Uniform Transfers With Death Act

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

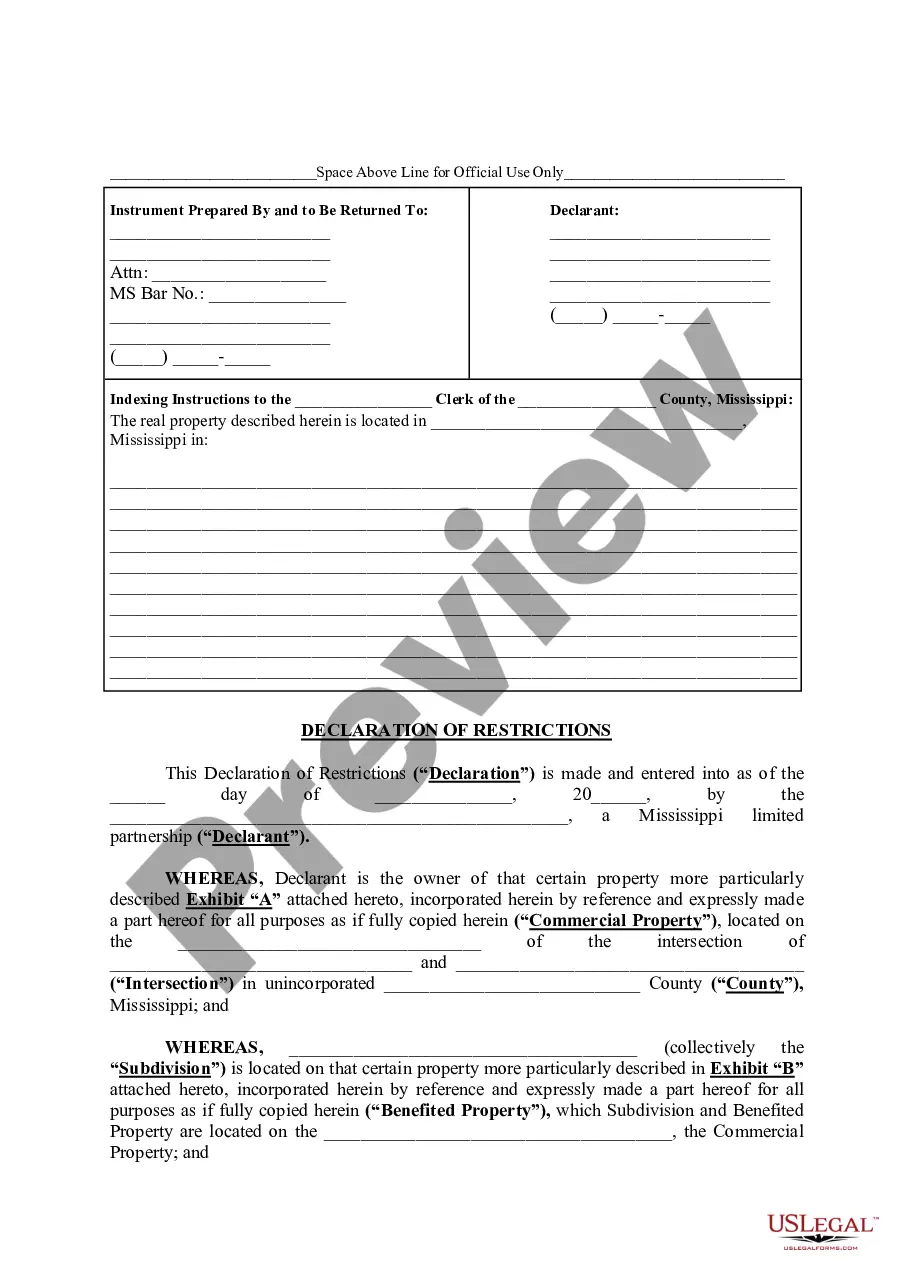

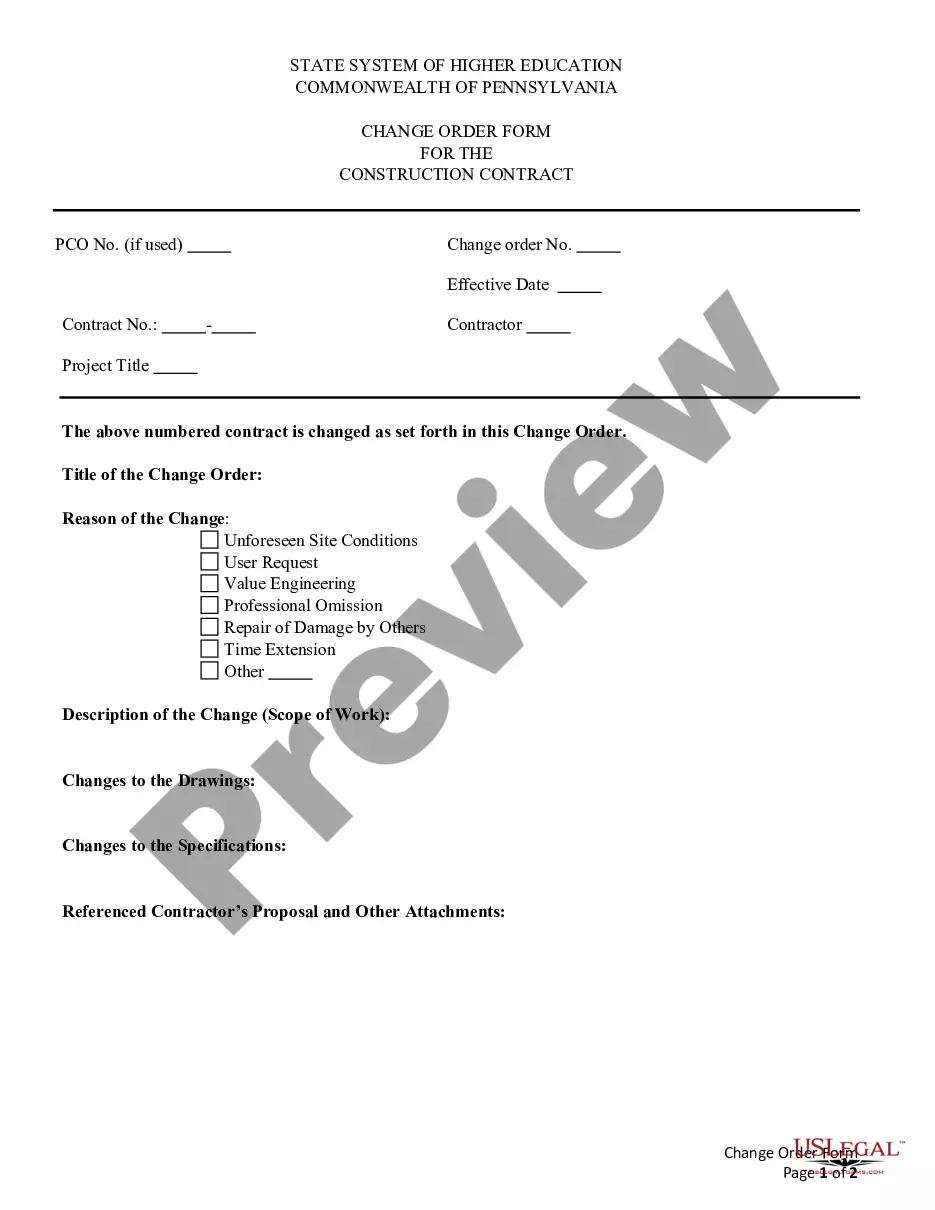

The Uniform Transfers With Death Act displayed on this page is a versatile official template crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal experts with more than 85,000 authenticated, state-specific documents for any business and personal need. It’s the quickest, easiest, and most dependable method to obtain the paperwork you require, as the service guarantees bank-grade data security and anti-malware safeguards.

Choose the format you want for your Uniform Transfers With Death Act (PDF, DOCX, RTF) and save the example on your device. Complete the paperwork by printing the template to fill it out manually. Alternatively, utilize an online multi-functional PDF editor to efficiently and accurately fill out and sign your form with a valid signature. Re-download your documents whenever necessary. Access the My documents tab in your profile to retrieve any previously saved files. Subscribe to US Legal Forms to have verified legal documents for all of life's circumstances readily available.

- Search for the document you need and review it.

- Browse through the file you searched and preview it or check the form description to ensure it meets your requirements. If not, use the search function to find the suitable one. Click Buy Now after you have found the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

The surviving joint owner only needs to send the Land Registry a death certificate along with a Deceased Joint Proprietor form (DJP form) and the Land Registry will amend the title.

Execute a stock transfer form transferring the shares to a named beneficiary. Become custodians of the shares until a buyer is sought. They should apply to the company in writing and the register of members should be updated with their names.

Some of these disadvantages are as follows: You cannot name an alternate or contingent beneficiary. There are limits and special rules for minors who are designated for Transfer On Death accounts.

With no present interest the designated beneficiary cannot withdraw funds for his or her personal use during the account holder's lifetime. Even if the designated beneficiary is also the agent under a durable power of attorney for the account holder, withdrawals must be solely for the account holder's benefit.

With no present interest the designated beneficiary cannot withdraw funds for his or her personal use during the account holder's lifetime. Even if the designated beneficiary is also the agent under a durable power of attorney for the account holder, withdrawals must be solely for the account holder's benefit.