Letter Of Credit Usa With Red Clause

Description

How to fill out Letter Of Credit Usa With Red Clause?

There’s no longer a need to spend numerous hours hunting for legal documents that comply with your local state regulations.

US Legal Forms has gathered all of them in one location and made their accessibility easier.

Our website provides over 85,000 templates for any business and personal legal matters organized by state and area of application.

Completing legal paperwork in accordance with federal and state regulations is fast and easy with our library. Try US Legal Forms today to maintain your documentation systematically!

- All forms are expertly prepared and verified for authenticity, assuring you of receiving a current Letter Of Credit Usa With Red Clause.

- If you are acquainted with our service and already hold an account, ensure your subscription is current before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever needed by accessing the My documents tab in your profile.

- If you’ve never used our service previously, additional steps will be required to complete the process.

- Here’s how new users can acquire the Letter Of Credit Usa With Red Clause from our catalog.

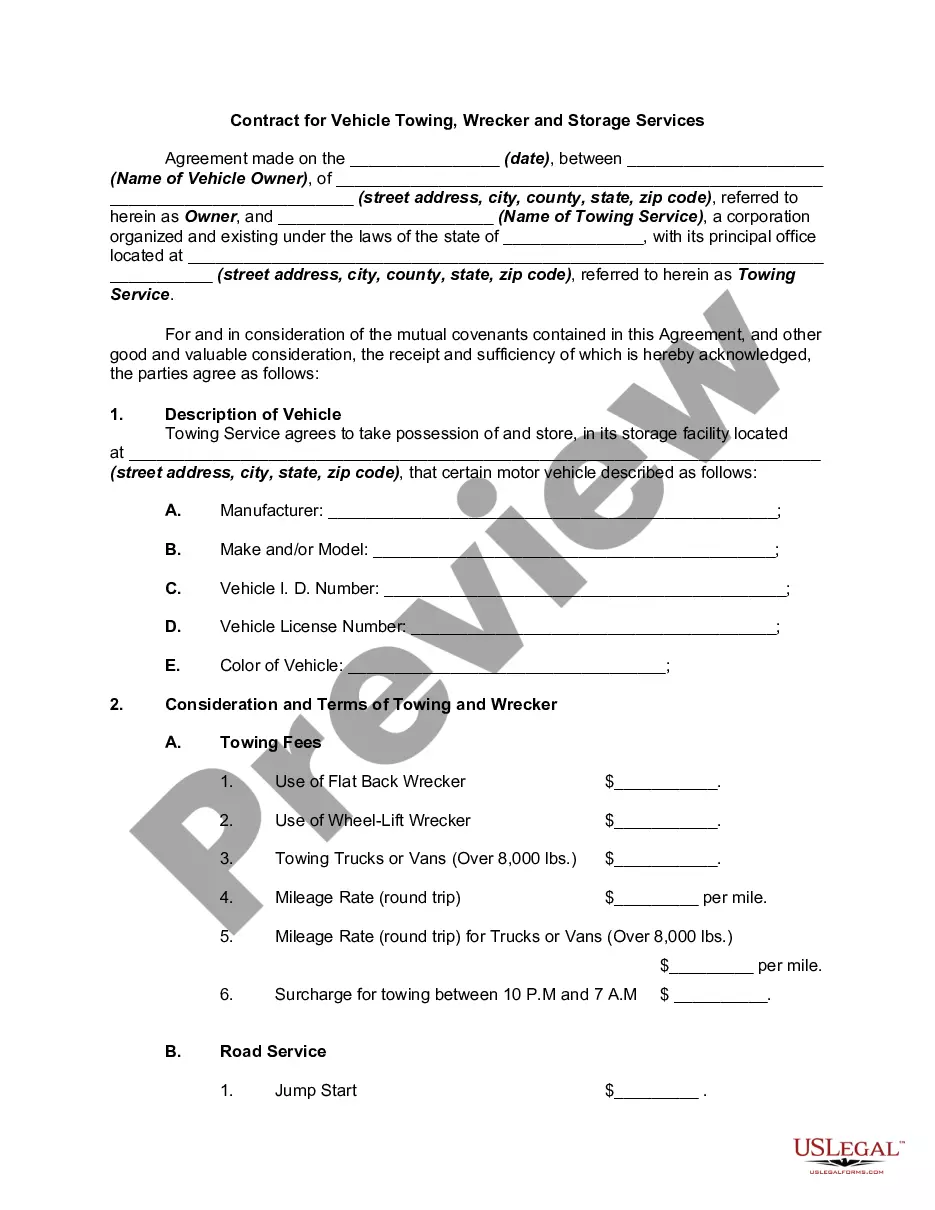

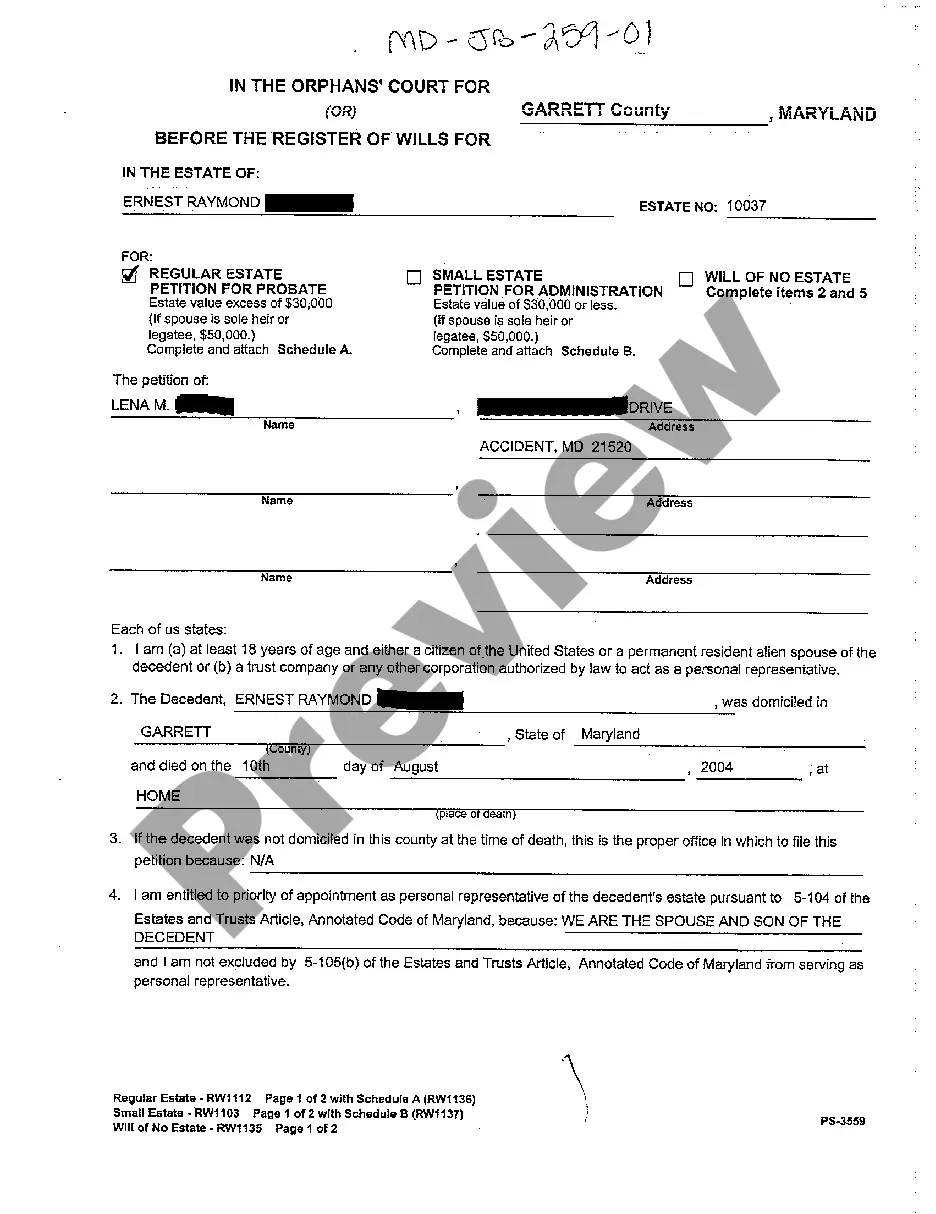

- Examine the page content closely to ensure it contains the sample you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

To open a letter of credit in the USA with a red clause, start by selecting a financial institution that offers this service. You will need to provide important documents such as a detailed application, proof of identity, and any pertinent transactional documents. Once you submit your application, the bank will assess the risk, and upon approval, they will issue the letter of credit. Uslegalforms can help streamline this process by providing the necessary forms and guidance, making it easier for you to establish your letter of credit USA with red clause.

A red cross letter of credit is a type of letter that signifies a restriction, often preventing the transfer or assignment of the credit without the bank's consent. This designation helps protect the interests of all parties involved. When working with financial instruments such as a letter of credit USA with red clause, understanding terms like the red cross designation is beneficial for ensuring compliance and mitigating risks.

