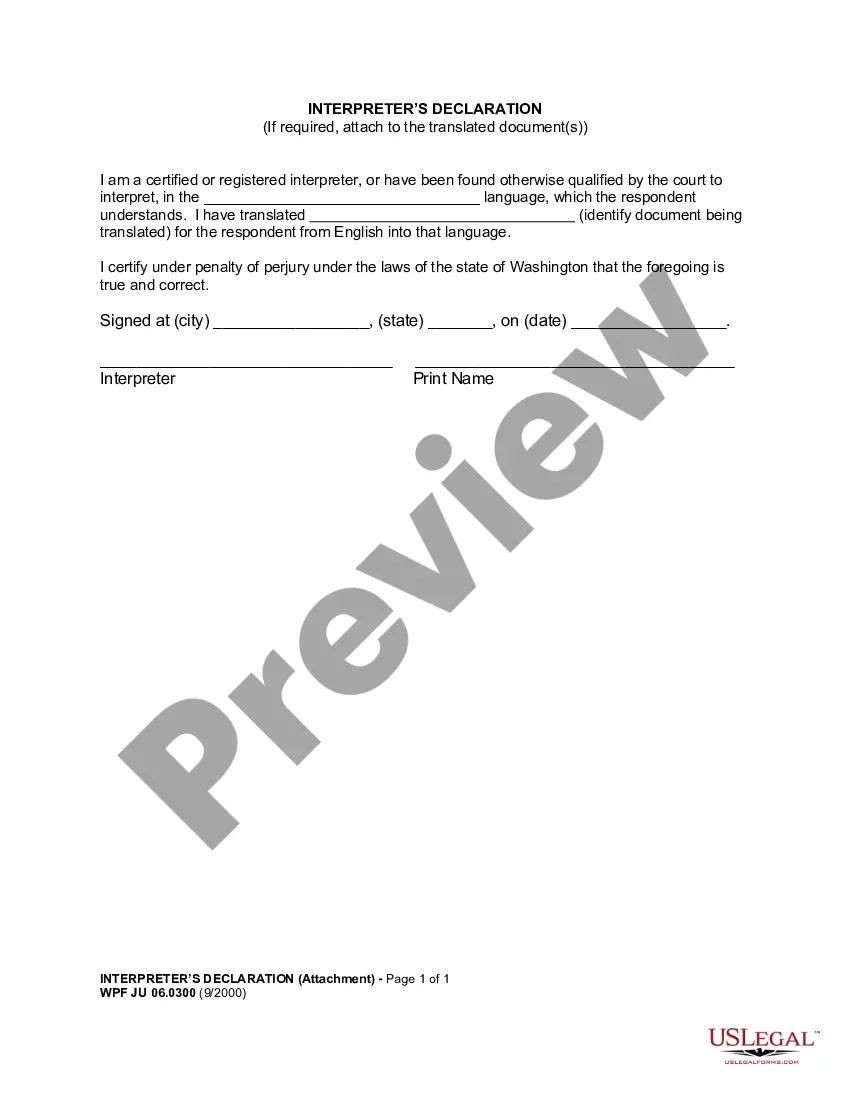

Review the form preview and descriptions to ensure you are accessing the document you need. Confirm that the form you select adheres to the rules and regulations of your state and county. Choose the most appropriate subscription option to acquire the Form Child Support With Taxes. Download the form, then complete, certify, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form completion a straightforward and efficient process!

- With just a few clicks, you can promptly access state- and county-compliant templates meticulously created for you by our legal experts.

- Utilize our website whenever you require a trustworthy and dependable service through which you can swiftly locate and download the Form Child Support With Taxes.

- If you’re familiar with our site and have previously established an account with us, simply Log In to your account, find the template and download it or re-download it anytime in the My documents section.

- Don’t have an account? No worries. It only takes a few minutes to register and browse the catalog.

- However, before proceeding to download Form Child Support With Taxes, adhere to these guidelines.

Form popularity

FAQ

Texas child support laws provide the following Guideline calculations: one child= 20% of Net Monthly Income (discussed further below); two children = 25% of Net Monthly Income; three children = 30% of Net Monthly Income; four children = 35% of Net Monthly Income; five children = 40% of Net Monthly Income; and six ...

Tax refunds Most parents pay tax in Australia. We may use a tax refund to pay any outstanding child or spousal support amounts. This may still happen if you have a payment arrangement in place. If this would cause you hardship, call us on the Child Support enquiry line.

In Australia, parents are not imprisoned for failing to pay child support.

Child support payments are not taxable. That means the parent making the payments cannot deduct them from income and their receipt is tax free to the parent who gets the payments on behalf of their children.

ATI is based on your taxable income ? your assessable income less allowable deductions ? with an array of other adjustments applied. These applicable adjustments may involve including any of the following: ? reportable employer superannuation contributions. ? deductible personal superannuation contributions.