Privacy Confidentiality And Disclosure Example

Description

How to fill out Privacy And Confidentiality Of Credit Card Purchases?

It’s widely known that becoming a legal expert cannot happen instantly, nor can you swiftly learn how to draft Privacy Confidentiality And Disclosure Example without possessing a distinct set of abilities.

Producing legal documents is a lengthy endeavor that demands specific education and expertise.

So why not leave the preparation of the Privacy Confidentiality And Disclosure Example to the specialists.

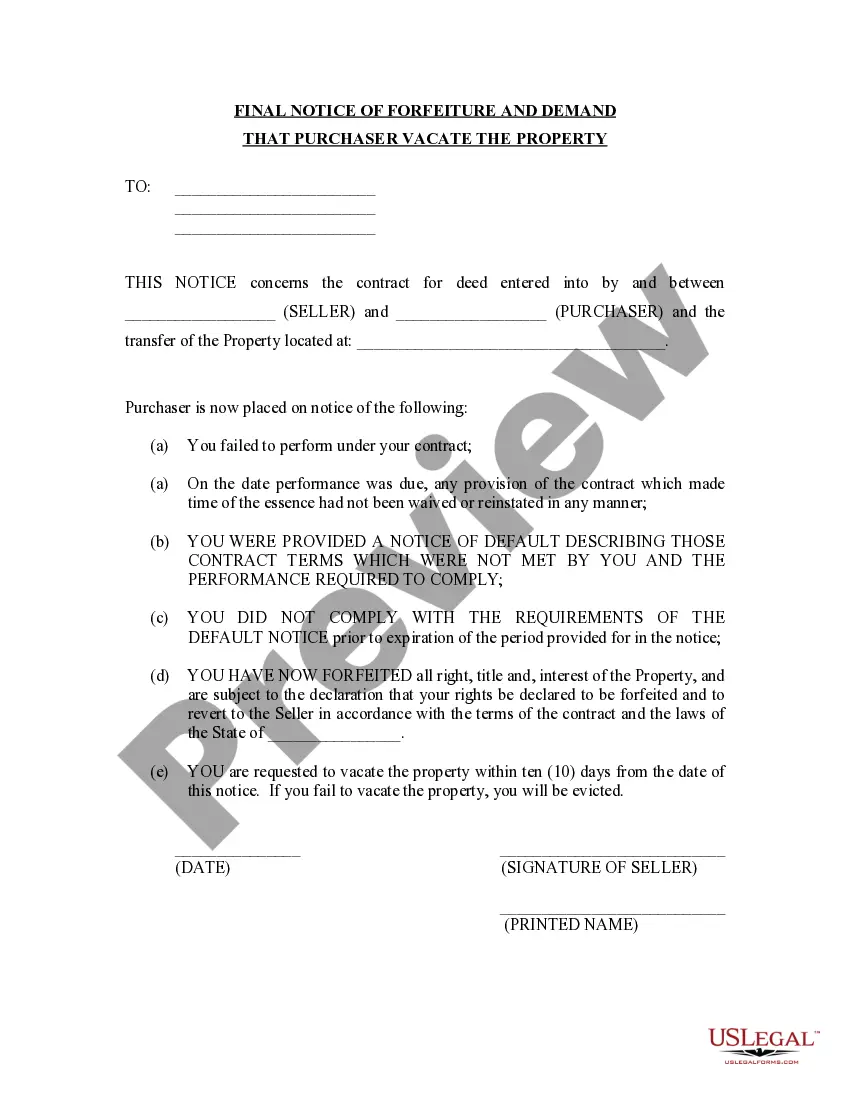

Preview it (if this option is available) and read the accompanying description to determine if Privacy Confidentiality And Disclosure Example is what you are looking for.

If you require any other form, begin your search again. Register for a free account and select a subscription plan to purchase the template.

- With US Legal Forms, one of the most extensive legal document collections, you can obtain anything from court paperwork to templates for office communication.

- We understand the significance of compliance and adherence to federal and state regulations.

- That’s why, on our platform, all forms are location-specific and current.

- Here’s how to get started on our website and acquire the document you need in just minutes.

- Discover the document you require using the search bar at the top of the page.

Form popularity

FAQ

Utah Powers of attorney requirements And (4), the power is to be granted in connection with real property, with documentation filed with the recorder of the county where the property is located. Otherwise, there is no need for witnesses or other complications.

A power of attorney shall be signed by the principal or in the principal's conscious presence by another individual directed by the principal to sign the principal's name on the power of attorney before a notary public or other individual authorized by the law to take acknowledgments.

What Types of Power of Attorneys Are Available in Utah? a power of attorney for finances, which allows someone to handle your financial or business matters, and. a power of attorney for health care, which allows someone to make medical decisions on your behalf.

Executing a power of attorney under Utah law The power of attorney document must be signed by the principal before a notary public.

A Utah Tax Power of Attorney (Form TC-737) is a required submission when you seek to hire a professional tax accountant or attorney and allow this entity to directly represent your interests with the Utah Tax Commission.

A Utah durable statutory power of attorney form lets a person select an agent to represent their best interests and handle their financial affairs during their lifetime. The person giving power (?principal?) will be able to transfer all financial-related responsibility to the agent as if they can do it themselves.

Executing a power of attorney under Utah law The power of attorney document must be signed by the principal before a notary public.

You can write a POA in two forms: general or limited. A general power of attorney allows the agent to make a wide range of decisions. This is your best option if you want to maximize the person's freedom to handle your assets and manage your care.