Application For Deceased Claim Annexure-3

Description

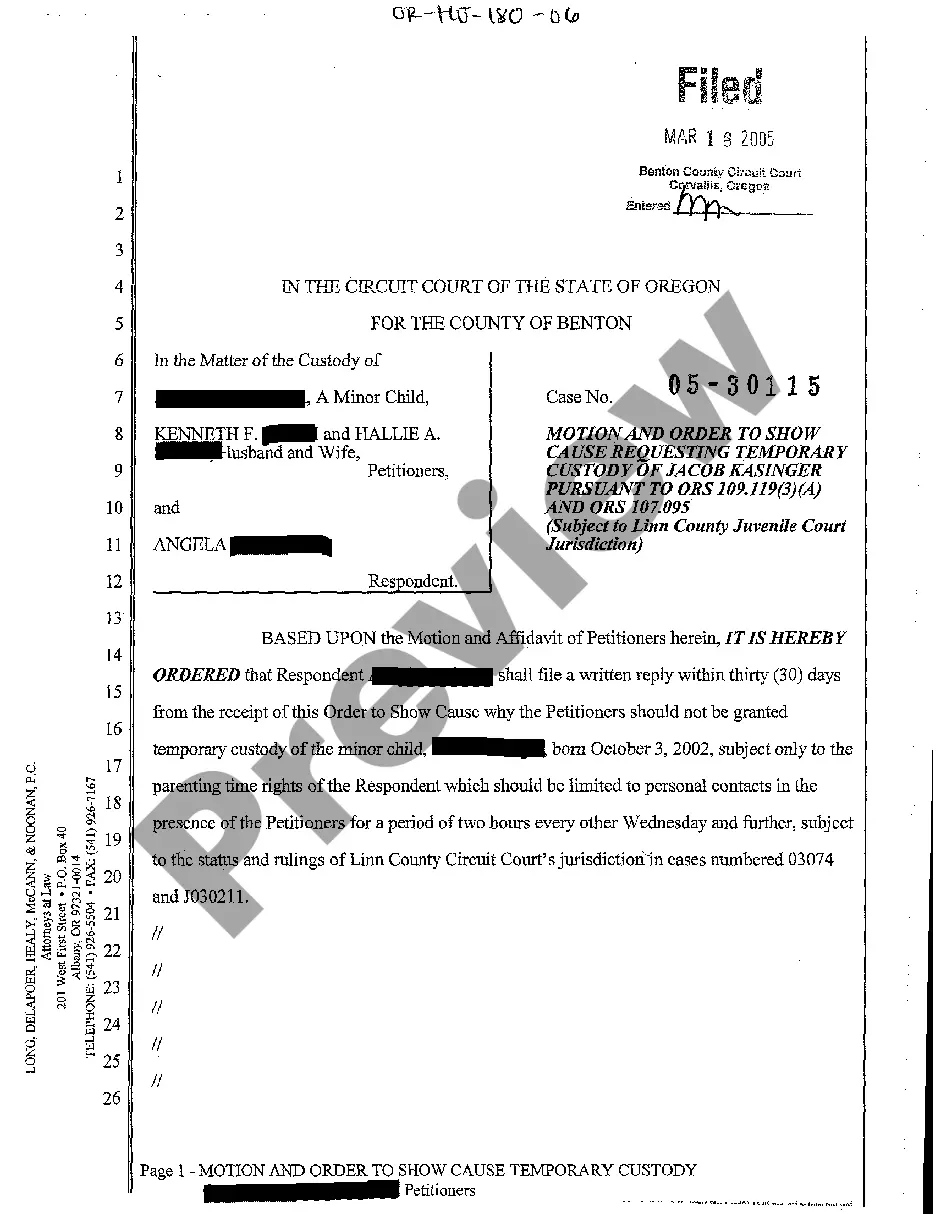

How to fill out Motion To Preclude Admission Of Gruesome And Highly Prejudicial Color Photographs Of Deceased?

Whether for commercial aims or personal issues, everyone encounters legal matters at some stage in their life. Completing legal documents necessitates meticulous attention, starting from choosing the suitable form template.

For instance, if you select an incorrect version of the Application For Deceased Claim Annexure-3, it will be declined upon submission. Thus, it is crucial to obtain a trustworthy source of legal paperwork such as US Legal Forms.

With an extensive collection of US Legal Forms available, you do not need to waste time searching for the suitable template on the web. Take advantage of the library's user-friendly navigation to discover the right template for any circumstance.

- Obtain the template you require using the search bar or catalog browsing.

- Review the form's details to confirm it aligns with your situation, state, and jurisdiction.

