Agent And Independent Contractor

Description

How to fill out Contract Between General Agent Of Insurance Company And Independent Agent?

There's no longer a need to dedicate hours searching for legal documents to comply with your local state laws. US Legal Forms has compiled all of them in one location and simplified their accessibility.

Our website offers over 85,000 templates for all business and personal legal situations organized by state and area of application. All forms are meticulously drafted and verified for authenticity, so you can have confidence in acquiring a current Agent And Independent Contractor.

If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates. Log In to your account, select the document, and click Download. You can also revisit all obtained documents whenever necessary by navigating to the My documents section in your profile.

Print your form to fill it out by hand or upload the template if you prefer to use an online editor. Preparing official documents in accordance with federal and state regulations is quick and easy with our resources. Try US Legal Forms today to keep your paperwork organized!

- If you've never utilized our platform, the process will require a few more steps to finalize.

- Here's how new users can acquire the Agent And Independent Contractor from our library.

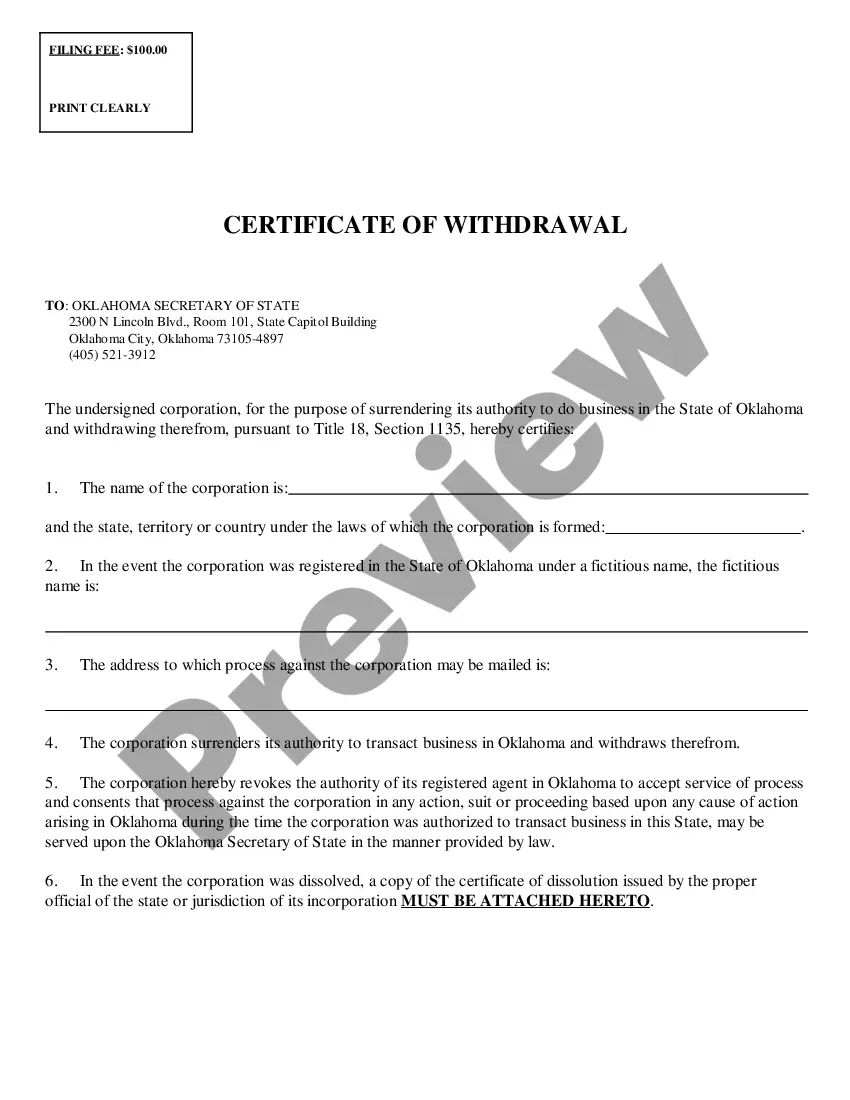

- Examine the page content closely to ensure it contains the sample you need.

- To do this, use the form description and preview options if available.

- Utilize the Search bar above to look for another sample if the current one does not suit you.

- Click Buy Now next to the title of the template when you find the right one.

- Select the preferred subscription plan and create an account or Log In.

- Make the payment for your subscription using a credit card or through PayPal to proceed.

- Choose the file format for your Agent And Independent Contractor and download it to your device.

Form popularity

FAQ

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.

As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

Agents and independent contractors sell products or provide services within different legal boundaries. Agents are employees, while independent contractors are self-employed; this difference affects how services are performed.

An agent is a person or entity that can be an employee or independent contractor providing service for the principal on an ongoing basis. However, a totally independent third party can be an agent and nothing else.

An independent contractor has almost absolute discretion whereas an agent is controlled by the principal. Due to the control of the principal, liability is more fairly attributed to the principal for the agent's actions.