Child Custody Holiday Schedule Examples

Description

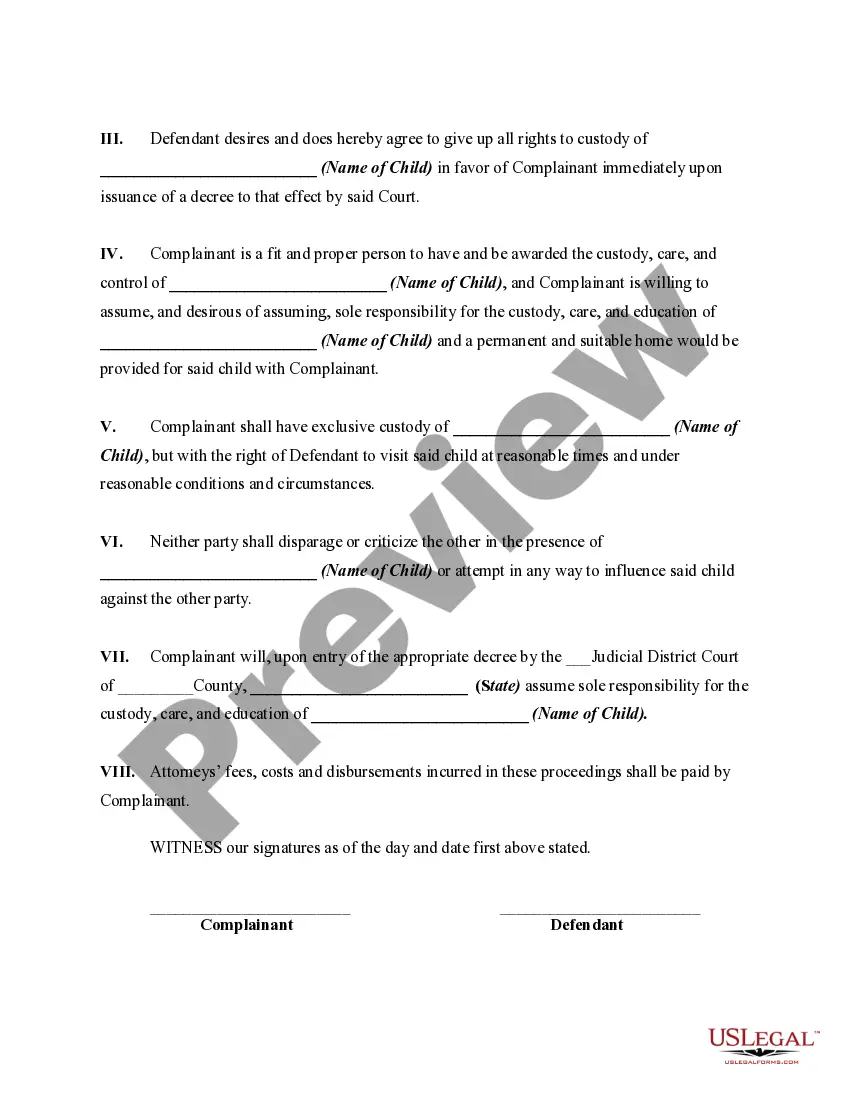

The following form is a sample of an agreement for a consent judgment granting sole custody of a minor child to the father.

How to fill out Agreement For Consent Judgment Granting Sole Custody Of Minor Child To Father?

The Child Custody Holiday Schedule Examples you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and local laws. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Child Custody Holiday Schedule Examples will take you just a few simple steps:

- Search for the document you need and check it. Look through the file you searched and preview it or review the form description to verify it satisfies your requirements. If it does not, use the search option to find the appropriate one. Click Buy Now once you have located the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Child Custody Holiday Schedule Examples (PDF, Word, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Make use of the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

In Ohio, the cost for comprehensive estate plan drafting can range from $550 to $4250, depending on the complexity of your estate and the attorney's experience. The cost of creating a will in Ohio can range from $150 to $850. A trust in Ohio typically costs between $550 and $2950.

Maximum Amount ($) ? For relief from administration, $35,000 (R.C. § 2113.03(A)(1)) or $100,000 if the decedent is survived by a spouse who is named in their will or their spouse is entitled to receive their full estate per R.C.

Ohio small estate affidavit The petition form must be filed with the court. For even smaller estates in Ohio ? less than $40,000 if there is a surviving spouse, or $5,000 if there is no surviving spouse ? a summary release procedure can be used instead. File a petition with the court to begin.

What Qualifies As A Small Estate In Ohio? An Ohio estate qualifies as a small estate if the value of the probate estate is: $35,000 or less; OR. $100,000 or less and the entire estate goes to the decedent's surviving spouse whether under a valid will or under intestacy.

Ohio law allows for certain small estates to be handled in less time, and with less paperwork. If an estate is eligible, one may submit an Application to Relieve from Administration or a Summary Release from Administration to settle an estate.

A small estate could comprise of assets worth less than around £10,000. This would mean they wouldn't own their house and any assets they do have would be items left after passing.

Release from Administration ? There is a surviving spouse who is the sole beneficiary and the estate is worth no more than $100,000, or there is no surviving spouse and the estate is worth no more than $35,000.

Every state sets different rules about what qualifies as a small estate, which is defined by its dollar value. The collection of the decedent's assets may need to be worth less than $50,000 to be considered small or may be able to be worth as much as $150,000, depending on the state law and what assets are counted.