Liability Employer Buy For College

Description

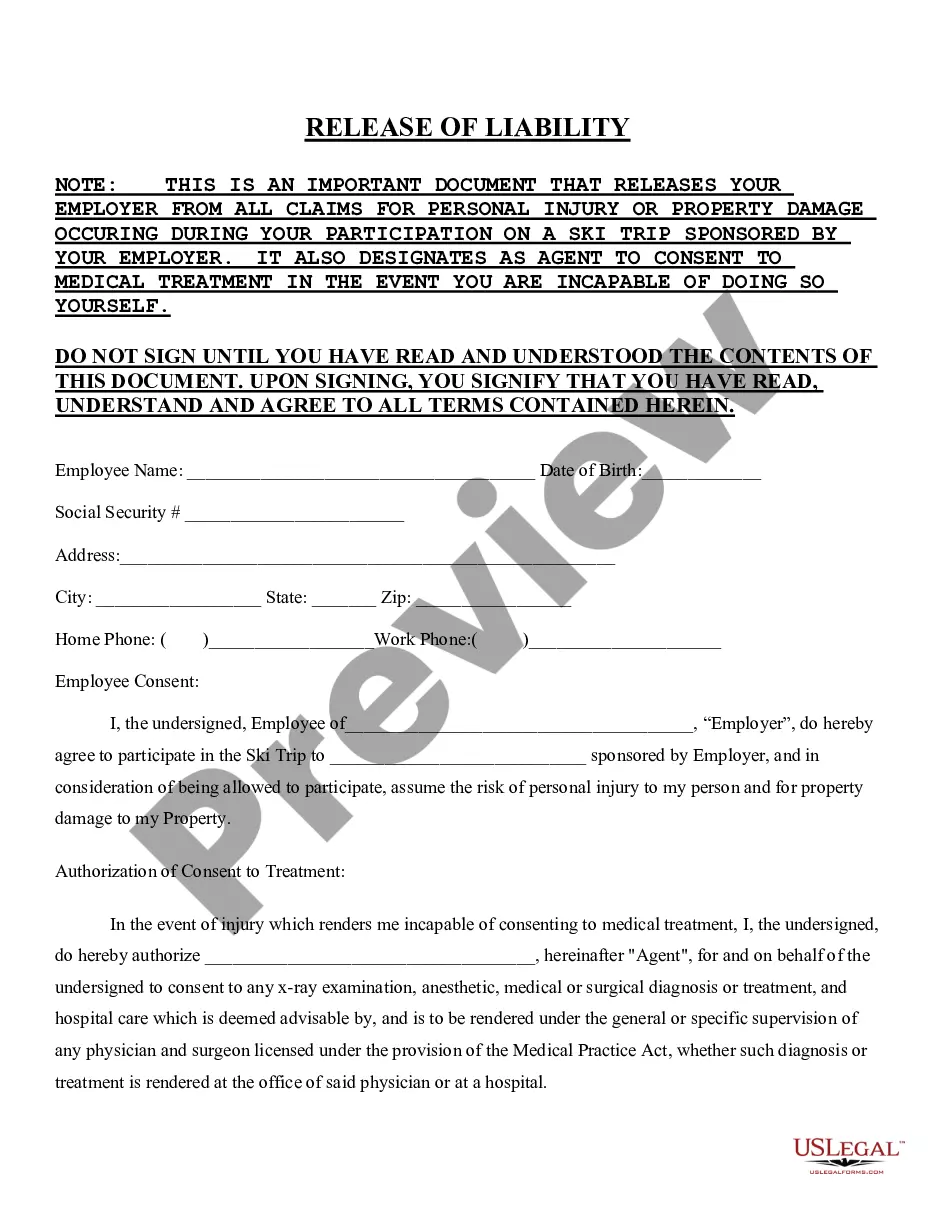

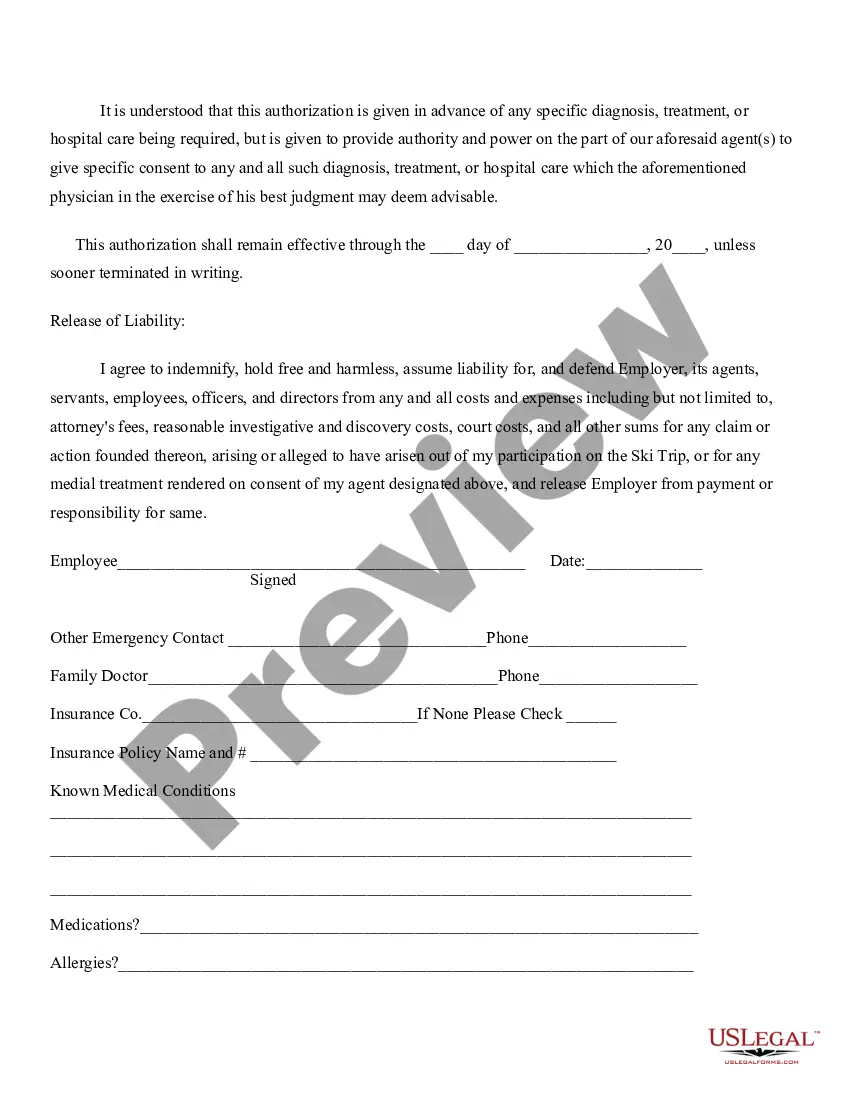

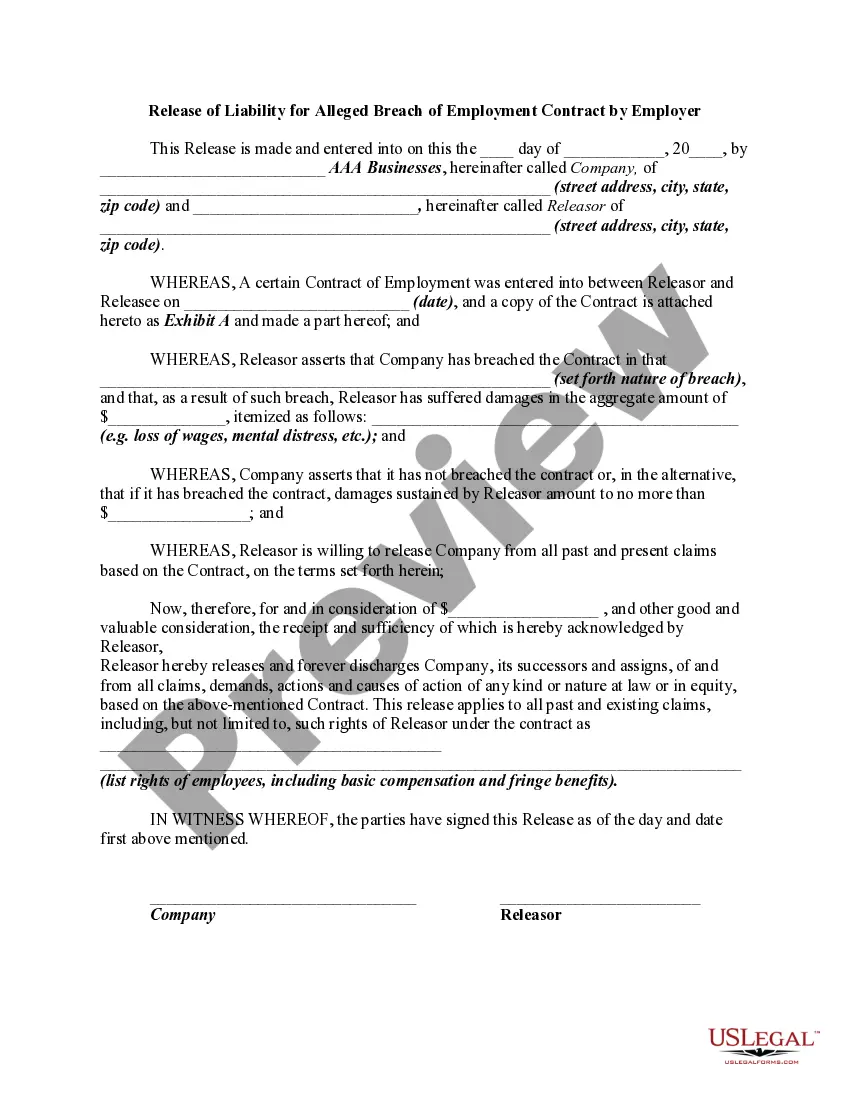

How to fill out Release Of Liability Of Employer - Ski Trip?

It’s no secret that you can’t become a legal expert immediately, nor can you learn how to quickly prepare Liability Employer Buy For College without having a specialized background. Putting together legal documents is a long process requiring a specific training and skills. So why not leave the preparation of the Liability Employer Buy For College to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court papers to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you need in mere minutes:

