What Does It Mean When Someone Owns Mineral Rights

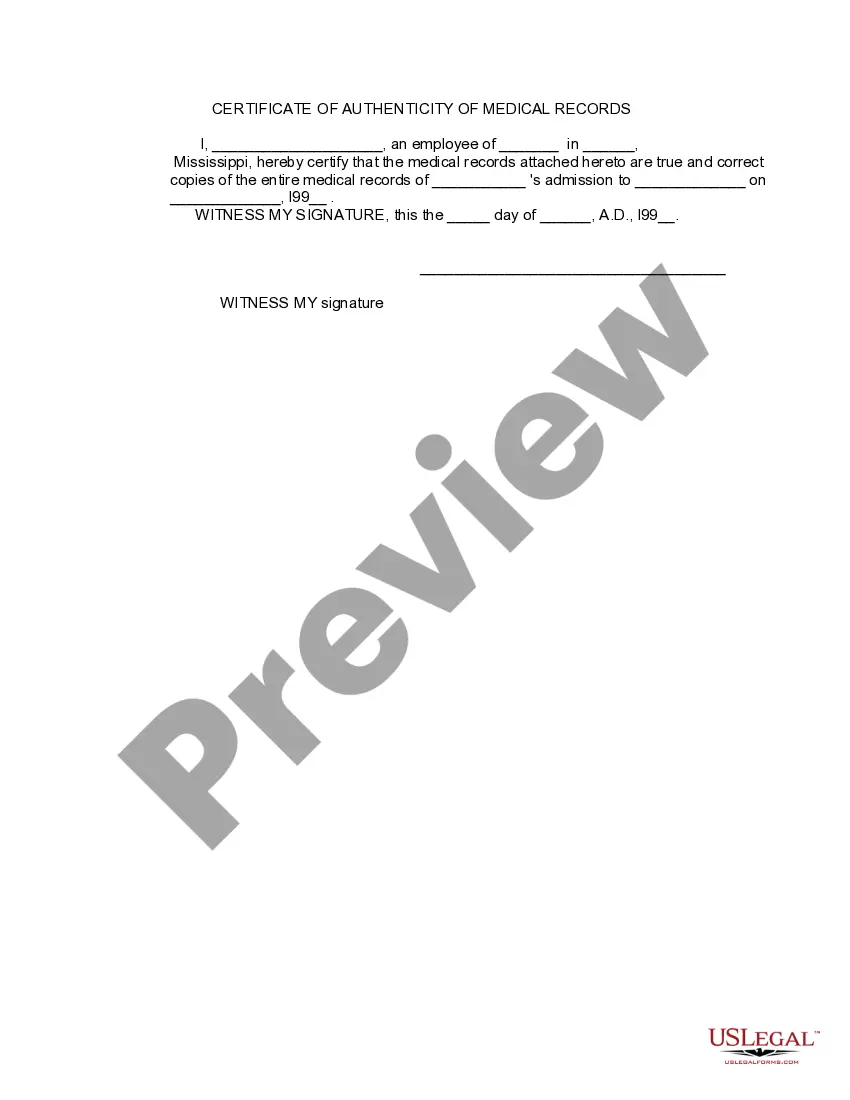

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active, or renew it if needed.

- Preview the form that suits your requirements. Check its description and confirm that it meets local jurisdiction guidelines.

- If the chosen form isn't right, use the search feature to find a more appropriate template.

- Select 'Buy Now' on the desired document, and pick a subscription plan that fits your needs.

- Complete your purchase by entering your payment information using a credit card or PayPal.

- Finally, download the document to your device and access it later under the 'My Forms' section of your profile.

In conclusion, US Legal Forms enhances your ability to navigate through legal documentation with ease. Their vast collection ensures you can find the exact forms needed, while premium expert support guarantees the accuracy of your documents.

Start your legal documentation journey today by visiting US Legal Forms and explore the extensive library available.

Form popularity

FAQ

To determine the value of your mineral rights, evaluate factors such as location, resource potential, and market demand. Engaging with professionals and utilizing online tools can provide accurate estimates. Additionally, understanding what it means when someone owns mineral rights can guide you in recognizing the assets you possess. Services like US Legal Forms offer resources to assist in this process.

If a seller retains mineral rights while transferring land ownership, they maintain control over any resources below the surface. This arrangement often means the new owner cannot benefit from mining activities without the seller's approval. It's crucial to clarify these rights during negotiations to avoid misunderstandings. Knowing what it means when someone owns mineral rights can empower both parties in such situations.

Owning mineral rights means you have the legal authority to explore and extract resources from the land. You can benefit financially if valuable minerals are found and extracted. Furthermore, if you decide not to develop the land, you might lease your rights to someone else. Understanding what it means when someone owns mineral rights can help you make informed decisions regarding your investment.

When valuing inherited mineral rights, you should consider the current market trends, the amount of land, and the potential resources available. Knowing what it means when someone owns mineral rights can help you assess their worth. You may need a professional appraisal to account for factors like production history and lease agreements. Using platforms like US Legal Forms can assist you in obtaining necessary documents and guidance.

Keeping your mineral rights can offer long-term financial benefits. They have the potential to generate income through leases or sales if mineral extraction occurs. Additionally, retaining these rights gives you control over decisions related to resource extraction. Engaging with platforms like US Legal Forms can help you navigate the complexities of mineral rights ownership, ensuring you make wise decisions for your future.

Understanding the value of your mineral rights is crucial. In essence, mineral rights give you ownership of the natural resources beneath your land. If you own these rights, they can be quite valuable, especially if oil or gas reserves exist below. To gauge their worth, consider market demand and potential resource extraction in your area.

To claim your mineral rights, you need to begin by gathering all relevant documentation proving your ownership. This may include your property deed along with any relevant leases or contracts. If there are disputes about ownership, you may need legal assistance to navigate the complexities of mineral rights. Platforms like uslegalforms provide templates and guidance to help you through the claiming process.

Claiming mineral rights on your taxes involves reporting any income generated from mining or extraction activities. Depending on your circumstances, this could include rental income from leasing out rights or royalty income from resource extraction. It's essential to maintain thorough records and consider consulting a tax professional who understands the specifics of mineral rights tax law. Knowing what it means when someone owns mineral rights will keep you informed about your tax responsibilities.

The value of your mineral rights can vary significantly based on several factors, including the location and type of resources available in your area. Market demand, geological assessments, and potential extraction costs also impact the value. To accurately assess your mineral rights, consider working with an appraiser who specializes in this field. This topic ties into understanding what it means when someone owns mineral rights.

If you want to obtain mineral rights on your property, you should first check your existing property documents to see if you already own them. If not, you may need to negotiate with the current mineral rights holder, which may involve purchasing or leasing those rights. Understanding the implications of mineral rights ownership can enhance your negotiation position. You can find resources on uslegalforms that guide you through the necessary steps.