Liability Employer Buy With Credit

Description

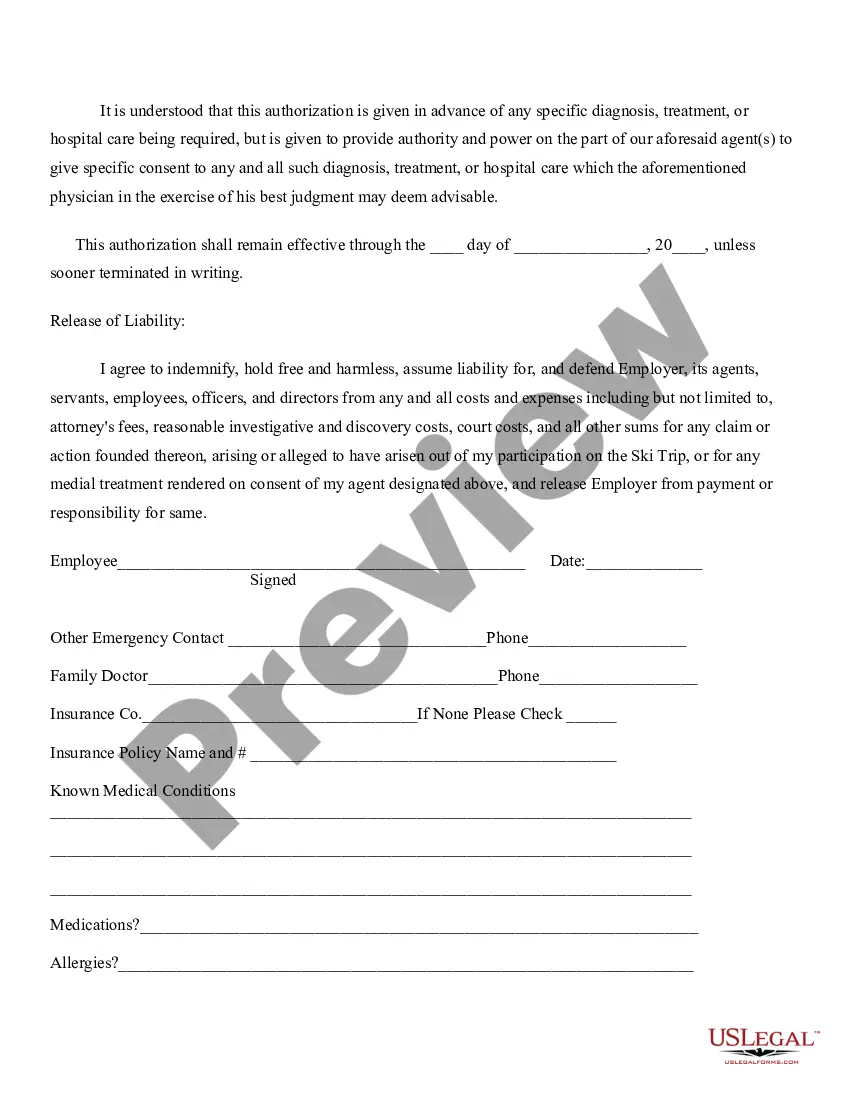

How to fill out Release Of Liability Of Employer - Ski Trip?

Working with legal documents and operations could be a time-consuming addition to your day. Liability Employer Buy With Credit and forms like it often require that you search for them and understand how to complete them appropriately. As a result, if you are taking care of financial, legal, or individual matters, having a comprehensive and hassle-free online library of forms at your fingertips will significantly help.

US Legal Forms is the best online platform of legal templates, offering over 85,000 state-specific forms and a number of resources that will help you complete your documents effortlessly. Check out the library of relevant papers available with just one click.

US Legal Forms provides you with state- and county-specific forms offered by any time for downloading. Shield your papers management procedures having a high quality services that lets you prepare any form in minutes with no additional or hidden cost. Just log in to your account, locate Liability Employer Buy With Credit and download it immediately from the My Forms tab. You can also access formerly saved forms.

Is it your first time using US Legal Forms? Register and set up a free account in a few minutes and you’ll get access to the form library and Liability Employer Buy With Credit. Then, follow the steps listed below to complete your form:

- Ensure you have the correct form by using the Review feature and looking at the form description.

- Choose Buy Now once all set, and choose the monthly subscription plan that is right for you.

- Choose Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of experience helping users control their legal documents. Discover the form you require today and improve any operation without breaking a sweat.

Form popularity

FAQ

What's the difference? When you use a debit card, the funds for the amount of your purchase are taken from your checking account almost instantly. When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to pay.

Common examples include car loans, mortgages, personal loans, and lines of credit. Essentially, when the bank or other financial institution makes a loan, it "credits" money to the borrower, who must pay it back at a future date.

As a business owner, there are a few different ways you can pay yourself. One common method is to pay yourself a salary, which you can do using a number of different payment methods including checks, direct deposit, or even a credit card. Yes, you read that right ? you can pay yourself a salary with a credit card!

Your account may be closed ?Most business credit card issuers will make you sign an agreement where you agree not to use your business card for personal expenses,? says Mike Pearson, founder of Credit Takeoff.

Is it illegal to use a company card for personal expenses? While it's not illegal to pay for personal expenses using a company card, it goes against company expense policy and will likely result in disciplinary action if it happens regularly. It will also have adverse effects on the company's tax liabilities.