Unsecured Loan Form For Sss

Description

How to fill out Multistate Promissory Note - Unsecured - Signature Loan?

Whether for commercial reasons or for individual concerns, everyone must manage legal issues sooner or later in their lifetime.

Completing legal documents demands meticulous focus, starting from selecting the correct form example.

With an extensive US Legal Forms catalog available, you never have to waste time searching for the right template online. Utilize the library’s user-friendly navigation to locate the appropriate template for any occasion.

- For example, if you pick an incorrect version of the Unsecured Loan Form For Sss, it will be declined upon submission.

- Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Unsecured Loan Form For Sss template, follow these straightforward steps.

- Obtain the template required by utilizing the search bar or catalog navigation.

- Review the form’s description to ensure it corresponds with your situation, state, and county.

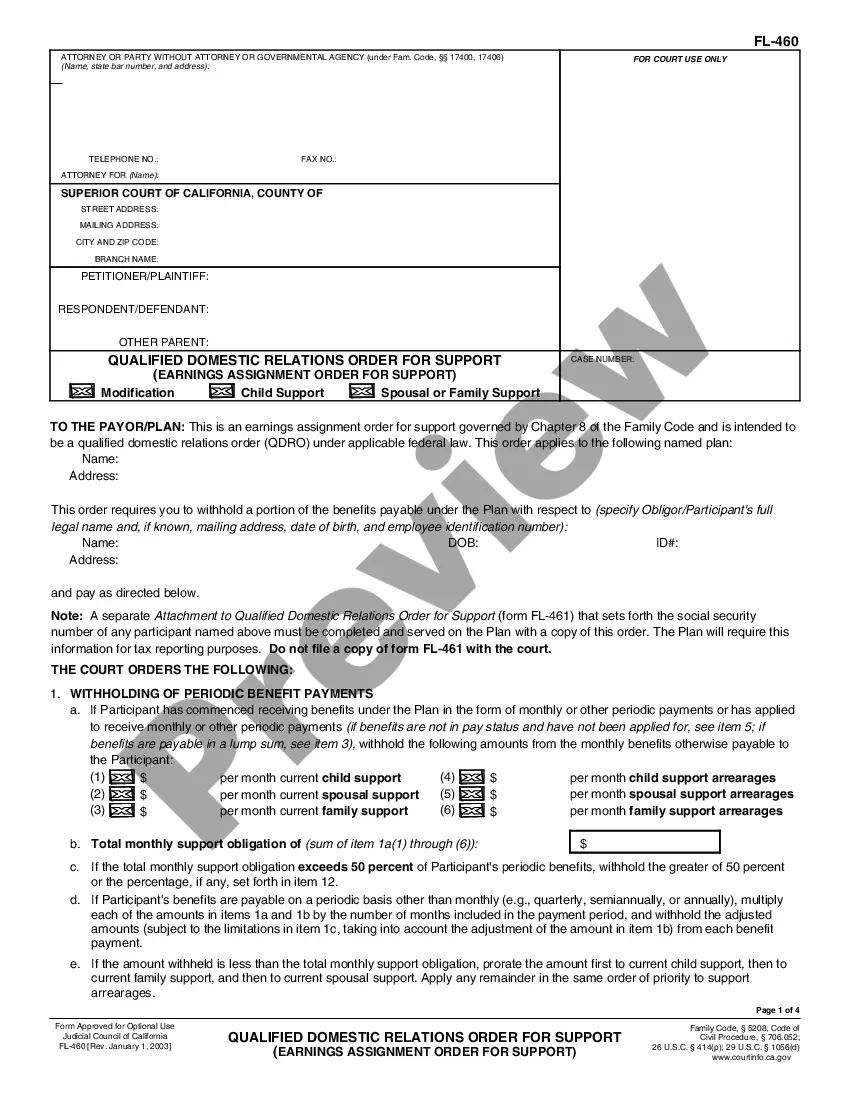

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Unsecured Loan Form For Sss template you require.

- Obtain the file when it aligns with your needs.

- If you possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- Should you not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you desire and download the Unsecured Loan Form For Sss.

- After it is downloaded, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

REPAYMENT TERM AND SCHEDULE OF PAYMENT The monthly amortization shall start on 2nd month following the date of loan, which is due on or before the payment deadline, as follows: Payment shall be made at any SSS branch with tellering facility, SSS-accredited bank or SSS-authorized payment center. Salary Loan Details - Republic of the Philippines Social Security System sss.gov.ph ? sss ? appmanager ? pages ? pag... sss.gov.ph ? sss ? appmanager ? pages ? pag...

Of course, you can! Employed members can apply online via the SSS website. The application must be certified by the employer. Self-employed and voluntary members can either apply online or head to an SSS branch near their place of residence or business.

How can members pay their SSS loans under the program? Members may pay their consolidated loan through a one-time payment within 30 calendar days upon the receipt of an approval notice. Alternatively, they may also opt to pay through installment.

Fill in personal information: Provide your complete name, SSS number, and date of birth at the top of the form. 3. Indicate the loan type: In the designated field, specify the type of loan you are repaying, such as Calamity Loan or Salary Loan.

First, you must be an SSS member. Second, you should have at least 36 months of contributions in total, with six months of these contributions made in the last 12 months. Alternatively, you can apply for a two-month salary loan if you don't meet this criteria.