Oil Royalties Purchase Withholding

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

It’s clear that you cannot instantly become a legal authority, nor can you swiftly learn how to prepare Oil Royalties Purchase Withholding without possessing a specialized skill set.

Assembling legal documents is a lengthy process that necessitates specific training and expertise. So why not entrust the creation of the Oil Royalties Purchase Withholding to the professionals.

With US Legal Forms, one of the most extensive legal document collections, you can discover everything from court filings to templates for internal corporate communications.

If you require a different form, restart your search.

Sign up for a free account and choose a subscription plan to acquire the form. Select Buy now. Once the payment is finalized, you can download the Oil Royalties Purchase Withholding, fill it out, print it, and send or mail it to the necessary individuals or organizations.

- We understand how vital compliance and adherence to federal and local laws and regulations are.

- That’s why, on our website, all forms are tailored to specific locations and are current.

- Here’s how you can begin with our platform and obtain the form you need in just minutes.

- Find the document you require using the search bar at the top of the page.

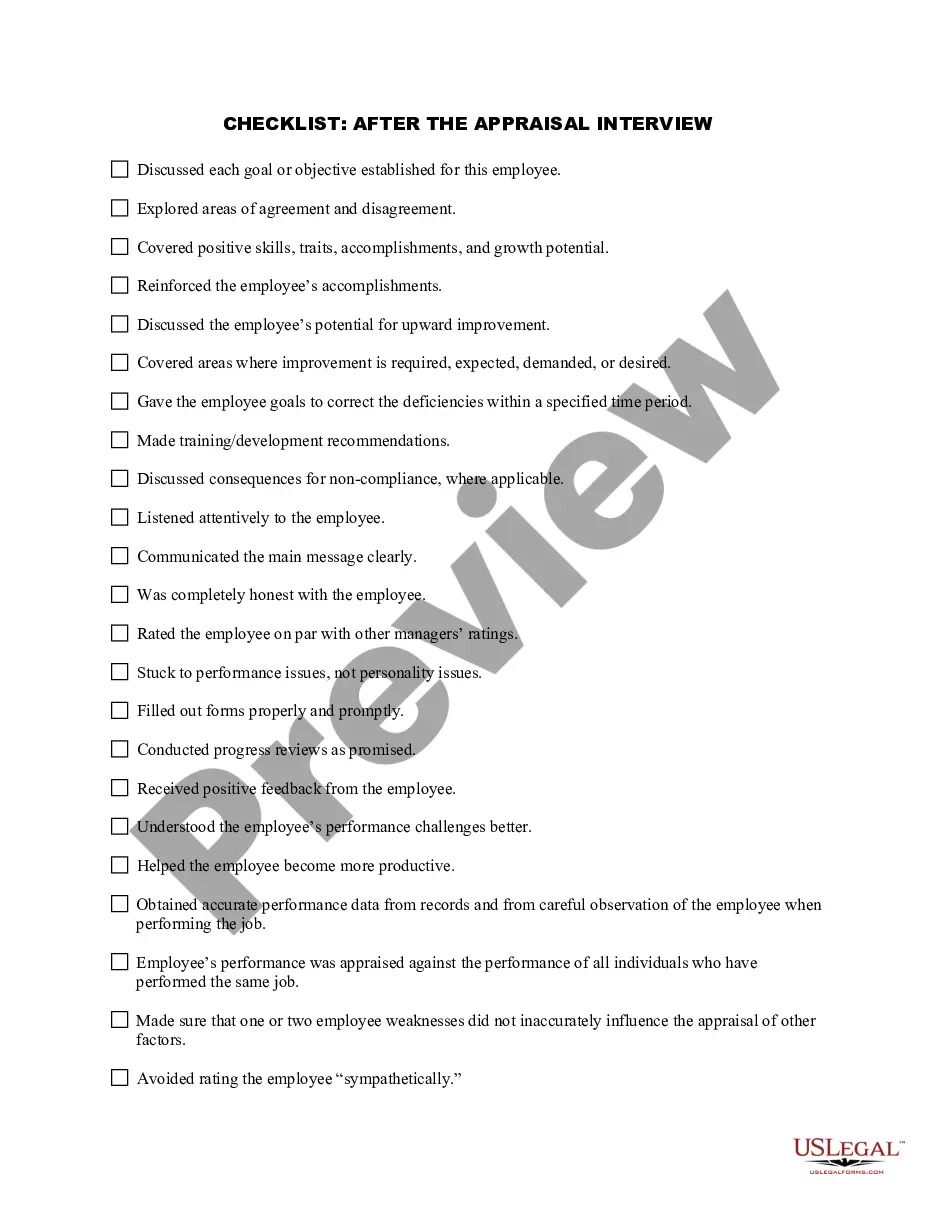

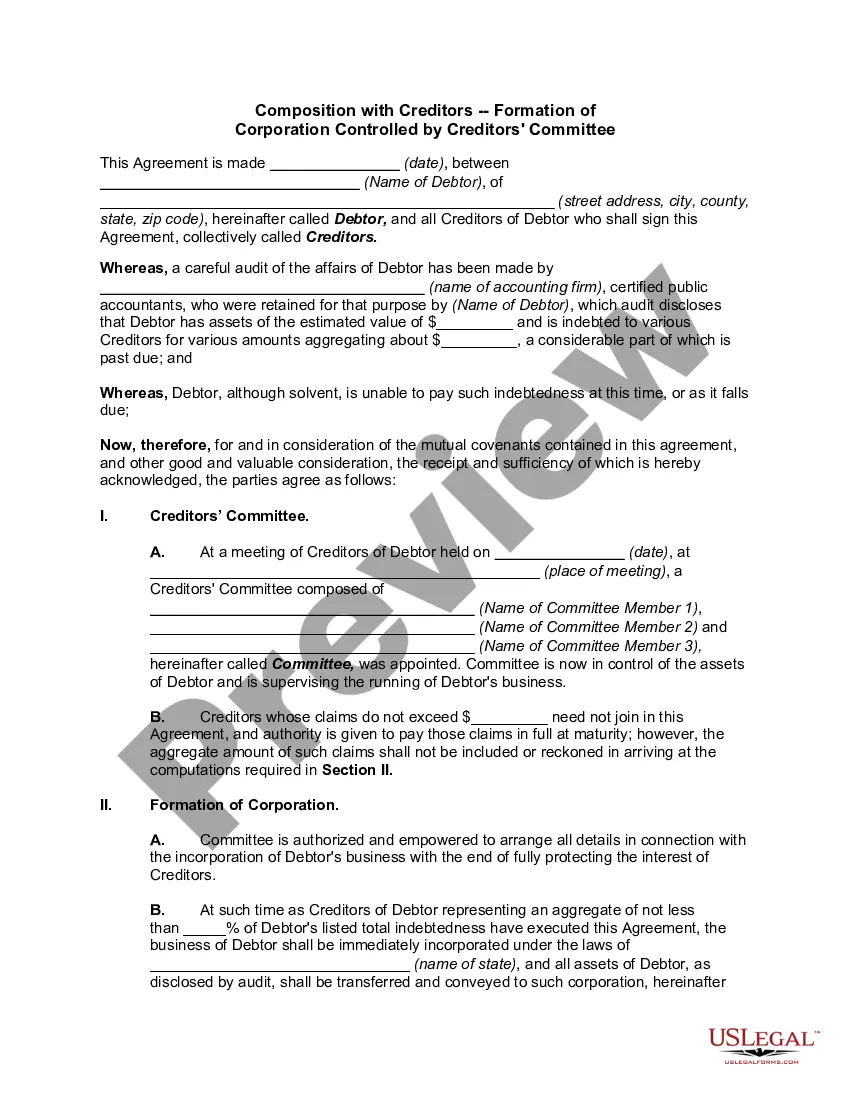

- Review it (if this option is available) and read the accompanying description to determine if Oil Royalties Purchase Withholding is what you’re looking for.

Form popularity

FAQ

The tax rate for income earned in the nature of Royalty and Fees for Technical Services is increased from 10 to 20 per cent under the Indian Domestic Tax law ? from the Indian Financial Year 2023-24 (i.e., 1 April 2023).

Royalties. Royalties from copyrights, patents, and oil, gas and mineral properties are taxable as ordinary income. You generally report royalties in Part I of Schedule E (Form 1040 or Form 1040-SR), Supplemental Income and Loss.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

The IRS treats royalties as regular income. To report royalty income, you will have fill in Schedule E as well as your Form 1040. If you have received income from royalties, use Form 1099-MISC at the end of the year. Report all other payments you receive as well.

For primary oil and gas, the percentage method is limited to the lesser of 15 percent of the taxable income from the property, or 65 percent from taxable income from all sources. The depletion should be reported on the Schedule E for royalty interest, and on Schedule C for working interest as an expense.