Experian Credit Report For Deceased Person

Description

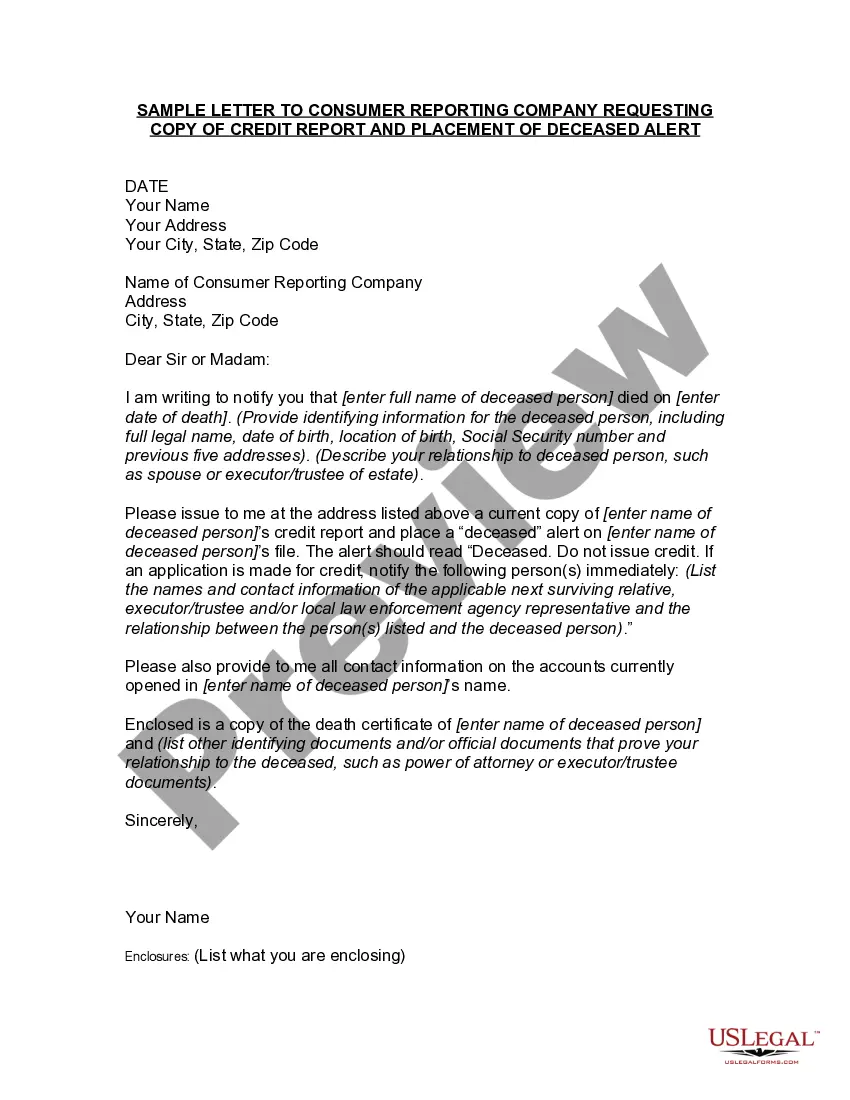

How to fill out Experian Credit Report For Deceased Person?

Bureaucracy requires exactness and precision.

Unless you manage completing documents like Experian Credit Report For Deceased Person regularly, it may result in some misunderstanding.

Selecting the appropriate sample from the outset will ensure that your document submission will proceed smoothly and avert any hassles of resending a document or starting the same task from the beginning.

If you are not a subscribing user, finding the necessary sample would involve a few extra steps: Locate the template using the search feature. Ensure the Experian Credit Report For Deceased Person you’ve identified is valid for your state or county. Open the preview or examine the description that includes the details on the template's application. If the result meets your expectations, click the Buy Now button. Choose the appropriate option from the recommended subscription plans. Log In to your account or create a new one. Complete the transaction using a credit card or PayPal payment method. Retrieve the form in the file format of your choice. Acquiring the correct and current samples for your documentation is just a few minutes away with an account at US Legal Forms. Eliminate bureaucratic uncertainties and enhance your paperwork process.

- You can always access the right sample for your documentation in US Legal Forms.

- US Legal Forms is the largest online forms repository that provides over 85 thousand examples across various topics.

- You can obtain the latest and most relevant version of the Experian Credit Report For Deceased Person by simply searching for it on the platform.

- Find, save, and download templates in your account or refer to the description to confirm you have the correct one available.

- With an account at US Legal Forms, it is convenient to gather, store in one place, and browse the templates you keep to retrieve them in just a few clicks.

- When on the site, click the Log In button to access your account.

- Then, navigate to the My documents section, where your documents are archived.

- Review the description of the forms and download the ones you require at any time.

Form popularity

FAQ

If you need to report someone to Experian, you can do so via their website or customer service. Provide detailed information regarding the issue you wish to report, ensuring you include relevant names, addresses, and any supporting documentation. This may include concerns about inaccuracies or identity theft related to the credit report. Engaging with US Legal Forms can also provide additional resources for formal reporting.

Yes, you can obtain a credit report on a deceased person, but it involves specific protocols. Generally, you need to supply Experian with a death certificate and other identifying information. This practice is crucial for understanding debts or obligations that may still be associated with the deceased person's Experian credit report.

Accessing the credit report of a deceased person requires appropriate documentation, including a death certificate. You can contact Experian directly to request this report, providing them with necessary identifying information about the deceased. This formal process ensures that you receive the Experian credit report for the deceased person responsibly and securely.

To obtain a credit report for another person, you must have their explicit consent due to privacy laws. You should guide them to provide you with their authorization and necessary identification. While it may be tricky, using tools from US Legal Forms can simplify the process and help you navigate the necessary steps involving the Experian credit report for the deceased person.

To request a credit freeze for a deceased person, you must contact each credit bureau, including Experian. You will need to provide a certified copy of the death certificate, the deceased's personal information, and any additional identification documents. This process helps prevent any unauthorized use of the deceased person's Experian credit report.

To notify Experian of a death, you need to provide them with a copy of the death certificate. You can send this document through mail with a written request that includes the deceased person's full name, Social Security number, and date of birth. This ensures that Experian updates their records accurately and helps protect against identity theft related to the Experian credit report for the deceased person.

You can pull a deceased person's credit report, but there are steps to follow. Typically, you must provide proof of death, such as a death certificate, along with your identification. Platforms like uslegalforms can guide you through the process of obtaining an Experian credit report for a deceased person, making it easier to navigate any legal requirements.

Generally, Social Security does notify credit bureaus when a person passes away, but updates may not be immediate. It is advisable to check the credit report for any discrepancies after a death, especially if you are managing the estate. Obtaining an Experian credit report for a deceased person can help you identify any outstanding debts and take necessary actions to resolve them.

Yes, you can check the credit report of a deceased person, but certain procedures apply. To obtain an Experian credit report for a deceased person, you typically must submit a written request along with necessary documentation, such as proof of death and your identification. This process ensures that sensitive information is protected while allowing authorized individuals to access the credit report.

You can check someone's credit history, but access may be limited by laws and regulations. Generally, you need consent from the individual or a legitimate reason, such as being an executor of their estate. If you seek an Experian credit report for a deceased person, you may need to provide documentation, such as a death certificate, to verify your authorization.