Mineral Royalty Rate Formula

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

Locating a reliable source for obtaining the most updated and suitable legal templates constitutes a significant portion of navigating bureaucratic processes.

Identifying the proper legal documents requires precision and careful attention, which is why sourcing samples of the Mineral Royalty Rate Formula from credible origins, such as US Legal Forms, is crucial. An incorrect template can squander your time and delay your current situation.

After acquiring the form on your device, you can edit it using the editor or print it out to complete manually. Eliminate the hassle associated with your legal paperwork. Browse the comprehensive US Legal Forms catalog to find legal templates, assess their relevance to your specific situation, and download them instantly.

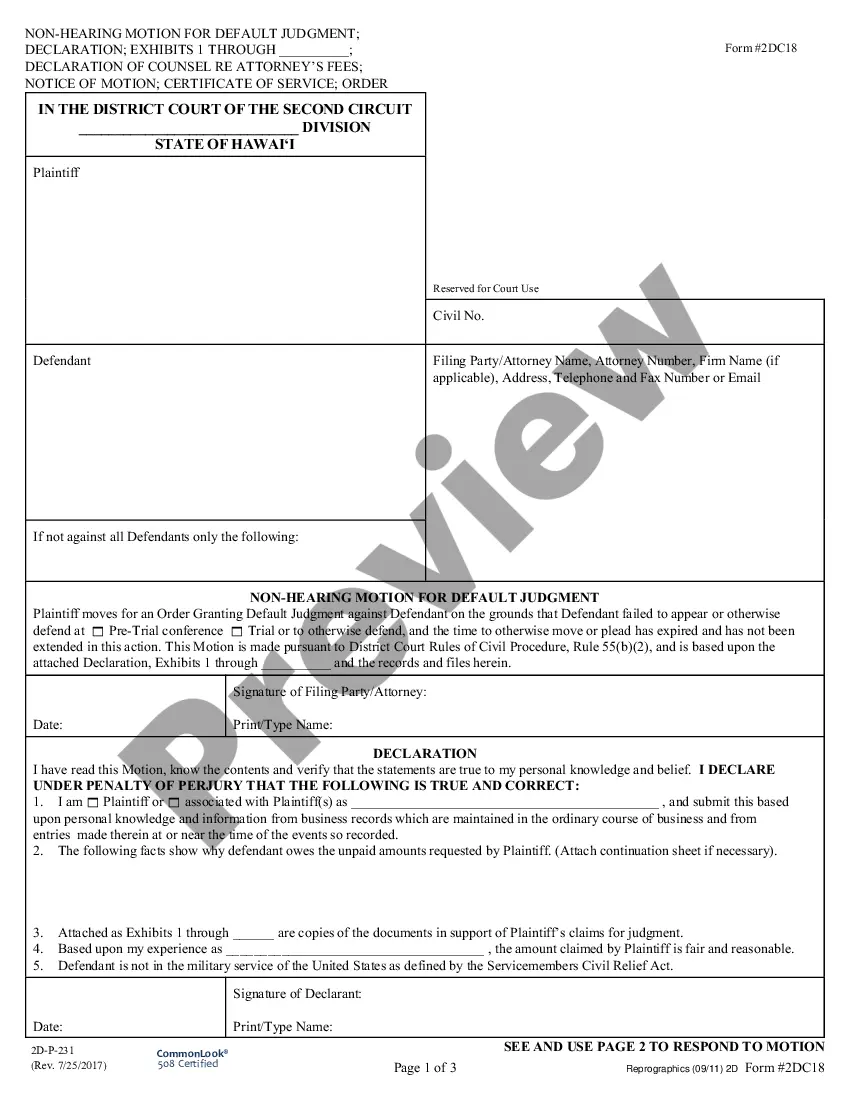

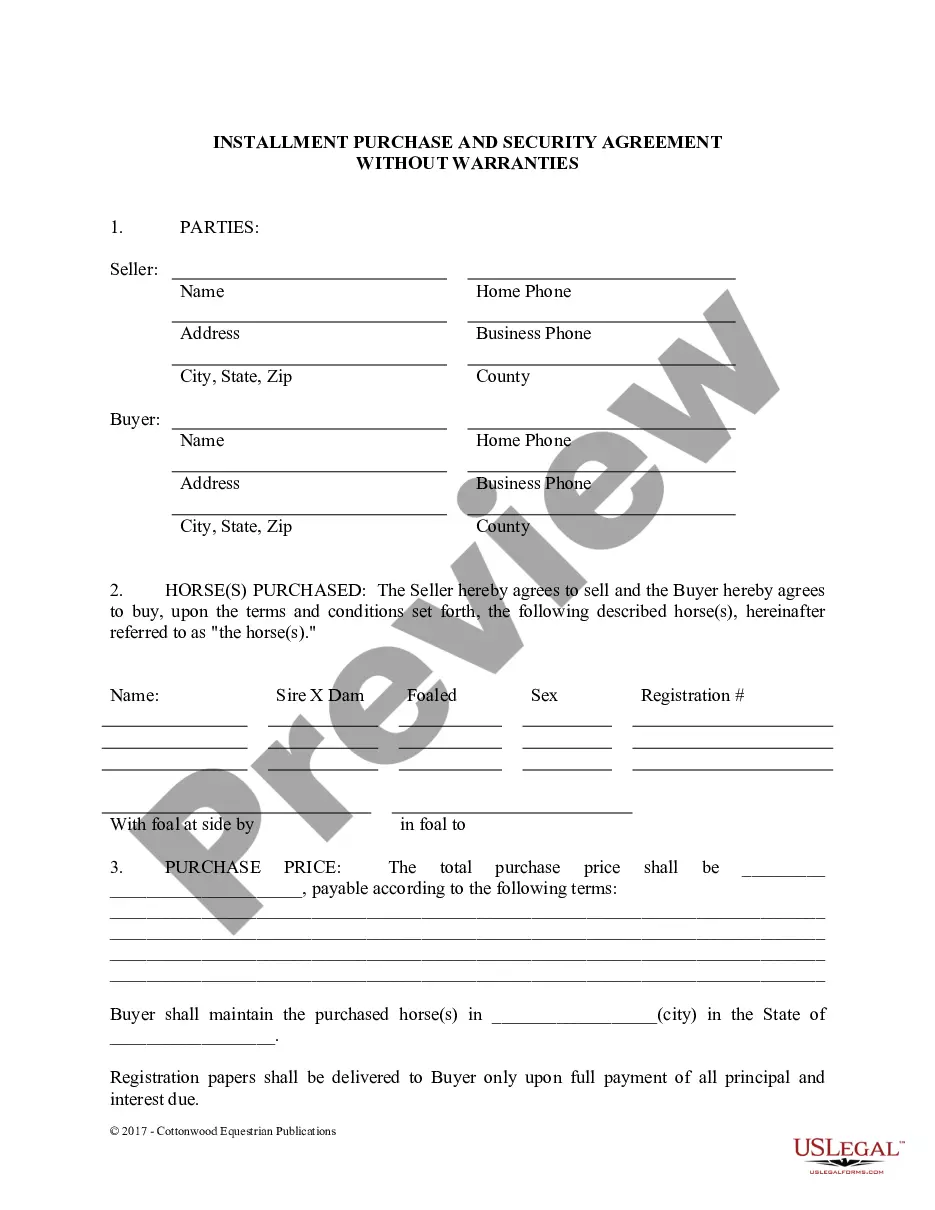

- Utilize the catalog navigation or search bar to find your template.

- Access the form’s details to confirm its alignment with the regulations of your state and region.

- View the form preview, if available, to ensure the template matches what you are looking for.

- If the Mineral Royalty Rate Formula does not meet your needs, return to the search for the appropriate template.

- Once you are confident about the document’s relevance to your case, download it.

- If you are a registered user, click Log in to verify and access your selected documents in My documents.

- In case you do not have an account, click Buy now to acquire the document.

- Choose the pricing option that best fits your needs.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Select the format for downloading the Mineral Royalty Rate Formula.

Form popularity

FAQ