A clause in the letter of credit refers to specific provisions or conditions that define the terms under which the credit is utilized. These clauses can dictate payment terms, documentation requirements, and the responsibilities of the parties involved. Knowing these clauses helps you navigate the complexities of a letter of credit USA with red clause effectively.

The red clause letter of credit allows the beneficiary to receive an advance payment before shipping the goods. This feature offers financial support to exporters, making it easier to manage working capital. On the other hand, a green clause letter of credit also provides an advance, but it is typically related to the storage of goods before shipment. Understanding these differences is crucial when choosing a letter of credit USA with red clause.

The main difference between a red and green letter of credit lies in the payment terms and conditions. A red LC allows for advances before shipment, while a green LC does not, requiring payment only upon shipping goods. Understanding these distinctions helps businesses choose the right approach when engaging in international trade.

In banking, a red flag refers to warning signs that suggest possible fraud or issues with a client's account. These can include a sudden change in account activity, large and unexplained deposits, or frequent transactions that deviate from a client's usual behavior. Being aware of these signs is crucial for maintaining the integrity of financial transactions.

A credit red flag is any sign that suggests a potential risk in a financial transaction or creditworthiness. These indicators can include inconsistent financial statements, late payments, or unusual transaction patterns. Identifying these red flags helps in making informed decisions to mitigate risks while engaging in transactions.

A red flag letter of credit acts as a warning signal for potential issues in a transaction. It indicates that there might be discrepancies or irregularities that warrant further investigation. Recognizing these red flags early can help parties involved take corrective actions, ensuring the transaction proceeds with minimal risk.