Director Resolution For Dividend

Description

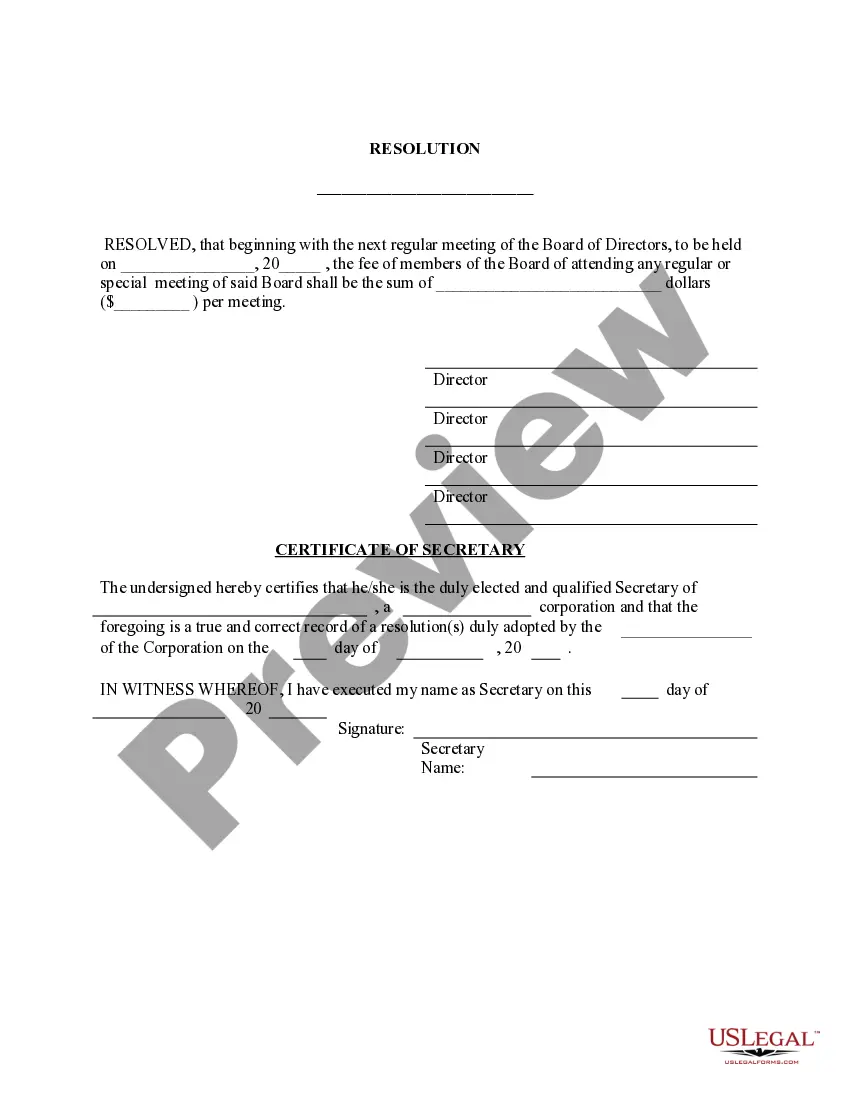

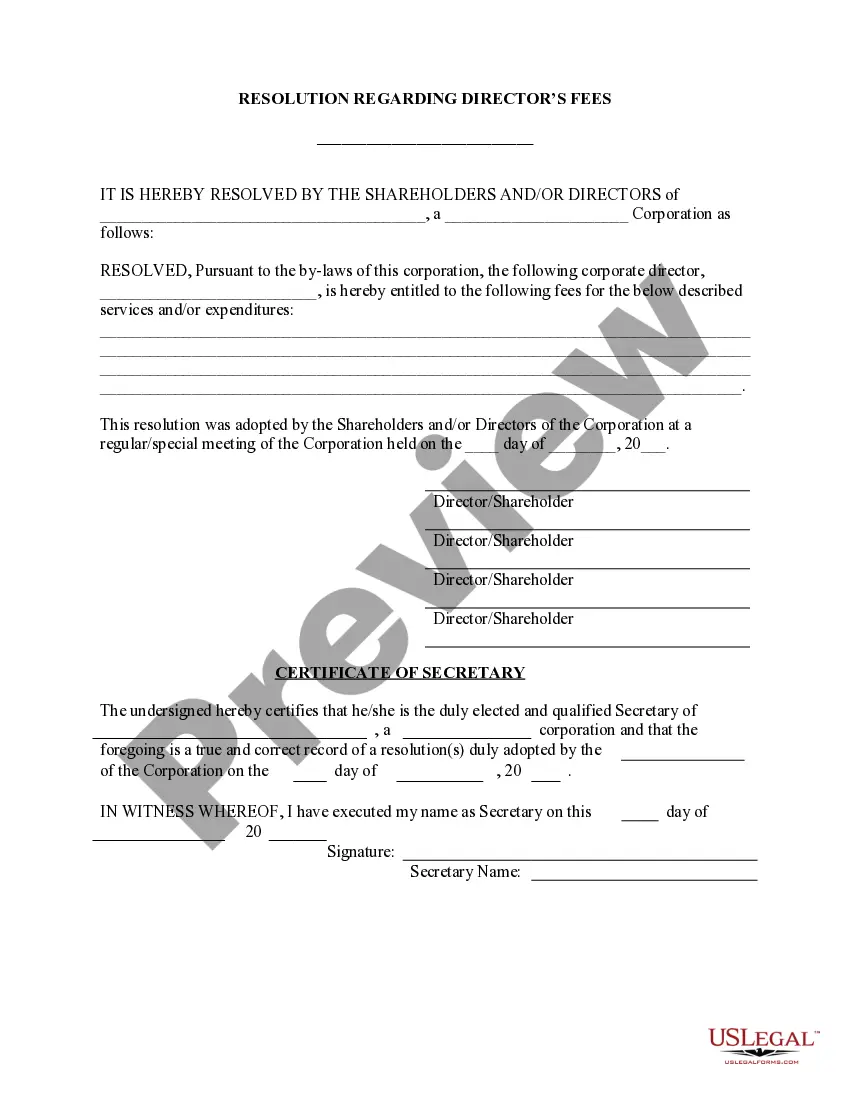

How to fill out Director's Fees - Resolution Form - Corporate Resolutions?

It’s widely known that you cannot instantly become a legal authority, nor can you swiftly master how to create a Director Resolution For Dividend without a specific background.

Assembling legal documents is a lengthy endeavor that demands particular training and expertise. So why not entrust the development of the Director Resolution For Dividend to the professionals.

With US Legal Forms, one of the most extensive collections of legal templates, you can obtain everything from court documents to templates for internal communication.

If you need any other document, restart your search.

Sign up for a free account and select a subscription plan to buy the template. Click Buy now. After the transaction is finished, you can obtain the Director Resolution For Dividend, complete it, print it, and send or mail it to the appropriate individuals or organizations.

- We recognize the significance of compliance and adherence to federal and state regulations.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how you can begin using our platform and acquire the document you need in just a few minutes.

- Search for the document you need utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to see if the Director Resolution For Dividend is what you require.

Form popularity

FAQ

?BE IT RESOLVED THAT a dividend in the aggregate amount of $** payable to the holder(s) of the issued and outstanding [common] shares in the capital of the Corporation is declared payable on [declaration date] to the shareholders of record of the Corporation as of [record date].

XYZ CORPORATION RESOLVED: That a special cash Dividend is hereby declared in the amount of $0.35 per share of common stock. RESOLVED: That the close of business on _________, is hereby fixed as the Record Date for the determination of stockholders entitled to receive payment of such Dividend.

If a company pays a dividend by distributing income from current operations, the transaction is recorded as an operating activity on the cash flow statement. On the other hand, if a company pays a dividend from retained earnings, then it is recorded on the balance sheet as both an asset and liability entry.

Resolutions of the board of directors declaring a cash dividend. These resolutions can be used for either a private corporation declaring capital, non-eligible or eligible dividends, or a public corporation declaring non-eligible or eligible dividends.

You will also find templates for both these options in this sub-folder. Note that a resolution is only required for the declaration of a final dividend where a company's articles (usually if the company has private company model articles) requires it. Directors are able to recommend and declare interim dividends.