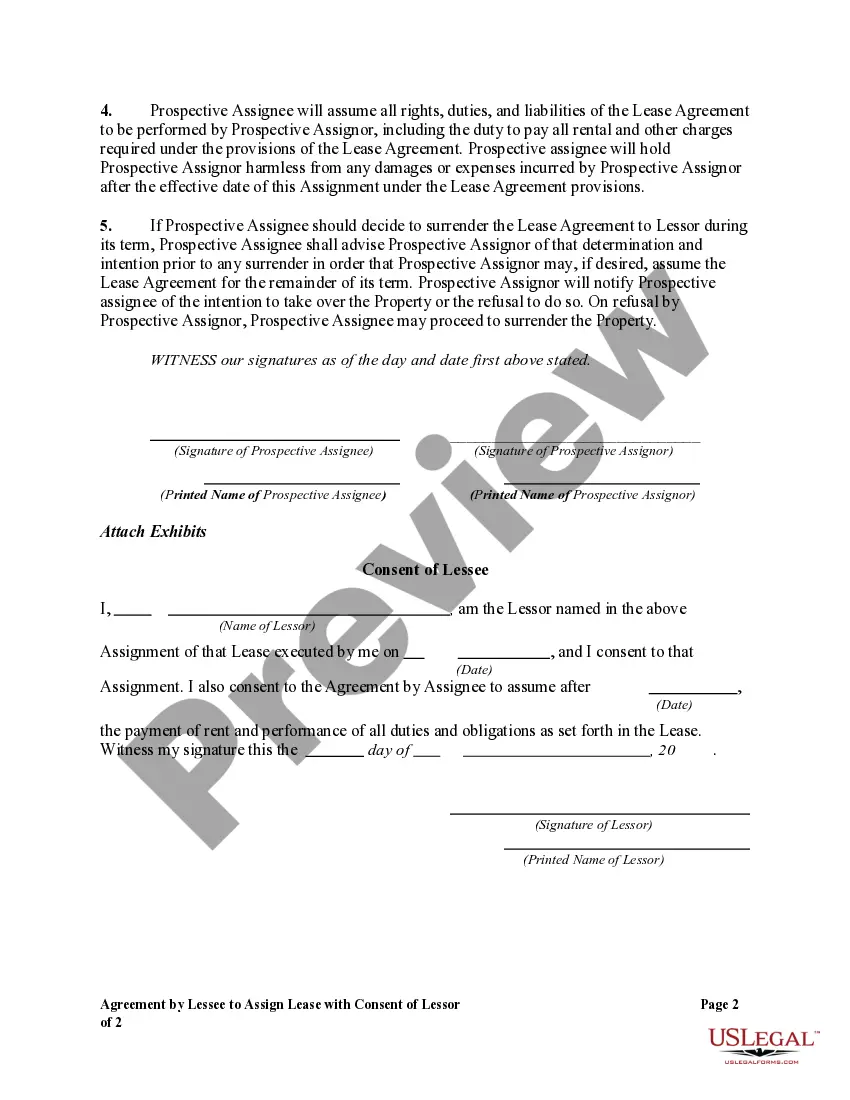

Lessor And Lessee Agreement Sample

Description

How to fill out Agreement By Lessee To Assign Lease With Consent Of Lessor?

Maneuvering through the red tape of official paperwork and formats can be challenging, particularly if one does not engage in that professionally.

Even locating the appropriate format for the Lessor And Lessee Agreement Sample will be labor-intensive, as it needs to be authentic and accurate to the last digit.

Nonetheless, you will have to invest considerably less time sourcing a suitable template from a trusted provider.

Acquire the correct form in a few straightforward steps: Enter the document name in the search box. Identify the suitable Lessor And Lessee Agreement Sample from the results. Review the sample description or view its preview. When the format meets your criteria, click Buy Now. Choose your subscription plan. Use your email and create a password to register an account at US Legal Forms. Select a credit card or PayPal as your payment method. Download the template document on your device in your preferred format. US Legal Forms can save you time and effort verifying if the form you discovered online is suitable for your requirements. Establish an account and gain unrestricted access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of finding the right documents online.

- US Legal Forms serves as a single destination to access the latest document samples, verify their uses, and download these samples for completion.

- This resource houses over 85,000 forms applicable across various sectors.

- When searching for a Lessor And Lessee Agreement Sample, you can trust its reliability since all forms are authenticated.

- Having an account at US Legal Forms grants you easy access to all necessary samples.

- You can store them in your history or add them to the My documents collection.

- Retrieve your saved forms from any device by clicking Log In on the library site.

- If you still don’t have an account, you can always search again for the template you require.

Form popularity

FAQ

Nearly all leases contain covenants, that is, where the landlord and tenant promise each other to do, or not to do, certain things in relation to the land, eg, landlord promise to keep premises in repair and tenant may promise not to use premises for any trade or business.

The lessor in a lease agreement is the person or legal entity who grants a lease to an individual or family, often a lease on a property. The lessor is the owner of the asset in the lease agreement.

How to Write a Lease AgreementStep 1: Outline your lease agreement. Lease agreements should be organized, clear, and easy to read for both parties.Step 2: Determine important provisions.Step 3: Construct your lease clauses.Step 4: Consult local laws or a local real estate lawyer.Step 5: Formatting and fine-tuning.

A lease is a contract outlining the terms under which one party agrees to rent an assetin this case, propertyowned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.