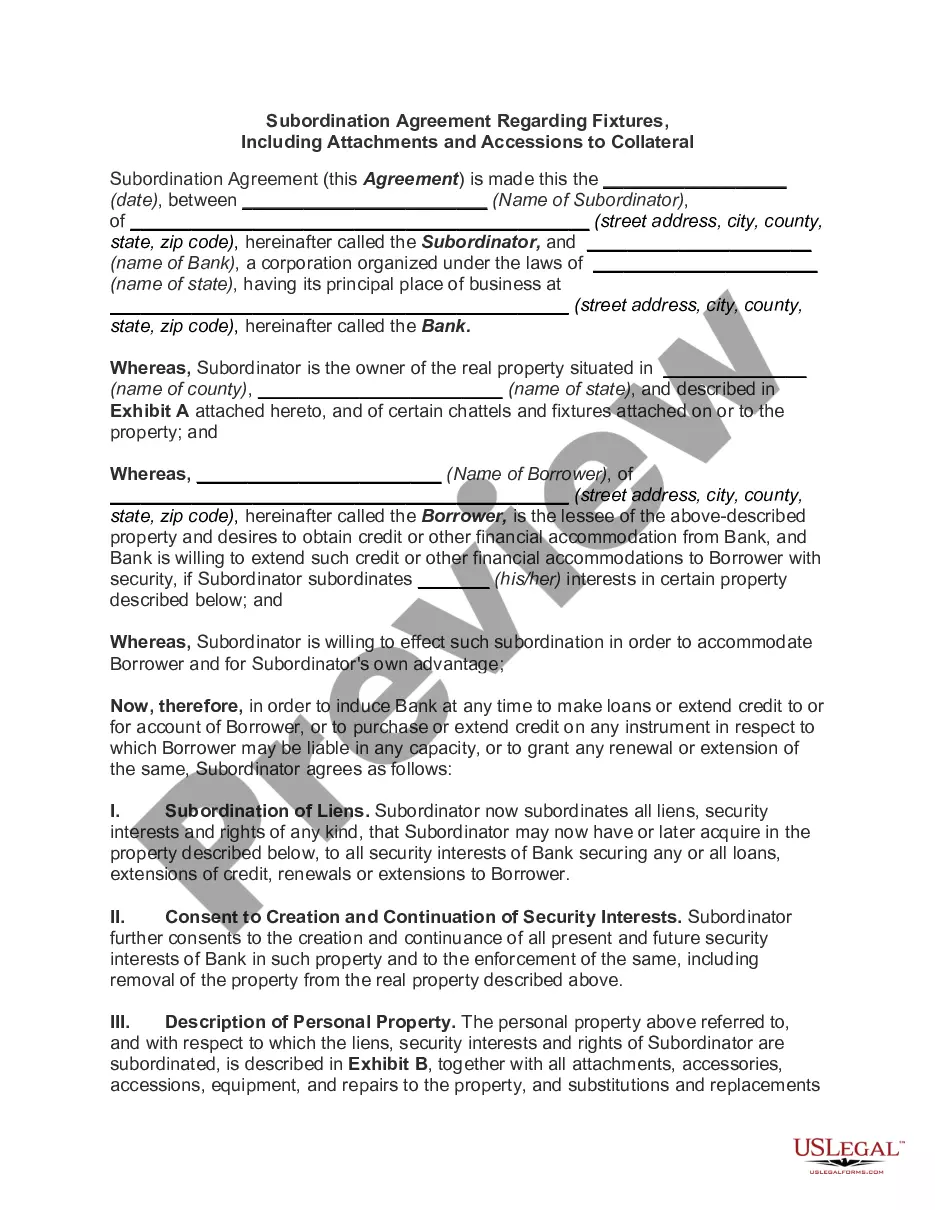

Subordination Agreement Explained For Ucc Filing

Description

How to fill out Subordination Agreement - Lien?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant financial investment.

If you’re searching for a simpler and more economical method to generate Subordination Agreement Explained For Ucc Filing or any other documentation without unnecessary hurdles, US Legal Forms is always accessible.

Our online collection of more than 85,000 current legal forms encompasses nearly every element of your financial, legal, and personal affairs.

