Liability Employer Buy Foreign Currency

Description

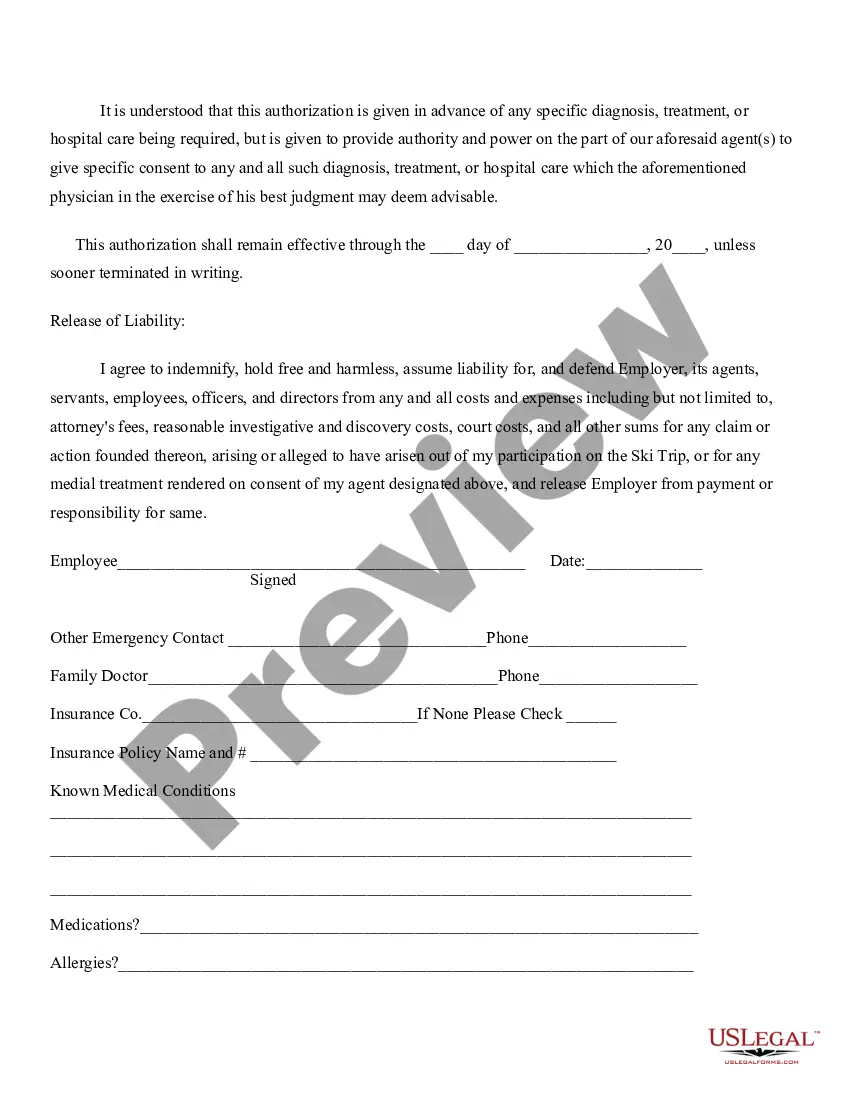

How to fill out Release Of Liability Of Employer - Ski Trip?

Drafting legal paperwork from scratch can often be daunting. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more cost-effective way of creating Liability Employer Buy Foreign Currency or any other forms without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online catalog of over 85,000 up-to-date legal forms covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant forms carefully put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Liability Employer Buy Foreign Currency. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes little to no time to set it up and navigate the catalog. But before jumping straight to downloading Liability Employer Buy Foreign Currency, follow these tips:

- Check the form preview and descriptions to make sure you are on the the document you are searching for.

- Make sure the form you select complies with the requirements of your state and county.

- Choose the right subscription option to buy the Liability Employer Buy Foreign Currency.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and transform document completion into something easy and streamlined!

Form popularity

FAQ

If you are a U.S. citizen working outside of the United States for a foreign government or international organization, you must report the foreign source compensation as wages on Form 1040 but are not subject to self-employment tax on this compensation.

You would enter the information on Schedule 1 (Form 1040) Additional Income and Adjustments to Income, Line 8 as an ordinary gain or (loss). To enter a description and an amount for Schedule 1 (Form 1040), Line 8: From within your TaxAct return (Online or Desktop), click Federal.

Not all foreign assets need to be reported on Form 8938. These exceptions include: Assets reported on other forms. If a foreign asset is already reported on other IRS forms, such as Form 3520 (for foreign trusts) or Form 5471 (for foreign corporations), it may not need to be reported again on Form 8938.

Filing Criteria for Those with Foreign Assets U.S. citizens, U.S. residents, certain residents of U.S. Possessions and nonresidents who elect to be treated as U.S. residents will have to fill out this form if they hold financial accounts or certain assets held for investment (deemed ?specified persons?).

You must express the amounts you report on your U.S. tax return in U.S. dollars. Therefore, you must translate foreign currency into U.S. dollars if you receive income or pay expenses in a foreign currency. In general, use the exchange rate prevailing (i.e., the spot rate) when you receive, pay or accrue the item.