Purchase Real Estate Land Foreclosures

Description

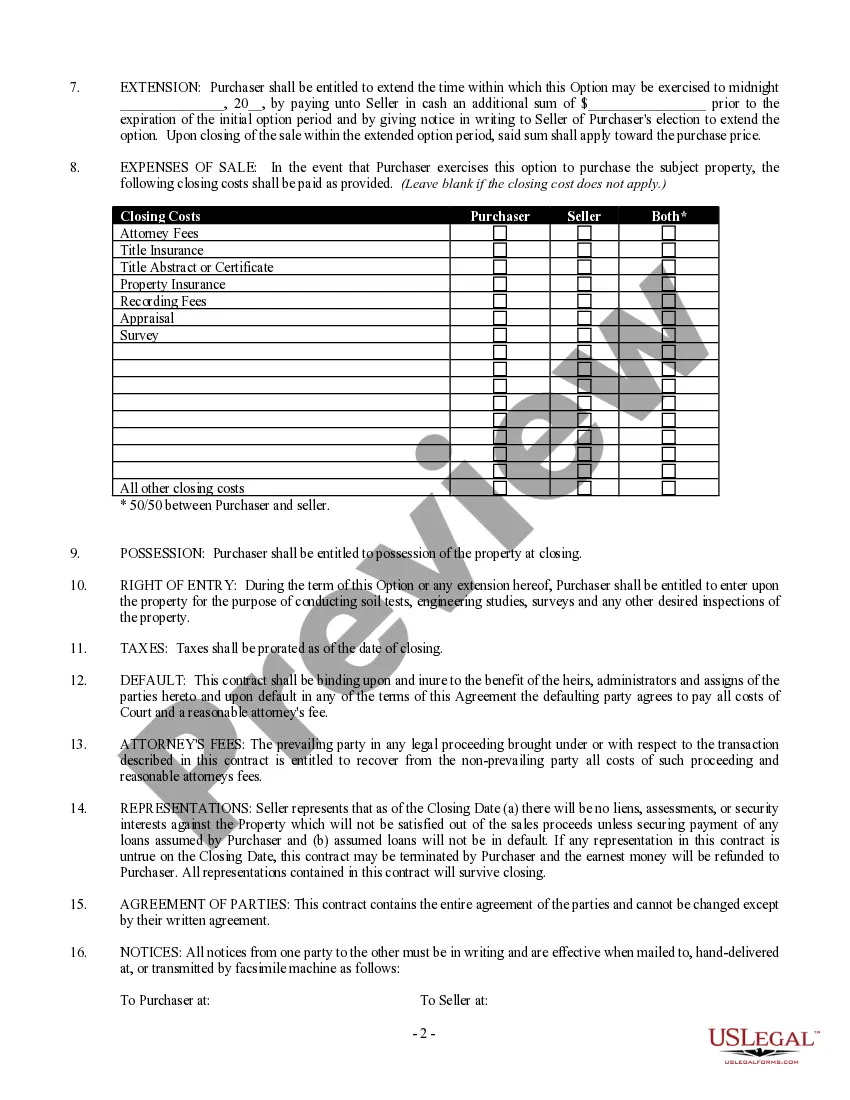

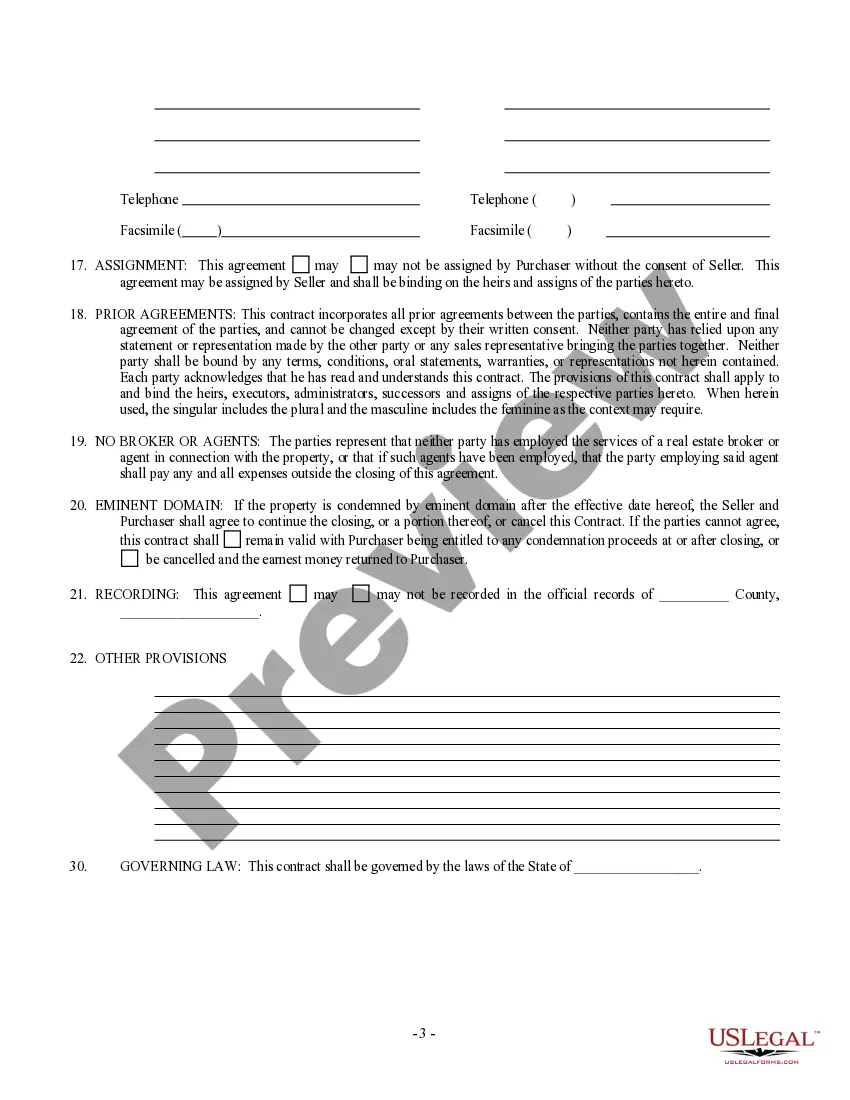

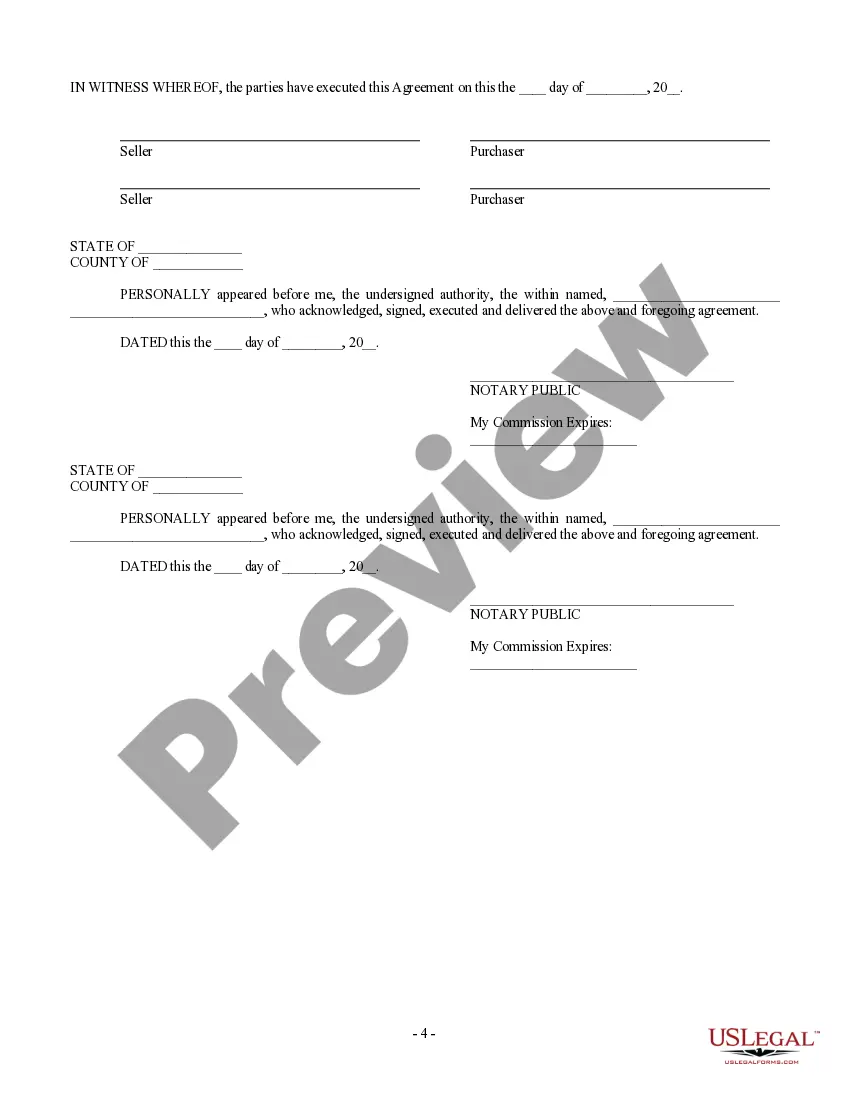

How to fill out Option For The Sale And Purchase Of Real Estate - Residential Lot Or Land?

Handling legal documents and processes can be a lengthy addition to your day.

Acquisition of Real Estate Land Foreclosures and similar forms typically necessitates searching for them and comprehending how to fill them out correctly.

Consequently, if you are managing financial, legal, or personal issues, having a comprehensive and functional online directory of forms readily available will greatly assist you.

US Legal Forms is the leading online platform for legal templates, providing over 85,000 state-specific forms along with numerous resources to help you complete your documents swiftly.

Simply Log In to your account, locate Purchase Real Estate Land Foreclosures, and download it instantly from the My documents section. You can also retrieve forms you have saved previously. Is it your first time using US Legal Forms? Register and create an account in a few minutes