Uniform To Transfer Minors Act

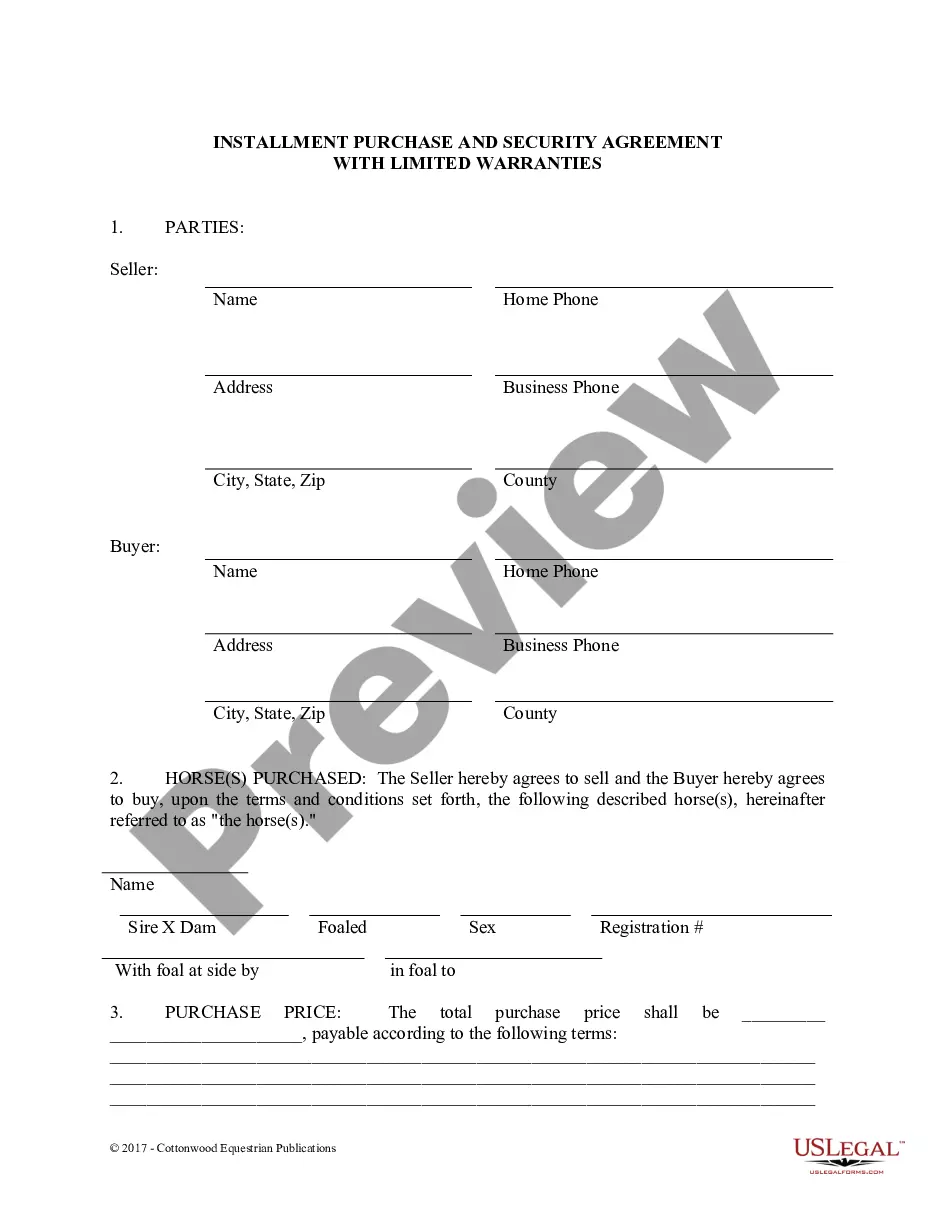

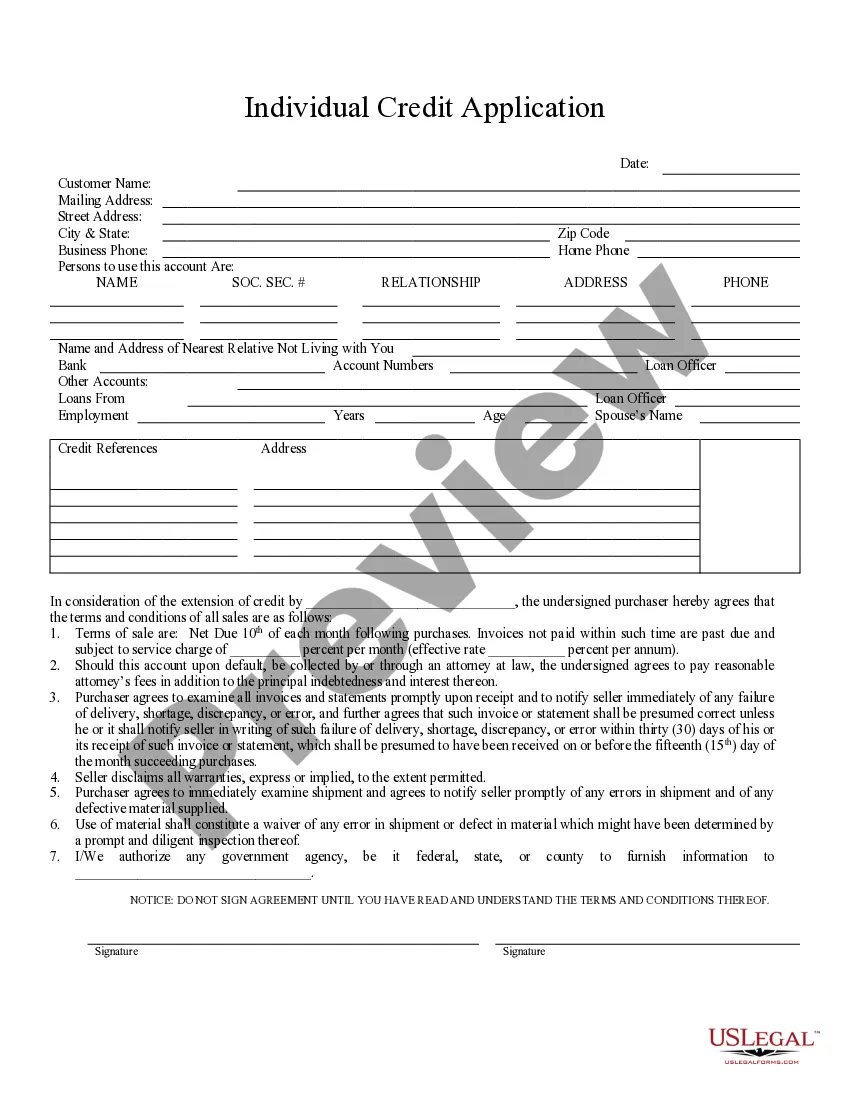

Description

How to fill out Transfer Of Property Under The Uniform Transfers To Minors Act?

Locating a reliable source for the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents necessitates precision and careful consideration, which is why it is crucial to obtain samples of the Uniform To Transfer Minors Act exclusively from reputable sources, such as US Legal Forms. An incorrect template can squander your time and postpone your current situation. With US Legal Forms, you have minimal concerns. You can access and examine all the information regarding the document's application and significance for your situation and in your state or locality.

Once you have the form on your device, you may edit it using the editor or print it out and fill it in manually. Eliminate the stress associated with your legal paperwork. Explore the comprehensive US Legal Forms collection to discover legal templates, verify their pertinence to your situation, and download them instantly.

- Utilize the library navigation or search tool to find your template.

- Review the form's details to ensure it meets the criteria of your state and locality.

- Open the form preview, if available, to confirm it is the document you are interested in.

- Continue your search and find the correct document if the Uniform To Transfer Minors Act does not meet your requirements.

- Once you are confident about the form's applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you have not yet created a profile, click Buy now to acquire the template.

- Select the pricing option that aligns with your needs.

- Proceed with the registration to complete your purchase.

- Conclude your transaction by choosing a payment method (credit card or PayPal).

- Choose the document format for downloading the Uniform To Transfer Minors Act.

Form popularity

FAQ

The main advantage of using a UTMA account is that the money contributed to the account is exempted from paying a gift tax of up to a maximum of $16,000 per year for 2022 ($17,000 for 2023). 2 Any income earned on the contributed funds is taxed at the tax rate of the minor who is being gifted the funds.

An UTMA account is easy to open and straightforward to use. An adult opens the UTMA account and contributes to it on behalf of a minor beneficiary. The custodian manages the account until the minor comes of age. All custodial assets transfer to the UTMA beneficiary.

Cons Greater impact on financial aid. Because they're held in the name of the child, UTMA/UGMA accounts hurt financial aid eligibility more than comparable 529 plans. Money becomes the child's at majority. ... Transfers are irrevocable.

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

It's possible to withdraw money from an UTMA account. However, there's one essential rule you've got to bear in mind ? all withdrawals from a custodial account must be for the direct benefit of the beneficiary.