Mineral Royalty Agreement With Another Employer

Description

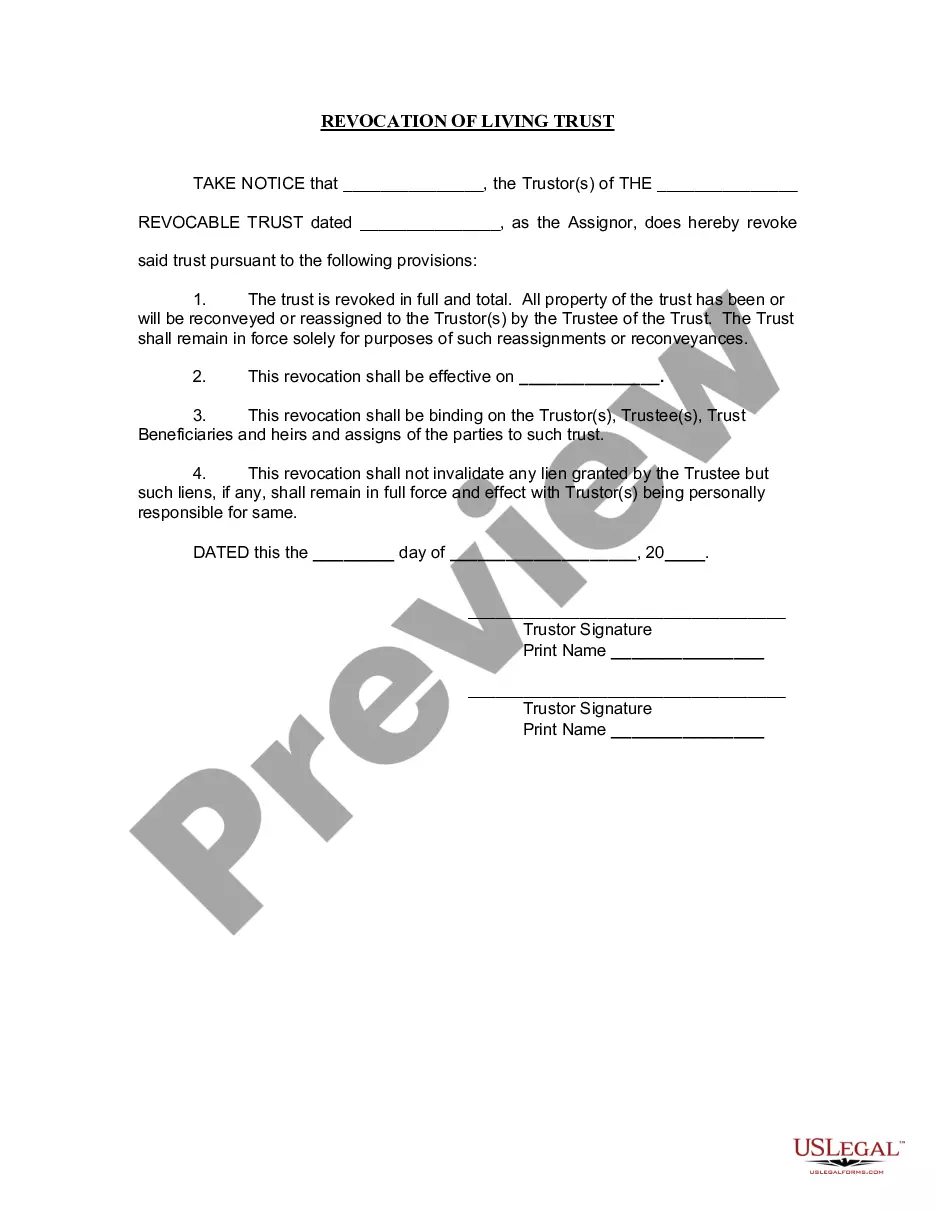

How to fill out Oil, Gas And Mineral Royalty Transfer?

The Mineral Royalty Agreement With Another Employer you see on this page is a multi-usable legal template drafted by professional lawyers in line with federal and local laws. For more than 25 years, US Legal Forms has provided individuals, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Mineral Royalty Agreement With Another Employer will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, use the search bar to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Choose the format you want for your Mineral Royalty Agreement With Another Employer (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

In law, there is no distinction or difference between royalty and seigniorage fee. Both reflect the sovereign right of the State to collect sums from the grantee for privilege to quarry minerals.

Typically, a royalty agreement is used when an inventor wants to license their intellectual property rights so that another party can manufacture and sell their invention. Both parties must agree on an appropriate royalty rate ? a payment that the licensee will make to the licensor on a regular basis.

The NSR represents a cost that the operator must bear even if the operation is not profitable, whereas the NPI ought to be a less painful burden in that the amount paid varies with the mine's profitability and is not payable at all unless and until the mine is profitable.

Royalty is calculated on the quantity of minerals extracted or removed. The owner of the land is called lessor. The lessor has a right to receive a royalty based on the production of minerals.

Typically, the parties involved will sign a contract or agreement. The agreement will lay out the royalty fees and payment amounts. For example, there may be a fixed fee, or the fee may be a variable percentage of gross sales. Royalties for specific products (like a book) might be based on the number of units sold.