Texas Special Needs Trust With An Annuity

Description

How to fill out Trust Agreement - Family Special Needs?

Whether for professional aims or personal affairs, everyone must navigate legal circumstances at some point during their lifetime.

Completing legal documents requires careful focus, starting with selecting the appropriate form template.

Once it is saved, you can fill out the form with the assistance of editing software or print it out to complete it by hand. With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template across the internet. Utilize the library’s straightforward navigation to find the appropriate template for any circumstance.

- Locate the template you require using the search bar or catalog browsing.

- Review the description of the form to confirm it aligns with your situation, state, and locality.

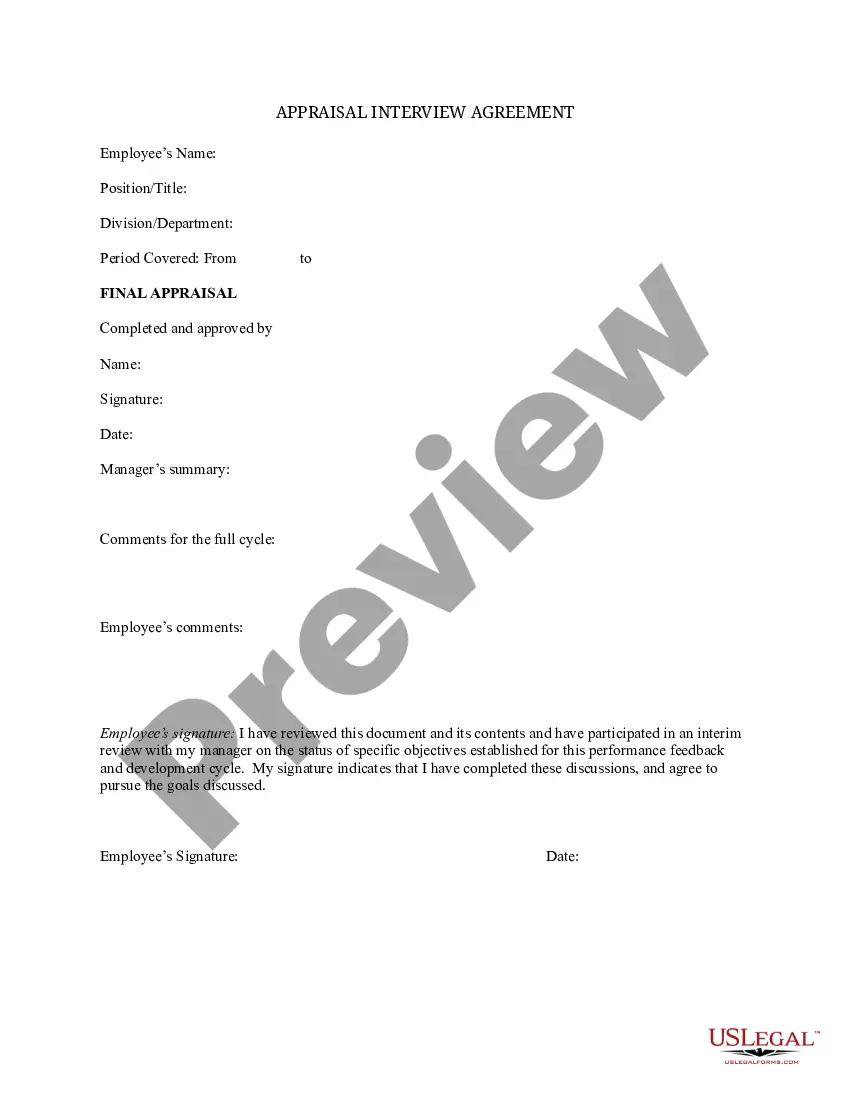

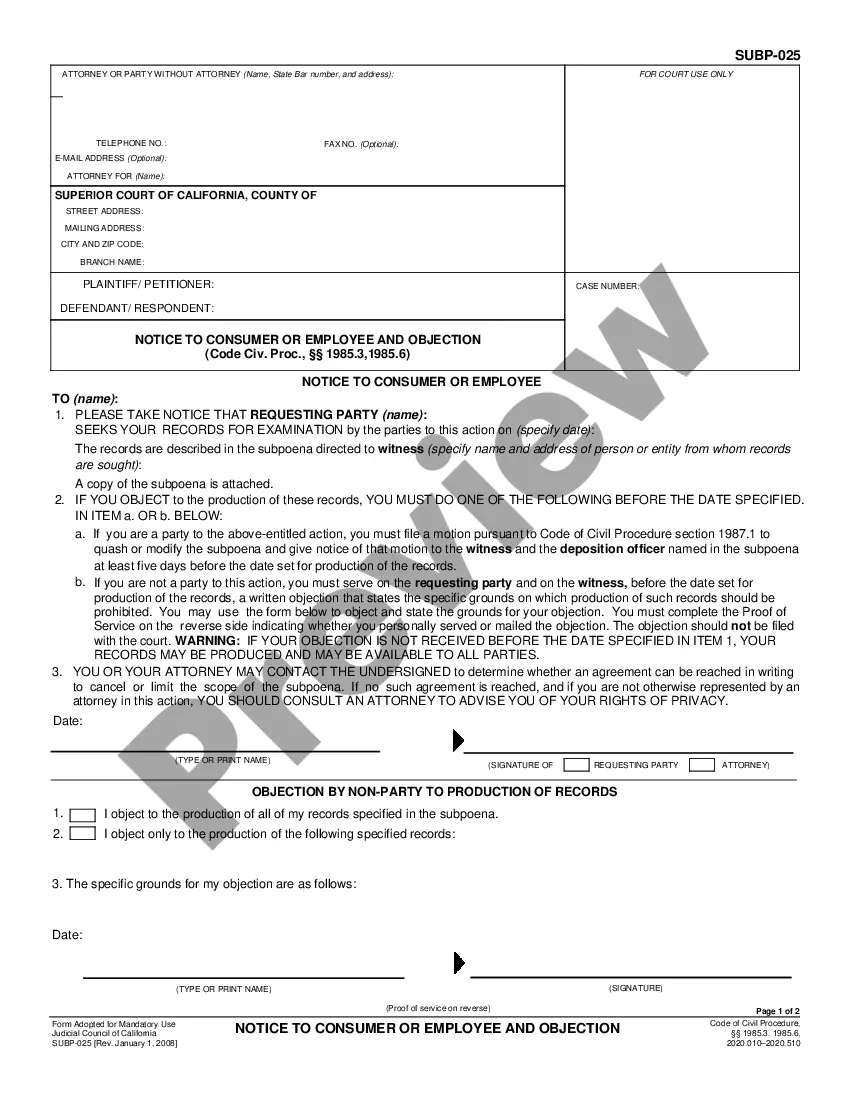

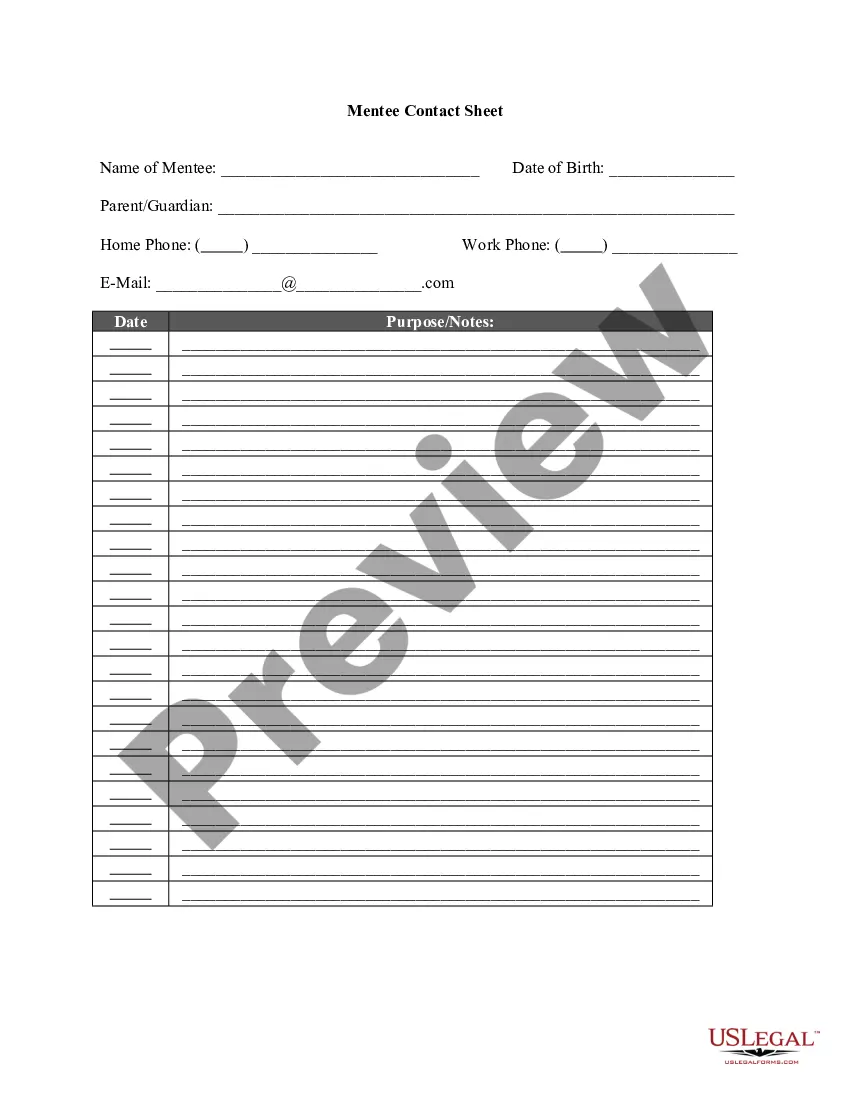

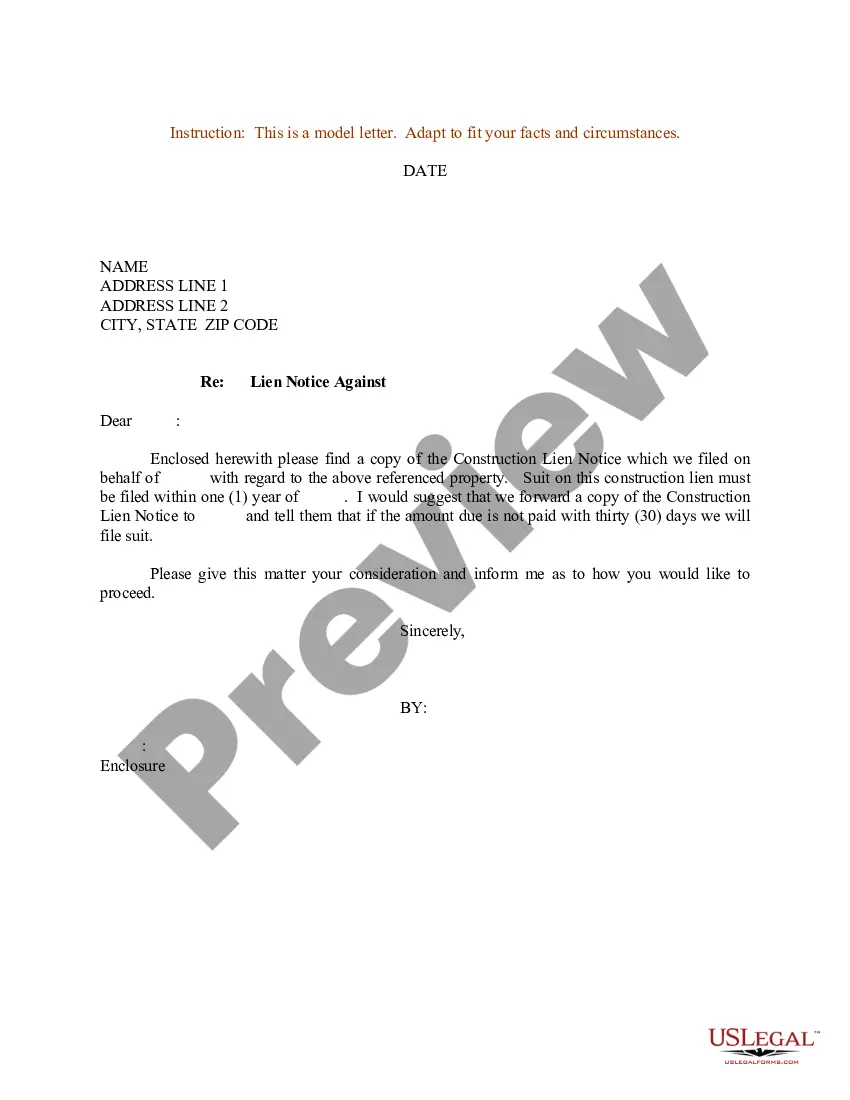

- Click on the preview of the form to inspect it.

- If it is the incorrect document, return to the search feature to find the Texas Special Needs Trust With An Annuity template you need.

- Download the file when it fits your specifications.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- If you do not yet have an account, acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Decide on your payment method: use a credit card or PayPal account.

