Cash Advance Contract For College Students

Description

How to fill out Agreement To Repay Cash Advance On Credit Card?

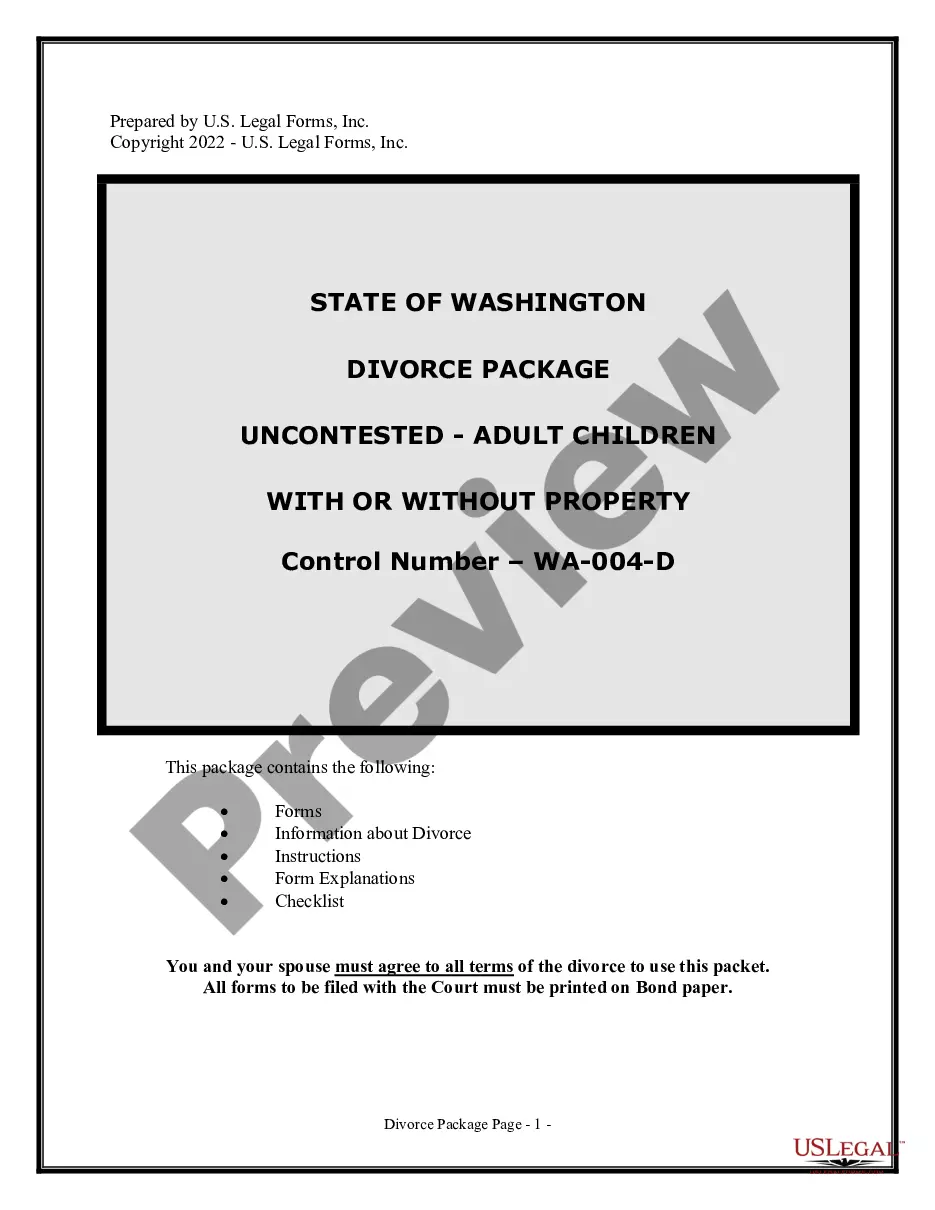

Properly prepared official documents are a crucial safeguard against complications and legal disputes, but obtaining them without the help of a lawyer can be time-consuming.

Whether you are in immediate need of a current Cash Advance Contract for College Students or any other forms related to employment, family, or business matters, US Legal Forms is consistently available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If you have an active subscription, you simply need to Log In to your account and click the Download button next to the desired file. Additionally, you can retrieve the Cash Advance Contract for College Students at any time, as all documents obtained on the platform remain accessible within the My documents tab of your profile. Save time and money on preparing official paperwork. Experience US Legal Forms today!

- Verify that the form applies to your situation and region by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar located in the page header.

- Press Buy Now upon finding the correct template.

- Choose the pricing plan, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (via a credit card or PayPal).

- Pick either PDF or DOCX file format for your Cash Advance Contract for College Students.

- Press Download, then print the template to complete it, or upload it to an online editor.

Form popularity

FAQ

The cash advance needs to be reported as a reduction in the company's Cash account and an increase in an asset account such as Advance to Employees or Other Receivables: Advances. (If the amount is expected to be repaid within one year, this account will be reported as a current asset.)

A merchant cash advance agreement is a contract in which a lender agrees to offer a cash advance that is to be repaid against future revenues of the business. In addition, the borrower agrees to a fee, usually a fixed interest rate.

Credit card cash advances: the consHigh APR.Additional fees.It could affect your credit score.No safety net if your money is stolen.Carry a balance on your card.Reallocate funds.Consider a personal loan.21-Apr-2020

ProcedureOn the Concur home page, select New and then New Cash Advance.On the Details tab, enter a name for your cash advance request.Enter the amount of your request.Provide the purpose, travel dates, requested issue date, and city (destination) in the appropriate fields.More items...

A cash advance allows employees to borrow money from their company prior to incurring any expenses. When a requested cash advance is approved and paid, the employee can use the money for the business expenses they may be about to incur.