Transfer On Death Vs Joint With Rights Of Survivorship

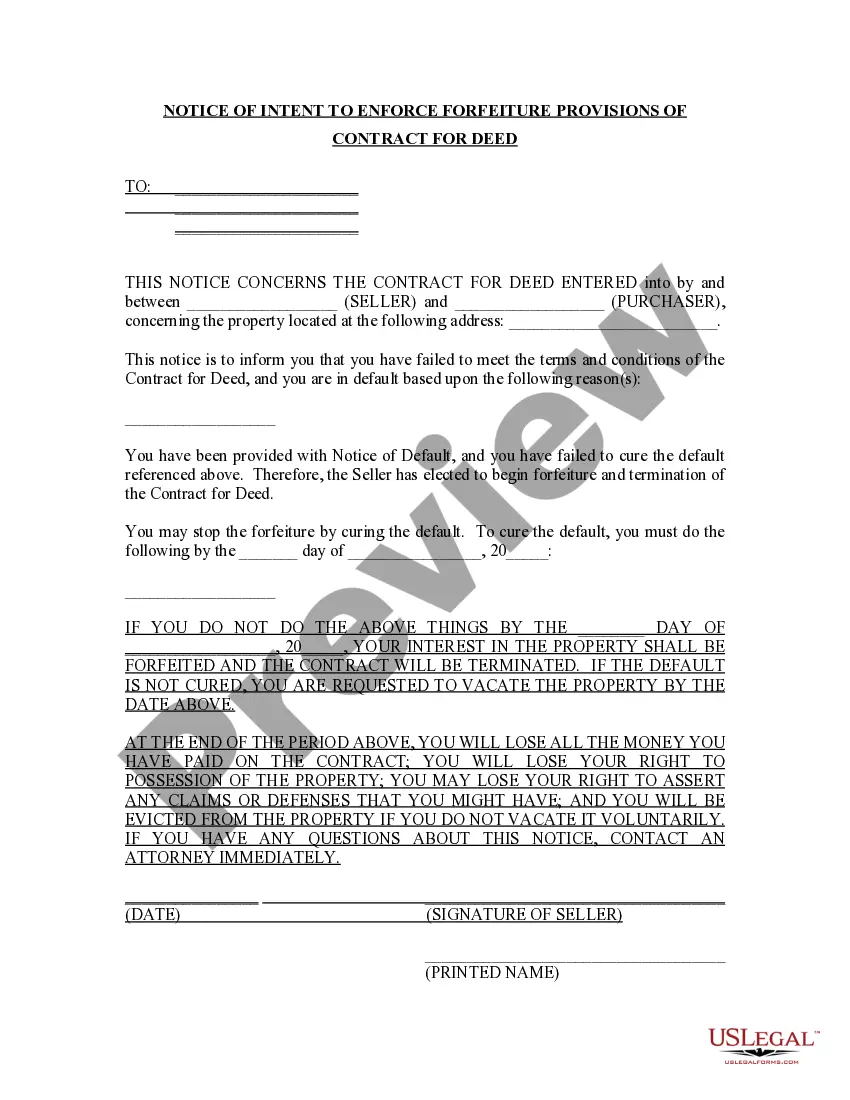

Description

How to fill out Agreement Between Unmarried Individuals To Purchase And Hold Residence As Joint Tenants With Right Of Survivorship?

Using legal templates that comply with federal and regional laws is essential, and the internet offers numerous options to choose from. But what’s the point in wasting time searching for the right Transfer On Death Vs Joint With Rights Of Survivorship sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life case. They are simple to browse with all documents grouped by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your form is up to date and compliant when acquiring a Transfer On Death Vs Joint With Rights Of Survivorship from our website.

Obtaining a Transfer On Death Vs Joint With Rights Of Survivorship is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template using the Preview option or through the text description to ensure it meets your requirements.

- Browse for another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the right form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Transfer On Death Vs Joint With Rights Of Survivorship and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

For joint ownership with right of survivorship or tenants by entirety accounts, the joint registration transfers account ownership upon the first death, usually directly to the surviving accountholder. TOD becomes effective for joint accounts if both owners pass away simultaneously.

What happens if both owners of a JTWROS account pass away at the same time? In such cases, a TOD designation applies (for any named contingent beneficiary). To be technically clear, transfer on death signifies a route of asset transfer, while joint tenancy with right of survivorship signifies a form of asset ownership.

Lack of Resources To Pay Final Expenses A significant downfall with relying upon TOD or POD account registration to administer your assets upon death is that there might not be remaining assets in your estate to cover such expenses.

Disadvantages of joint tenants with right of survivorship JTWROS accounts involving real estate may require all owners to consent to selling the property. Frozen bank accounts. In some cases, the probate court can freeze bank accounts until the estate is settled.

What happens if both owners of a JTWROS account pass away at the same time? In such cases, a TOD designation applies (for any named contingent beneficiary). To be technically clear, transfer on death signifies a route of asset transfer, while joint tenancy with right of survivorship signifies a form of asset ownership.