- Choose the desired file format and download the Texas Special Needs Trust With An Annuity.

Form popularity

FAQ

Yes, an annuity can be included in a Texas special needs trust with an annuity. This includes adding an annuity as an asset, which can provide a steady income stream to support the beneficiary's needs. However, it's important to structure the trust carefully to ensure it aligns with legal guidelines and protects benefits. For tailored guidance, consider reaching out to US Legal Forms, which offers resources to help you navigate this process effectively.

When it comes to a Texas special needs trust with an annuity, filing taxes can depend on several factors. Generally, the trust itself may need to file a tax return if it generates income, but this is not the case for every trust. Beneficiaries or trustees should consult a tax professional to determine their obligations. Utilizing platforms like US Legal Forms can help clarify the requirements related to taxes for your specific situation.

One downside of a Texas special needs trust with an annuity is the complexity involved in establishing and maintaining the trust. This complexity can lead to increased legal and administrative costs over time. Additionally, if not properly structured, there could be a risk of losing government benefits, which the trust aims to protect. It’s crucial to consult legal professionals who specialize in special needs planning to ensure the trust meets all requirements.

The 5-year rule for a Texas special needs trust with an annuity refers to the period within which certain asset transfers may impact eligibility for government benefits. If assets are transferred to a trust within five years of applying for benefits, the government may consider those assets when determining eligibility. This emphasizes the importance of careful planning when funding a special needs trust. Consulting USLegalForms can help you navigate these complexities and ensure compliance.

Placing an annuity in a Texas special needs trust with an annuity helps provide a steady income stream for the beneficiary. This can enhance their quality of life without affecting eligibility for critical government benefits. By including an annuity, you ensure that funds are available for ongoing care and expenses while maintaining compliance with trust regulations. Use USLegalForms to guide you through including an annuity in your trust.

Yes, a trust can be designated as a beneficiary of a retirement annuity. This method provides guidance on how the retirement assets will be distributed according to your wishes, particularly useful in a Texas special needs trust with an annuity. It allows you to maintain control over the assets while ensuring that your beneficiary receives the support they need. It’s advisable to work with a knowledgeable expert to navigate the details involved.

A special needs trust comes with specific restrictions to protect the beneficiary’s government benefits. For instance, the funds in a Texas special needs trust with an annuity cannot be used for basic needs, such as housing and food, as this could jeopardize eligibility for public assistance. Instead, the trust can fund supplemental needs like education, medical expenses, or recreational activities. Understanding these restrictions is essential for effective planning.

A special needs trust can indeed be designated as the beneficiary of an annuity. Using a Texas special needs trust with an annuity allows you to provide financial support to a loved one with special needs without jeopardizing their eligibility for government benefits. This strategy can enhance financial stability while meeting legal requirements. Consulting a specialist on this matter can help clarify the specifics.

Yes, you can name a trust as the beneficiary of an annuity. This option can be especially beneficial for those managing assets through a Texas special needs trust with an annuity. By naming a trust, you can control the distribution of funds while ensuring your beneficiary's financial security. Always consult a legal advisor to ensure proper implementation.