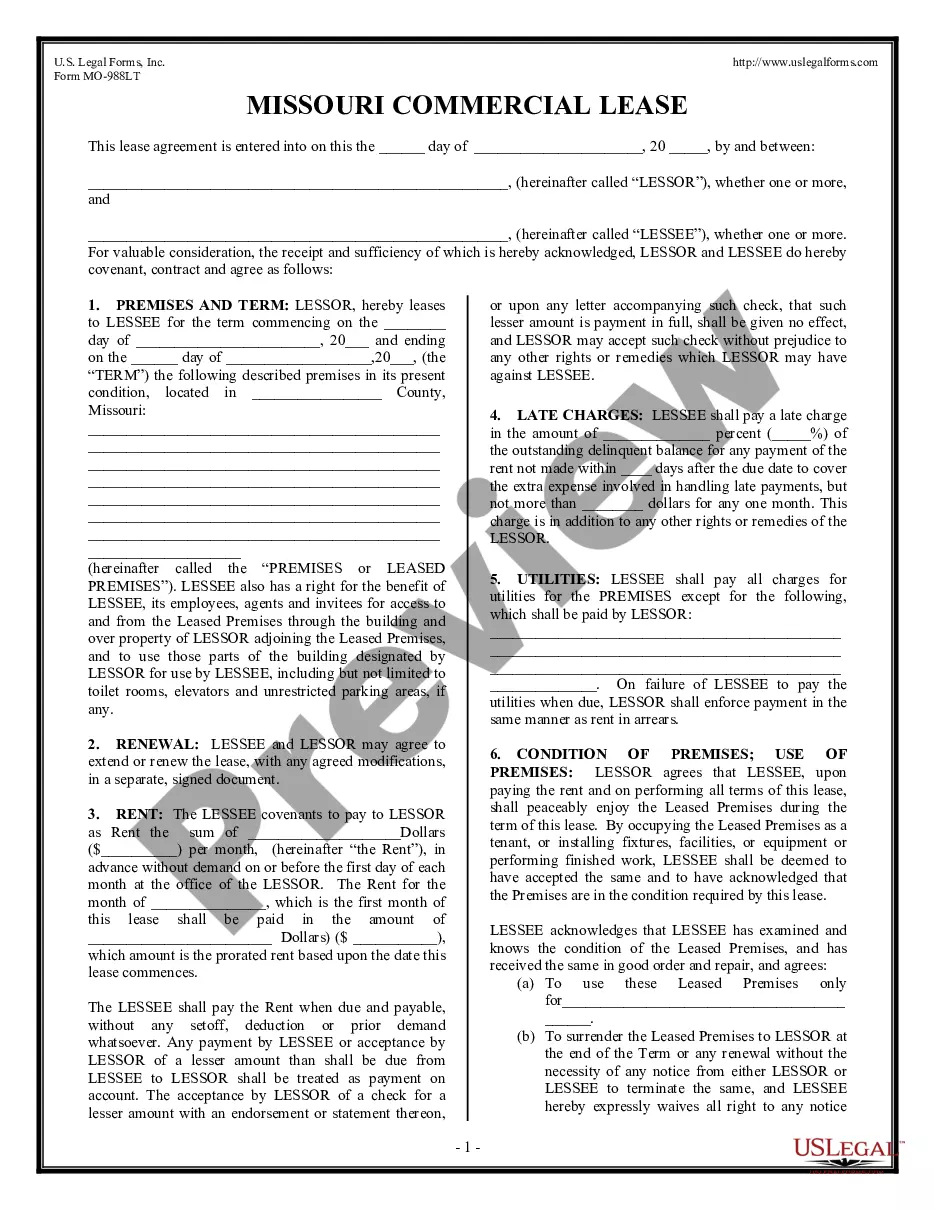

- Click on the form's preview to examine it.

- If it is the wrong document, return to the search tool to locate the Application For Deceased Claim Annexure-3 sample you need.

- Acquire the file when it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can utilize a debit card or PayPal account.

- Choose the document format you desire and download the Application For Deceased Claim Annexure-3.

- Once saved, you can fill in the form using editing software or print it and complete it manually.

Form popularity

FAQ

Probate is required in Rhode Island for most estates, though some estates may be able to avoid it depending on the estate's value, the will and a few other factors. Several assets almost always must enter probate, including: Real estate. Assets with tenants in common.

Before the terms of a will can be accepted, the will must be proven in probate court. Probate is the court-supervised process of distributing the estate of a deceased person. In Rhode Island, a decedent's will should be filed in the probate court of the town or city in which the decedent had resided.

The general requirements for a valid Will are usually as follows: (a) the document must be written (meaning typed or printed), (b) signed by the person making the Will (usually called the ?testator? or ?testatrix?, and (c) signed by two witnesses who were present to witness the execution of the document by the maker ...

?For a will to be legally binding in Rhode Island, it needs to be: In writing. Created by a testator (the person making the will) who is of sound mind and at least 18 years old. Signed by ? and in the presence of ? two or more witnesses.

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In Rhode Island, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If you are in possession of a will of a deceased person, you must either file it with the appropriate court or deliver it to the person named in the will as executor, as under Rhode Island law the will is to be filed within 30 days after death.

To finalize your will in Rhode Island: you must sign your will in front of two witnesses at the same time, and. your witnesses must sign your will.