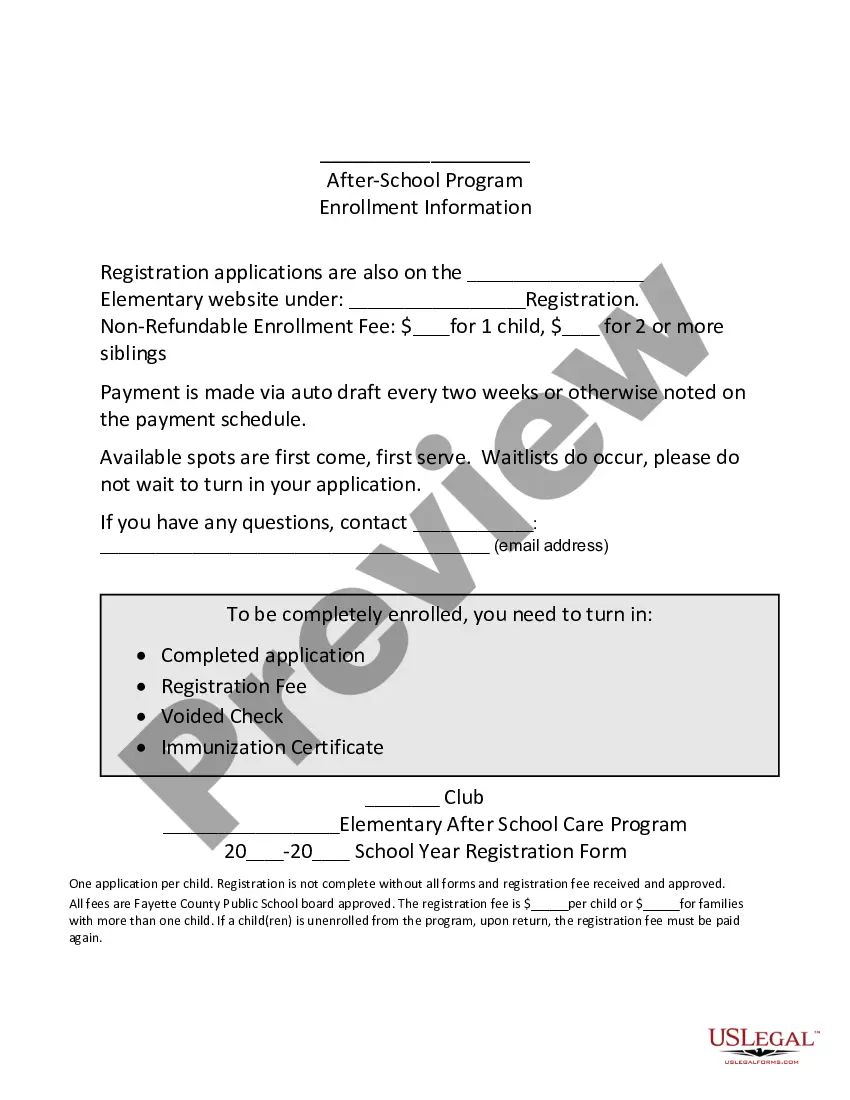

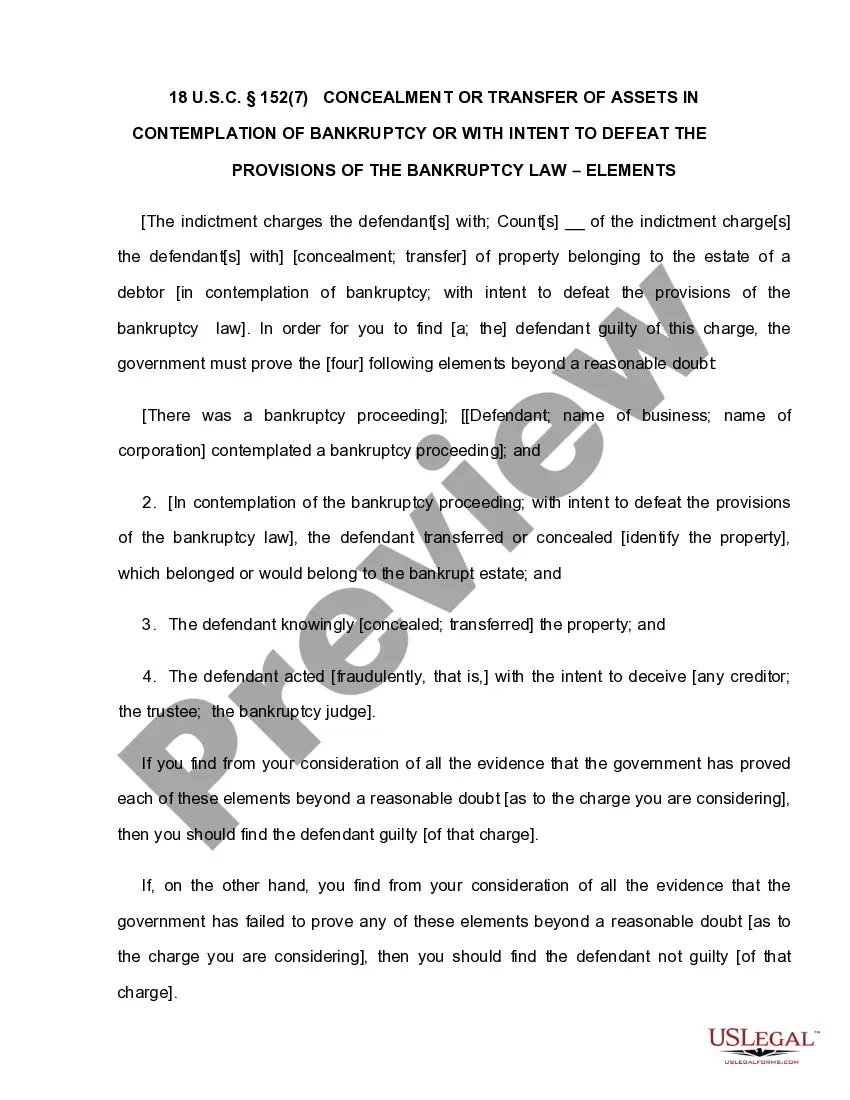

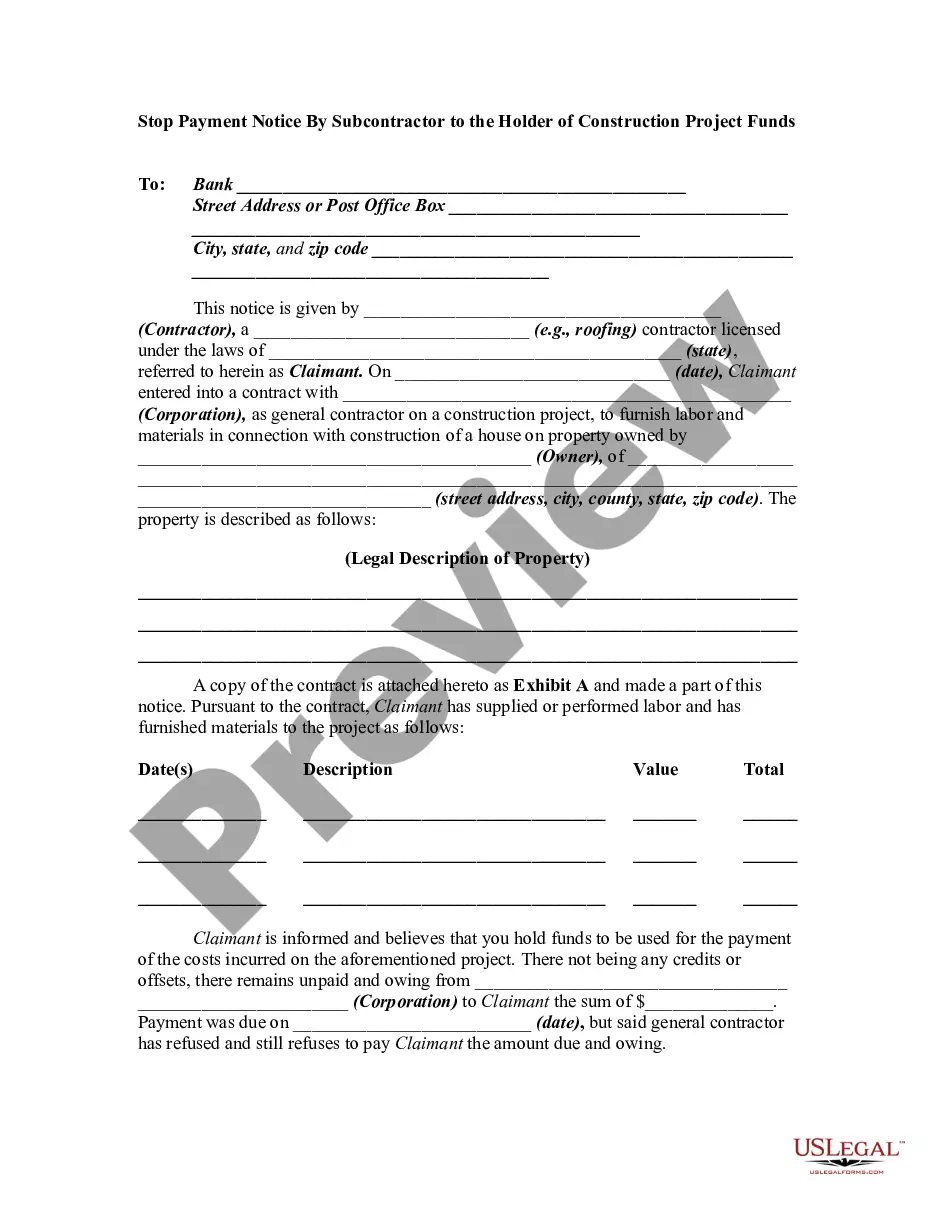

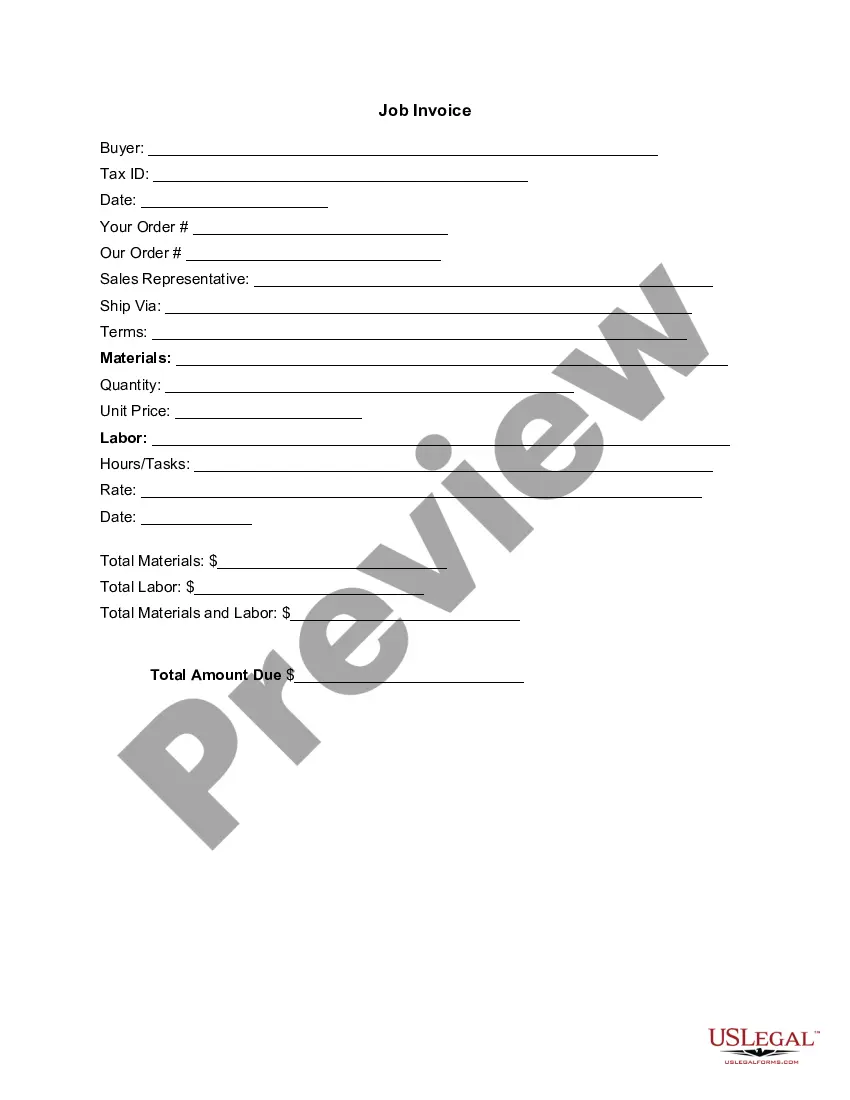

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Liability Employer Buy For College is what you’re searching for.

- Start your search over if you need any other form.

- Register for a free account and select a subscription option to buy the template.

- Choose Buy now. Once the transaction is through, you can get the Liability Employer Buy For College, complete it, print it, and send or send it by post to the designated individuals or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

How To File a General Liability Claim Contact Your Insurance Agent or Insurance Carrier. When you find out about an incident or if there's an injury at your business, contact your insurance agent or carrier as soon as you can. ... Collect Information. ... Document Everything. ... Decide How To Resolve the Claim.

How Do I Ask for a Certificate of Liability Insurance? Clearly communicate your requirements. Start by informing the contractor or vendor that you need a certificate of liability insurance from them as part of your contractual agreement. ... Wait for them to deliver the COI. ... Verify adequate coverage.

Are all students covered by the WSIB? No, only those who have a contract of service with an employer whose business is covered under the WSIA either compulsorily, or has registered for coverage by application. Coverage is provided during the paid employment work, but not during classroom courses.

Contingent Employers Liability Insurance in Canada: This insurance is for employers who pay into a workers' compensation plan is called Contingent Employers Liability (CEL). Like employer liability insurance, it can be added to a Commercial General Liability policy and is also not a no-fault coverage.

Because nurses who work in different roles remain accountable to the College, they must ensure they have PLP that will cover them if a situation arises that would require them to step out of their UCP role and into a nursing one to provide nursing care.