Pa Gas Royalties For Qbi

Description

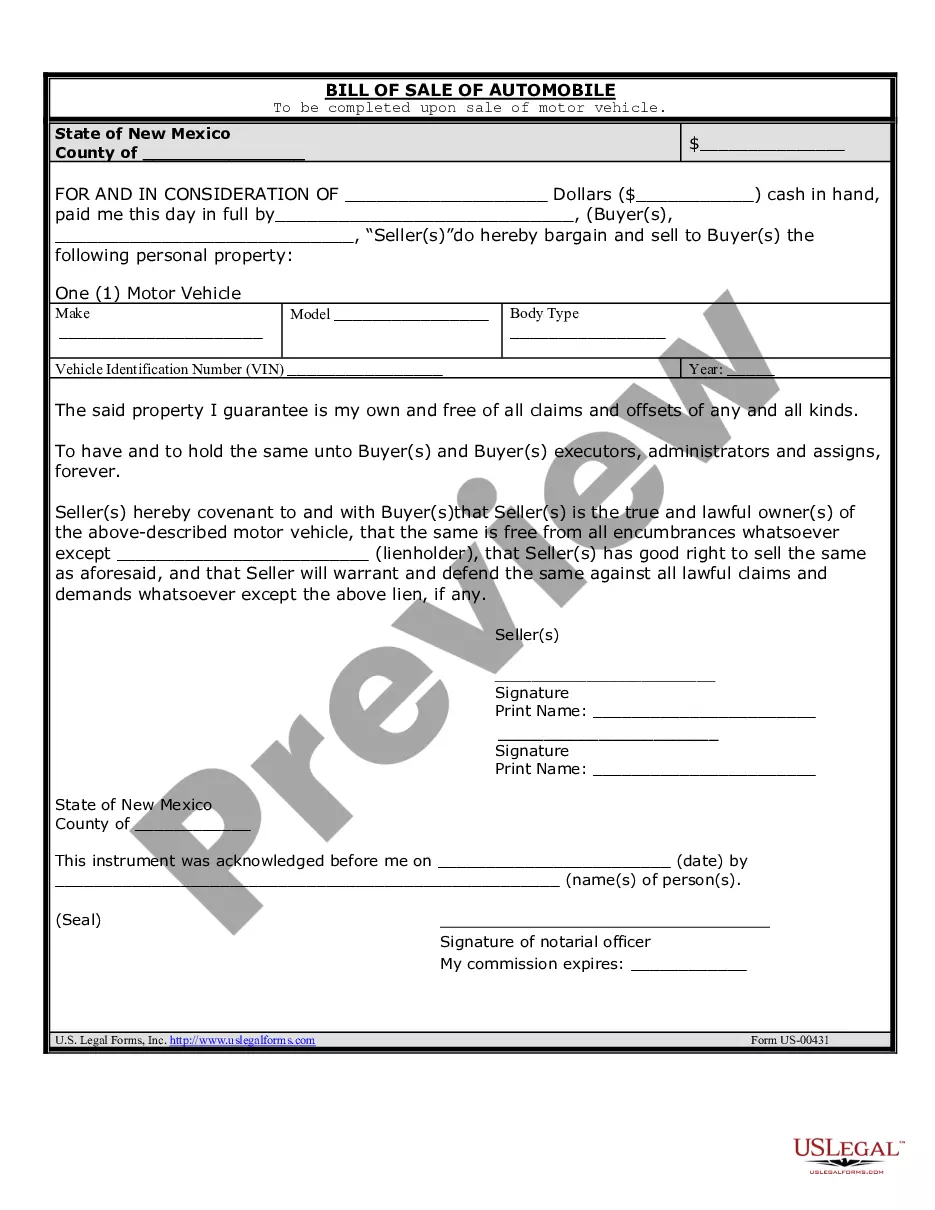

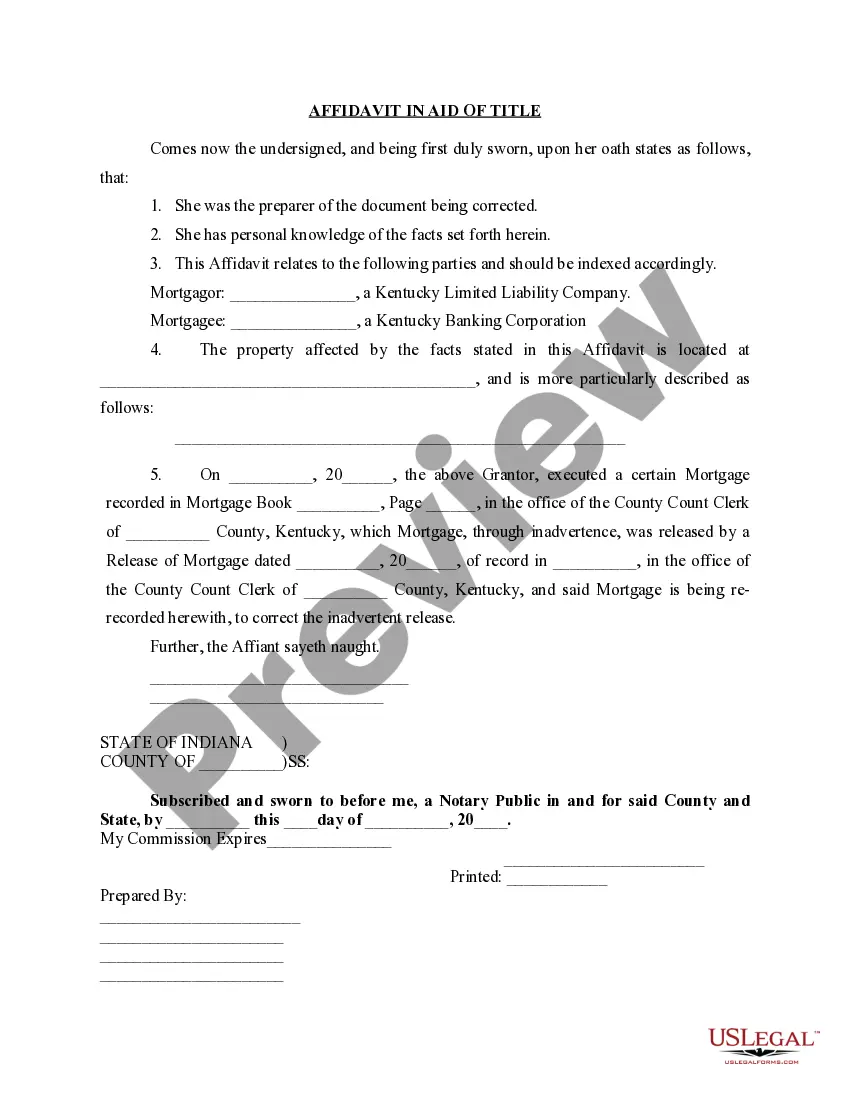

How to fill out Oil, Gas And Mineral Royalty Transfer?

The Pa Gas Royalties For Qbi you see on this page is a reusable formal template drafted by professional lawyers in accordance with federal and local regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Pa Gas Royalties For Qbi will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to verify it suits your requirements. If it does not, utilize the search bar to get the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Pick the format you want for your Pa Gas Royalties For Qbi (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Royalty income is generally reported on Schedule E; however, if you are in business as a self-employed writer, inventor, artist, etc., report your royalty income and expenses on Schedule C (Form 1040) Profit or Loss From Business (if you need help accessing Schedule C, go to our Schedule C - Entering Sole ...

Royalty payments may cover many different types of property, including patented inventions, the use of artwork, or the mining of resources. Royalties may be reported as business income or expenses. Typically, you have to report royalties on Schedule E when you file your taxes.

Royalties. Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.

Royalty tax reporting Royalty payments are tax reportable and are reported ing to the IRS instructions on the IRS Form 1099-MISC, Miscellaneous Income.

Oil and gas royalties from a working interest reported on Schedule C will be included in QBI.