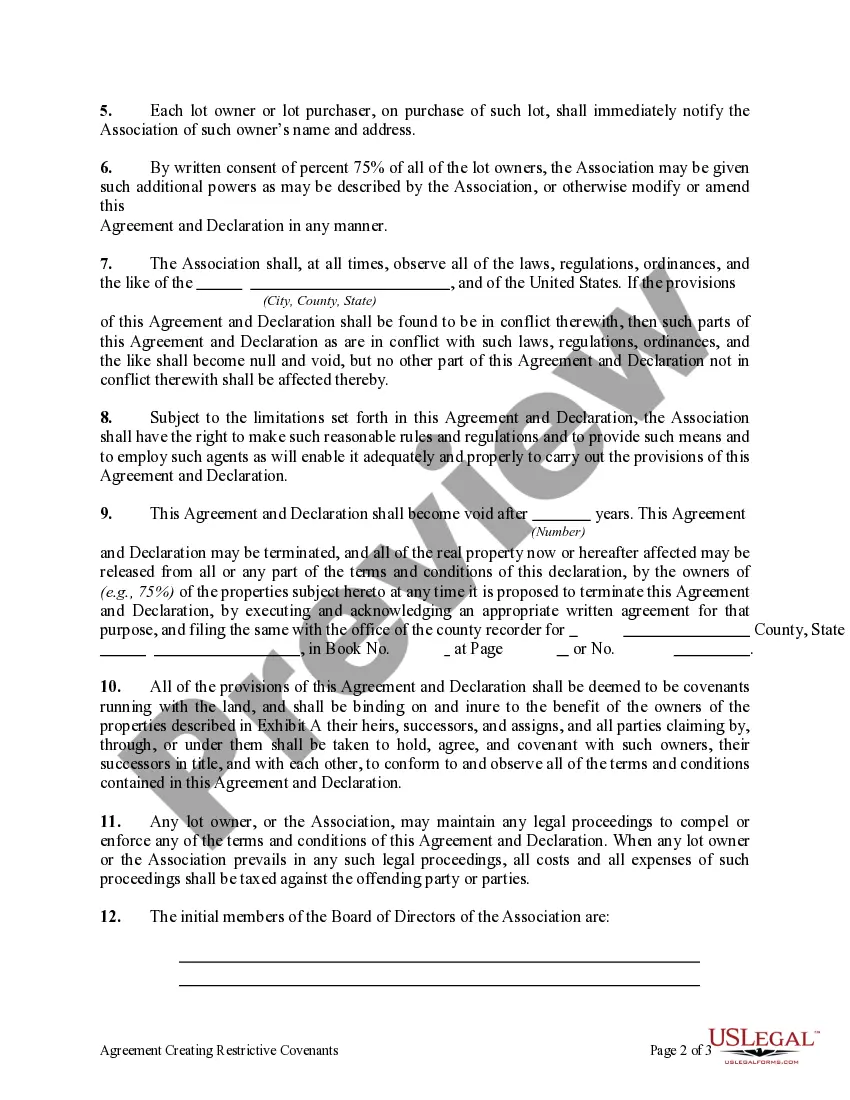

Agreement Restrictive Covenants With Standard Debt Provisions

Description

How to fill out Agreement Creating Restrictive Covenants?

There's no further justification to squander time looking for legal documents to comply with your local state requirements.

US Legal Forms has gathered all of them in a single location and facilitated their accessibility.

Our platform offers over 85k templates for various business and personal legal situations organized by state and area of application.

Use the search bar above to find another template if the current one does not suit your needs. Click Buy Now next to the template name when you identify the correct one. Choose the desired subscription plan and create an account or Log In. Make payment for your subscription with a card or through PayPal to continue. Select the file format for your Agreement Restrictive Covenants With Standard Debt Provisions and download it to your device. Print out your form to complete it manually or upload the sample if you prefer to do it in an online editor. Preparing official documentation under federal and state regulations is quick and straightforward using our platform. Try US Legal Forms today to keep your paperwork organized!

- All forms are correctly prepared and verified for authenticity, ensuring you receive a current Agreement Restrictive Covenants With Standard Debt Provisions.

- If you are acquainted with our platform and already possess an account, make certain your subscription is active prior to obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all acquired documents at any moment needed by navigating to the My documents tab in your profile.

- If you have not utilized our platform previously, the process will require a few additional steps to finalize.

- Here's how newcomers can find the Agreement Restrictive Covenants With Standard Debt Provisions in our library.

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

A restrictive loan covenant is simply a statement in the loan agreement between the lender and borrower stating that the small business can and cannot do certain things while it is paying on the bank loan. Companies that banks consider higher risk will have more restrictive covenants.

A restrictive covenant may include things that you can't do with your property, like raise livestock. A restrictive covenant will also include things that you must do, like mow your lawn regularly. The specific restrictive covenants you need to follow will vary depending on where you live.

Examples of affirmative covenants include requirements to maintain adequate levels of insurance, requirements to furnish audited financial statements to the lender, compliance with applicable laws, and maintenance of proper accounting books and credit rating, if applicable.

Below is a list of the top 10 most common metrics lenders use as debt covenants for borrowers:Debt / EBITDA.Debt / (EBITDA Capital Expenditures)Interest Coverage (EBITDA or EBIT / Interest)Fixed Charge Coverage (EBITDA / (Total Debt Service + Capital Expenditures + Taxes)Debt / Equity.Debt / Assets.Total Assets.More items...