A 10% royalty indicates that you will receive 10% of the total sales revenue produced from the mined minerals. In a scenario where the mining company makes $500,000, your payment would amount to $50,000. This rate often signifies a favorable agreement for the mineral rights holder, highlighting the importance of negotiation in your contract. Knowing how to calculate these rates ensures you maximize your financial returns.

The cost for changing your name varies by state. In some states the fee is under $100, but other states may charge up to $500. Keep in mind that you may also have to pay a fee to a newspaper for publication in addition to the court filings. Check your state court website for filing fee details.

How Long Will a Name Change Take? StateTime to CompleteRI2-8 weeksSC2-8 weeksSD2-8 weeksTN2-8 weeks47 more rows

A marriage license in South Dakota costs $10, while an official name change through court costs $70.

In order to legally change a name, you must file a Verified Petition for Name Change of a Minor Child form (UJS?030) with the Clerk of Court office in the county where you reside, provided you and the minor child have resided there for more than six months immediately before the filing of the verified petition.

In South Dakota, the standard parenting guidelines will set out the custody arrangement to be followed by the parents. You can object to the standard guidelines and the judge will order a hearing within thirty days.

How Long Will a Name Change Take? StateTime to CompleteRI2-8 weeksSC2-8 weeksSD2-8 weeksTN2-8 weeks47 more rows

In order to legally change a name you must file a Verified Petition For Adult Name Change form with the clerk of court's office in the county where you reside provided you have resided there for more than six months. You will also be required to pay the civil case filing fee.

A marriage license in South Dakota costs $10, while an official name change through court costs $70.