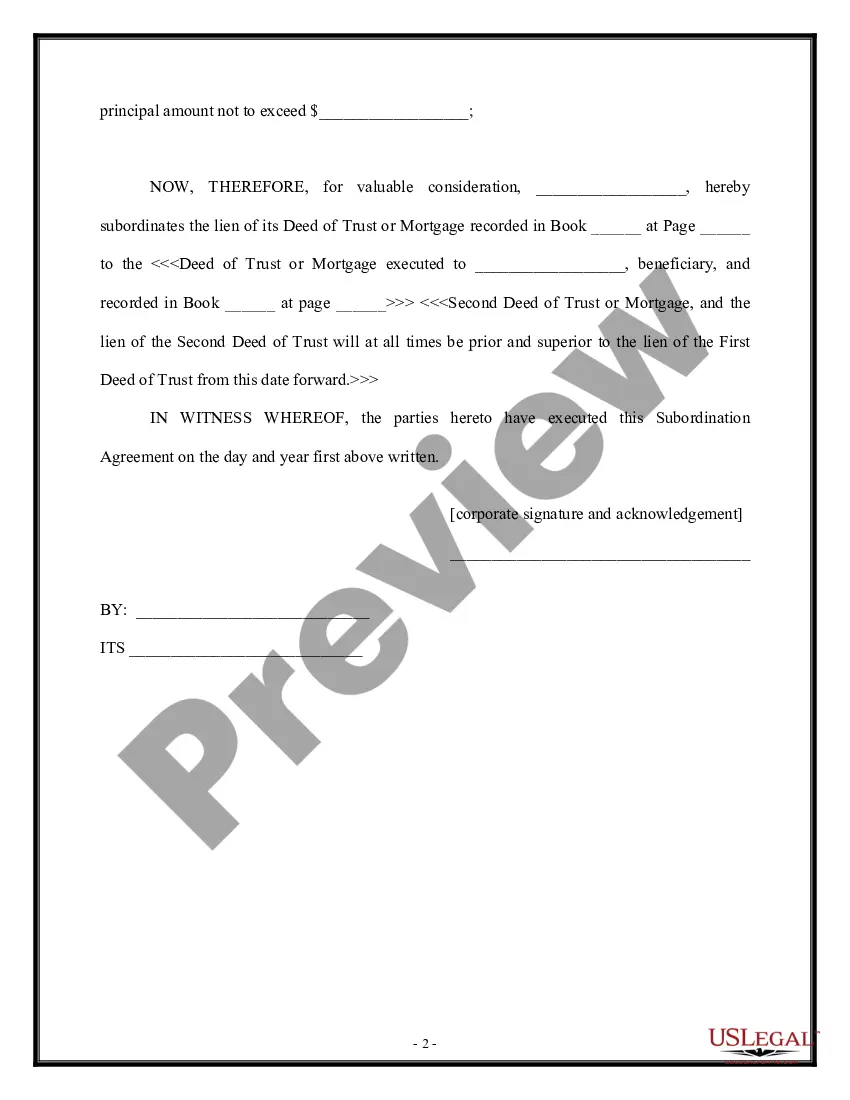

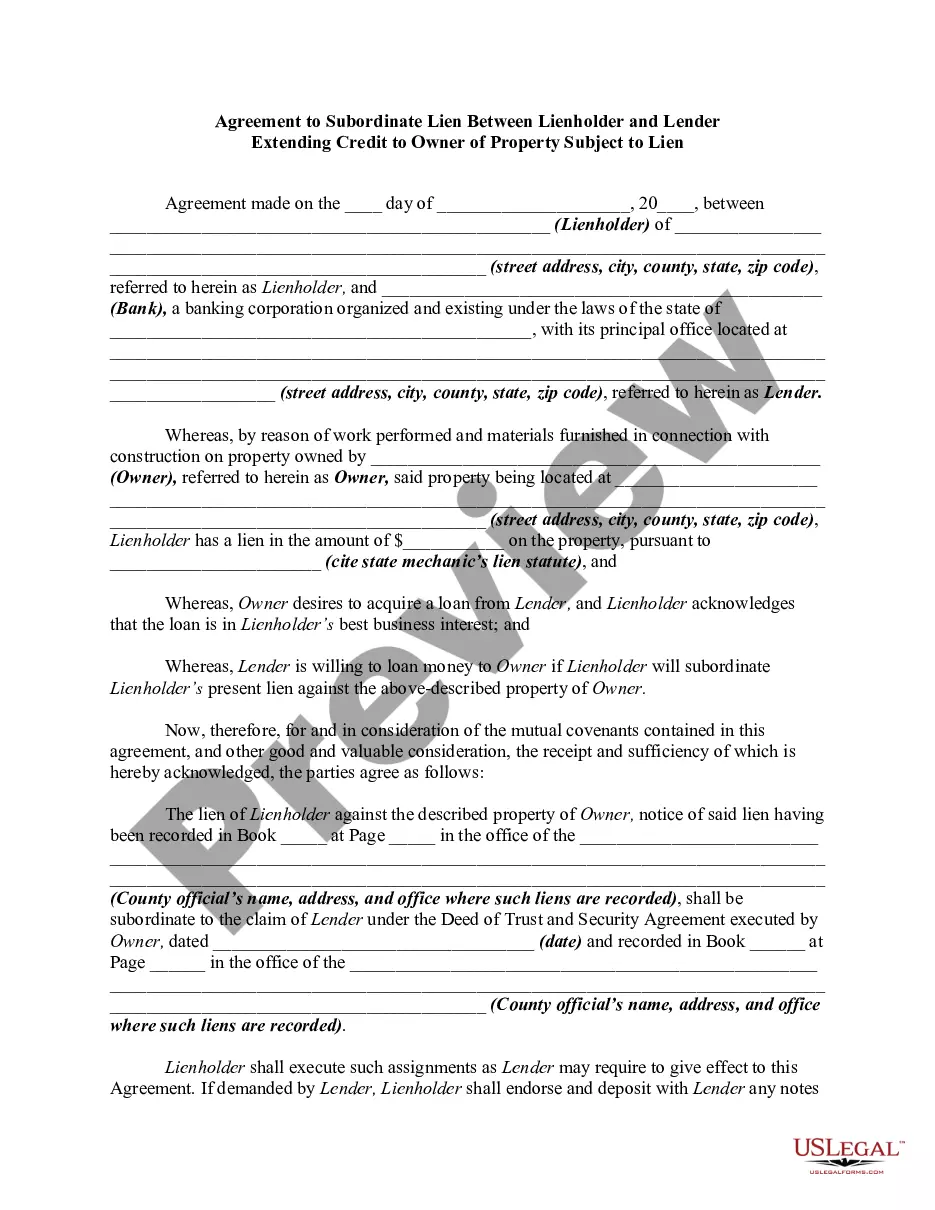

Examine the document preview and details to confirm that you have located the document you need. Ensure the form you select aligns with the specifications of your state and county. Choose the most appropriate subscription plan to acquire the Subordination Agreement Explained For Ucc Filing. Download the form, then complete, sign, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With only a few clicks, you can quickly obtain state- and county-specific forms meticulously crafted for you by our legal experts.

- Utilize our website whenever you require dependable and trustworthy services through which you can effortlessly locate and download the Subordination Agreement Explained For Ucc Filing.

- If you’re a returning user and have previously registered an account with us, simply Log In to your account, find the template, and download it or access it again anytime in the My documents section.

- Don’t have an account? No problem. It requires minimal time to sign up and browse the catalog.

- Before proceeding to download Subordination Agreement Explained For Ucc Filing, consider these suggestions.

Form popularity

FAQ

The Subordinated Lender hereby agrees that all Subordinated Obligations (as defined below) and all of his right, title and interest in and to the Subordinated Obligations shall be subordinate and junior in right of payment to the Senior Lender Loan and all rights of Senior Lender in respect of the Senior Lender Loan, ...

A UCC 3 Subordination is a form used when more than one lender has an interest in the same collateral. In this situation, a subordination agreement should be signed in order to establish the order in which the lenders will be refunded the money.

Now, for example, let's say you want to take a second mortgage with Bank#2. Bank#2 will search the Secretary of State records and find that Bank#1 has already lent you money. Bank#2 will not get its money back until Bank#1 has been paid in full so its interest is referred to as "subordinated".

Now, for example, let's say you want to take a second mortgage with Bank#2. Bank#2 will search the Secretary of State records and find that Bank#1 has already lent you money. Bank#2 will not get its money back until Bank#1 has been paid in full so its interest is referred to as "subordinated".

A subordination is a process where the second lender/funder asks the first lender/funding institution if they will ?let go? of a particular class of collateral. The most common subordination agreements take place with accounts receivable and inventory.