Assignment Of Promissory Note Format For Lending Money

Description

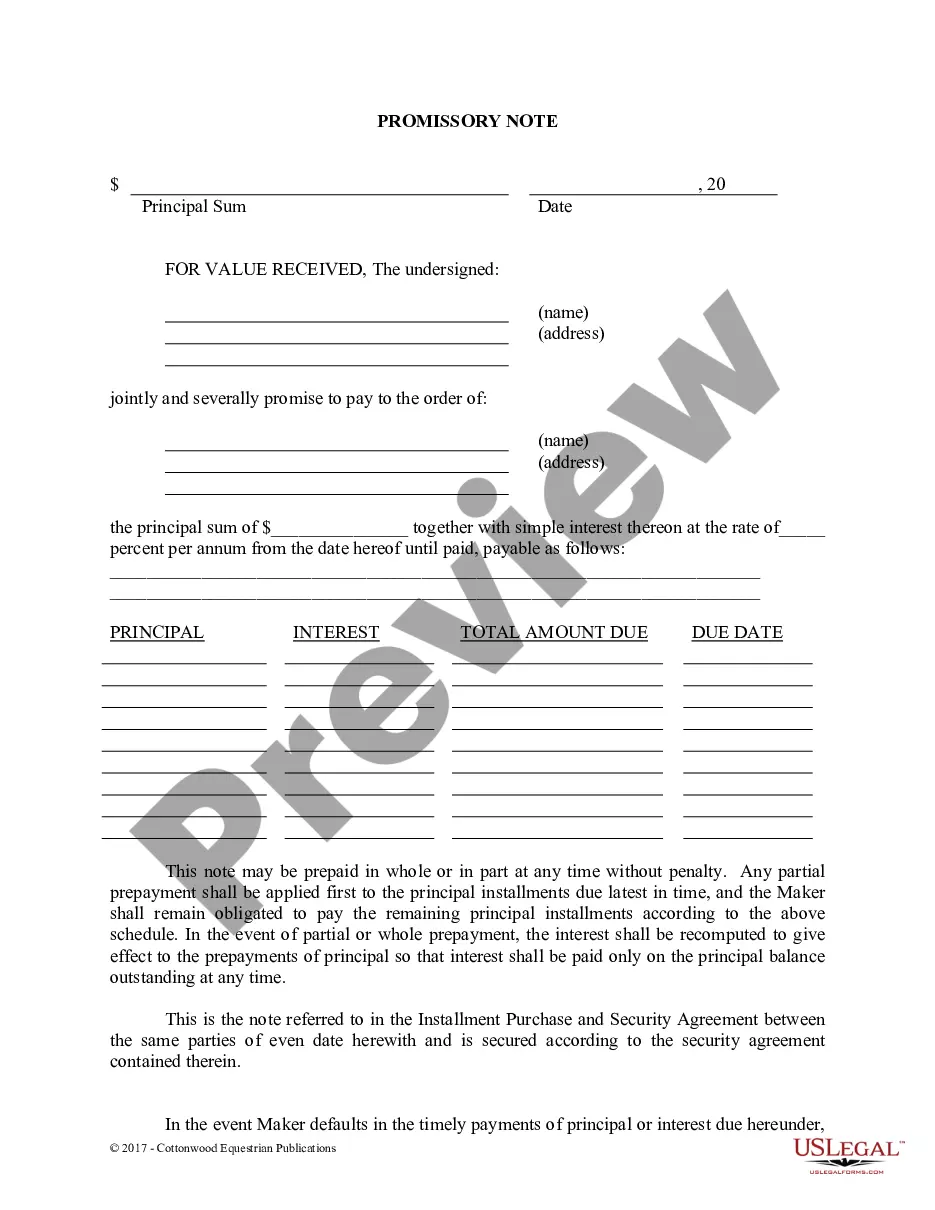

How to fill out Promissory Note Assignment And Notice Of Assignment?

Creating legal documents from the ground up can frequently feel daunting.

Certain situations may demand extensive research and substantial financial investment.

If you’re looking for a more straightforward and cost-effective method of generating Assignment Of Promissory Note Format For Lending Money or other paperwork without excessive complications, US Legal Forms is always available to assist you.

Our online database of over 85,000 current legal templates covers nearly all facets of your financial, legal, and personal considerations. With only a few clicks, you can promptly access state- and county-compliant forms meticulously assembled for you by our legal professionals.

Review the form preview and details to ensure it is the one you seek. Verify that the selected form meets the specifications of your state and county. Select the appropriate subscription plan to purchase the Assignment Of Promissory Note Format For Lending Money. Download the file, complete it, sign it, and print it out. US Legal Forms boasts a flawless track record and over 25 years of expertise. Join us today and make document completion a smooth and efficient process!

- Utilize our platform whenever you require a dependable service to swiftly find and download the Assignment Of Promissory Note Format For Lending Money.

- If you’re familiar with our services and have established an account with us previously, simply sign in to your account, find the template, and download it immediately or retrieve it whenever needed in the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to create one and browse the library.

- Before you go ahead and download the Assignment Of Promissory Note Format For Lending Money, keep these tips in mind.

Form popularity

FAQ

One key disadvantage of a promissory note is that it can be unsecured, leaving the lender with limited recourse in case of default. Additionally, if the terms are not clear, disputes may arise, complicating the repayment process. This highlights the importance of using a well-structured Assignment of promissory note format for lending money. Leveraging US Legal Forms can provide you with clear templates that help prevent misunderstandings.

Yes, you can create your own promissory note using a specific format. However, it is essential to include all necessary elements such as the amount, interest rate, and repayment terms. Utilizing an Assignment of promissory note format for lending money ensures that you meet legal requirements and protects both parties involved. For convenience, consider using US Legal Forms to access templates that simplify this process.

To assign a promissory note, first, you need to obtain the original document. Next, you must complete an assignment form that clearly states the transfer of rights from the original lender to the new lender. This process typically involves both parties signing the assignment document and ensuring that all terms related to the promissory note are clearly outlined. For a seamless experience, you can utilize the Assignment of promissory note format for lending money provided by US Legal Forms, which ensures you follow the correct procedure.

The assignment of a promissory note by the lender involves transferring the rights and benefits of the note to another party. This means that the new party can receive payments and enforce the terms of the note. It's crucial to document this assignment properly, often using an assignment of promissory note format for lending money, to ensure clarity and legality. Utilizing platforms like US Legal Forms can simplify this process by providing templates and guidance.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

(1) The Lender may assign all or part of the guaranteed portion of the loan to one or more Holders by using the Assignment Guarantee Agreement. The Lender must retain title to the Promissory Note.

Unless specifically prohibited in the language of the note, a promissory note is assignable by the lender. That is, the lender can sell or assign the note to a third party who the borrower must then repay.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.