to gain access to the form directory and Purchase Real Estate Land Foreclosures. Then, follow the instructions below to complete your form: Ensure you have the correct document by utilizing the Preview option and reviewing the form details. Select Buy Now when ready, and choose the monthly subscription plan that suits you best. Click Download, then complete, sign, and print the form. US Legal Forms has twenty-five years of expertise helping clients manage their legal documents. Acquire the form you need today and simplify any process effortlessly.

- Explore the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Protect your document management processes with a premium service that enables you to prepare any form in moments without extra or concealed fees.

Form popularity

FAQ

Record a journal entry for the transfer of the foreclosed asset to the lender. The journal entry should post a debit to Accumulated Depreciation for the account's balance and a debit to the Foreclosed Asset's liability account for the balance owed; a credit is also posted to the Foreclosed Asset's account for its cost.

To accomplish this, a power of sale clause is added to the mortgage, or deed of trust, which gives a third-party trustee the right to sell the property in the event the borrower does not make their payments. Given this clause, non-judicial foreclosures are sometimes referred to as foreclosure by power of sale.

To buy a foreclosure in Texas, you need to either contact the owner and purchase the property before auction, submit a winning bid at auction, or negotiate a sale with the owner of an REO. Conventional financing will only apply to pre-foreclosures and REOs ? auctions will require cash.

Buying a foreclosed home doesn't always make sense. Just because a home is being sold at a foreclosure auction doesn't necessarily mean it's a good deal. Some foreclosure homes have been completely trashed by the previous owner and require major repairs like new roofs or heating and air conditioning systems.

One risk is that foreclosed properties are usually sold "as is," meaning that any repairs or renovations needed will be the responsibility of the buyer. Another risk is that the buyer may not be able to inspect the home in advance, which can lead to unexpected issues after purchase.