Credit Collection Services For Progressive

Description

How to fill out Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

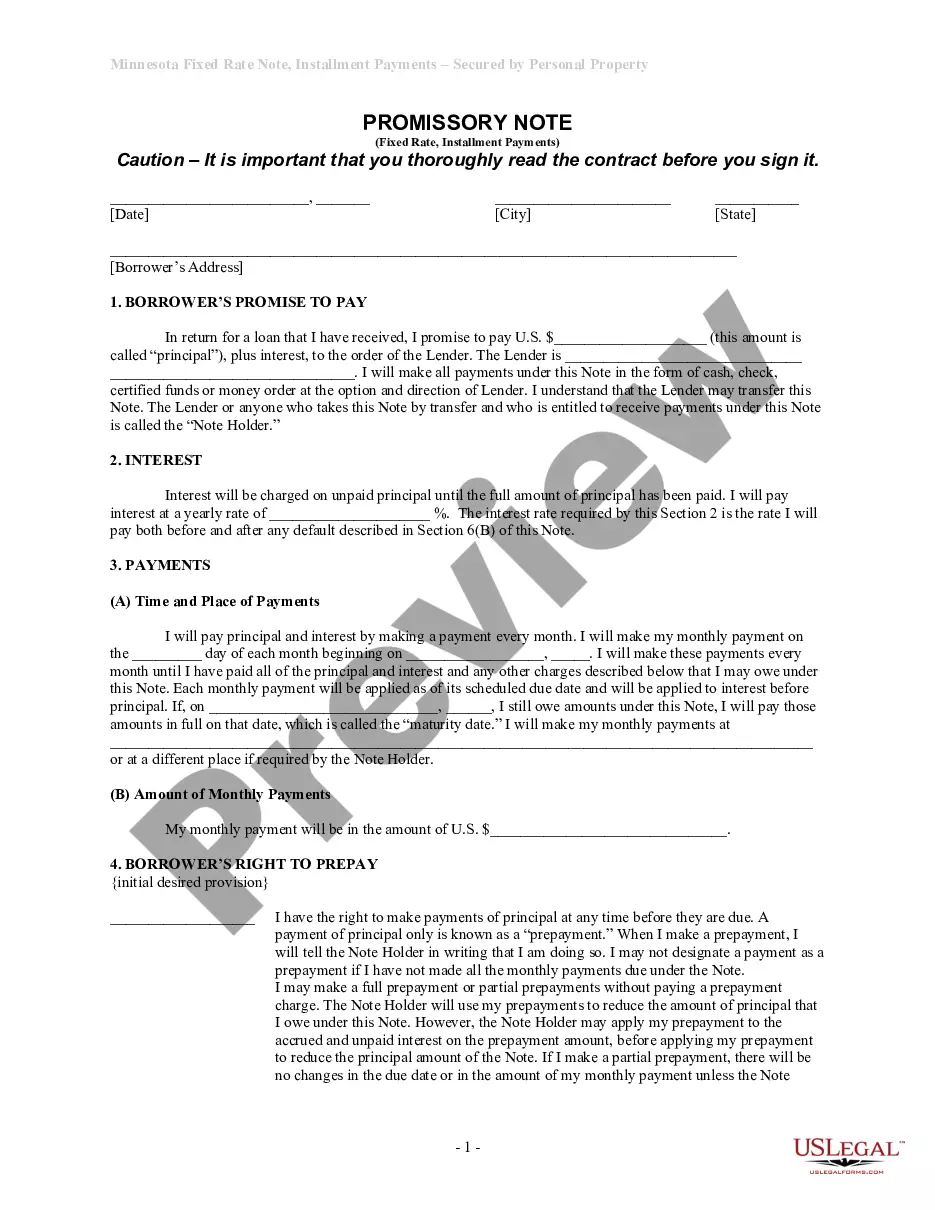

The Credit Collection Services For Progressive displayed on this page is a reusable formal framework created by experienced attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 validated, state-specific documents for any commercial and personal situation. It is the quickest, easiest, and most reliable method to obtain the forms you require, as the service ensures bank-level data protection and anti-malware safeguards.

Register for US Legal Forms to have certified legal templates for all of life's situations at your fingertips.

- Examine the document you require and assess it.

- Browse through the file you searched for and preview it or check the form description to confirm it meets your needs. If it doesn’t, utilize the search function to find the appropriate one. Click Buy Now when you have identified the template you need.

- Register and sign in.

- Choose the pricing option that best fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Pick the format you desire for your Credit Collection Services For Progressive (PDF, DOCX, RTF) and download the example to your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to quickly and accurately fill in and sign your form with a valid signature.

- Download your documents once again.

- Access the same document again anytime required. Open the My documents tab in your profile to redownload any previously retrieved forms.

Form popularity

FAQ

Progressive tends to settle claims for a considerable range, depending on the specifics of each case. Factors such as the total outstanding debt, the debtor's financial capacity, and time since the debt was incurred influence the final settlement amount. Credit collection services for Progressive can help you navigate these variables to understand potential figures better. Engaging with experts can increase your chances of achieving a favorable settlement.

How do I change ownership of a property? To make changes to an existing deed, a new deed must be prepared and recorded. If your spouse dies, and your name is on the deed, you do not have to change it. If you elect to change it, a new deed must be prepared and recorded.

A gift letter is a legal instrument that clearly and explicitly states, without question, that a friend or family member ?gifted? - rather than loaned - you money. You can use a gift letter for mortgage lenders who may be questioning a large influx of cash that suddenly showed up in your checking or savings account.

What is a Gift Affidavit? A Gift Affidavit is a sworn statement that can be used to document the gifting of property. If you've received or given a gift, you might have to prove it wasn't a loan or financial transaction with a Gift Affidavit.

How do I change ownership of a property? To make changes to an existing deed, a new deed must be prepared and recorded. If your spouse dies, and your name is on the deed, you do not have to change it. If you elect to change it, a new deed must be prepared and recorded.

Checklist: Preparing and Recording Your Quitclaim Deed Fill in the deed form. Print it out. Have the grantor(s) and grantee(s) sign and get the signature(s) notarized. Fill out a Statement of Value form, if necessary. Get the Uniform Parcel Number (UPI) on the deed certified, if required by your county.

The PA deed transfer tax is generally about 2% of the final sales price, which consists of two different sets of fees: The state of Pennsylvania charges 1% of the sales price. The locality charges a second fee usually totaling about 1%, which is split between the municipality and school district.

A gift must be given out of disinterest or pure generosity. This means to qualify as a gift; the property must be given freely or in exchange for goods or services that cost significantly less than the value of the gift.

Gift Deed for Real Estate Located in Pennsylvania. A gift deed, or deed of gift, is a legal document voluntarily transferring title to real property from one party (the grantor or donor) to another (the grantee or donee). A gift deed typically transfers real property between family or close friends.