Liability Employer Buy With Cash

Description

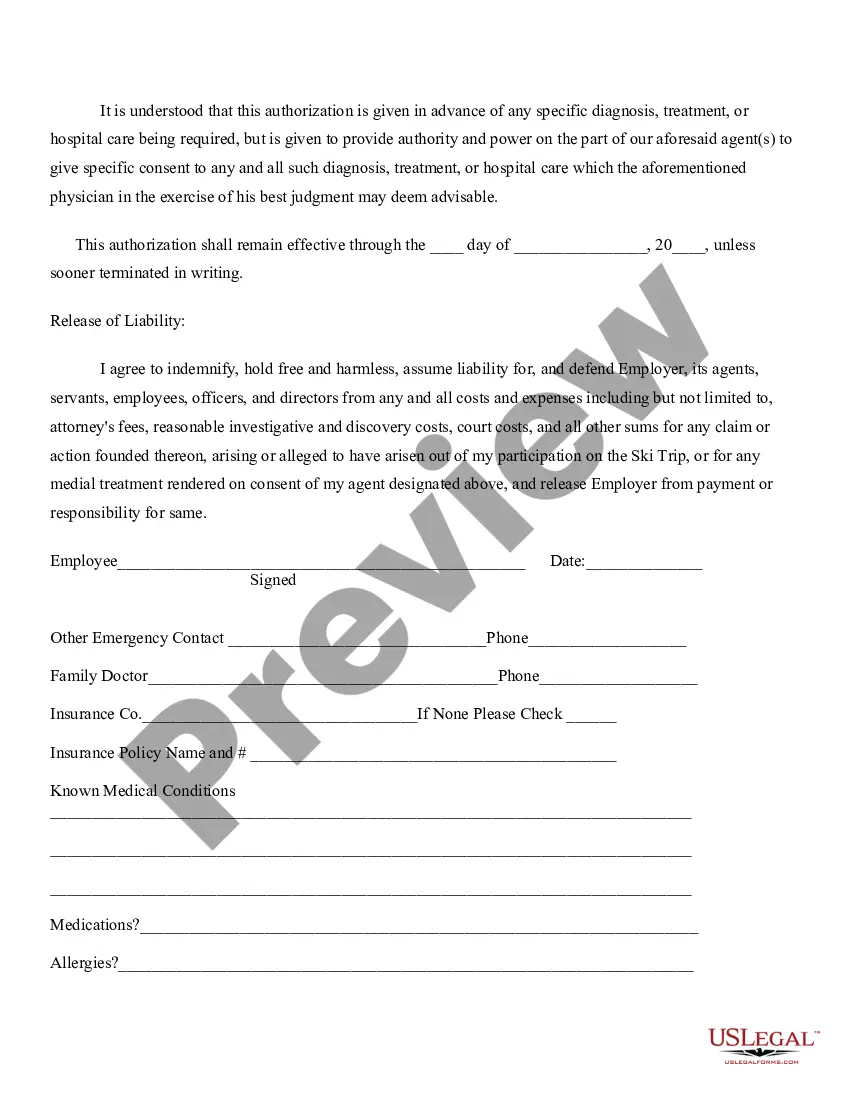

How to fill out Release Of Liability Of Employer - Ski Trip?

Legal papers managing may be overwhelming, even for knowledgeable professionals. When you are searching for a Liability Employer Buy With Cash and don’t get the time to devote trying to find the appropriate and updated version, the procedures might be stress filled. A robust online form library can be a gamechanger for everyone who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any time.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you might have, from personal to organization documents, in one spot.

- Use advanced tools to accomplish and handle your Liability Employer Buy With Cash

- Access a resource base of articles, instructions and handbooks and resources related to your situation and requirements

Save time and effort trying to find the documents you will need, and utilize US Legal Forms’ advanced search and Preview feature to locate Liability Employer Buy With Cash and get it. For those who have a membership, log in to the US Legal Forms account, search for the form, and get it. Take a look at My Forms tab to view the documents you previously downloaded and also to handle your folders as you see fit.

If it is your first time with US Legal Forms, create an account and acquire unrestricted use of all benefits of the library. Here are the steps to consider after getting the form you need:

- Verify this is the proper form by previewing it and reading its information.

- Be sure that the sample is acknowledged in your state or county.

- Select Buy Now once you are ready.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, eSign, print and send your papers.

Take advantage of the US Legal Forms online library, supported with 25 years of experience and trustworthiness. Enhance your daily papers administration into a smooth and easy-to-use process today.

Form popularity

FAQ

If you are an employee, you report your cash payments for services on Form 1040, line 7 as wages. The IRS requires all employers to send a Form W-2 to every employee. However, because you are paid in cash, it is possible that your employer will not issue you a Form W-2.

Cash payments made to vendors and others with whom you do business must still be substantiated if you want these cash payments to be deducted as expenses on your business tax return.

To avoid a lack of payment records, provide a pay stub to your employees as proof of payment, and ask them to sign it before giving them their cash payments.

If you earn all of your wages in cash and don't receive a W-2 form from your employer, you'll need to request a 1099-MISC form from your employer or contract provider at the end of the tax year. You'll use this 1099-MISC to claim income that you received as an independent contractor or earned as interest or dividends.

If your employer pays you in cash and fails to meet their bookkeeping obligations, they could face fines and criminal charges. Some people call this ?paying employees under the table? and it's illegal. It's a practice that might seem beneficial to you and the employer.