Mineral Royalty Agreement With Another Company

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

Working with legal paperwork and procedures can be a time-consuming addition to your entire day. Mineral Royalty Agreement With Another Company and forms like it typically require you to look for them and navigate how to complete them properly. As a result, whether you are taking care of financial, legal, or individual matters, having a thorough and hassle-free online library of forms at your fingertips will significantly help.

US Legal Forms is the top online platform of legal templates, featuring more than 85,000 state-specific forms and a variety of resources to assist you to complete your paperwork quickly. Check out the library of pertinent documents available with just a single click.

US Legal Forms provides you with state- and county-specific forms offered at any moment for downloading. Safeguard your papers management operations by using a top-notch services that allows you to prepare any form within a few minutes with no extra or hidden charges. Just log in to your profile, locate Mineral Royalty Agreement With Another Company and acquire it straight away within the My Forms tab. You can also gain access to formerly saved forms.

Could it be the first time using US Legal Forms? Sign up and set up your account in a few minutes and you’ll gain access to the form library and Mineral Royalty Agreement With Another Company. Then, stick to the steps below to complete your form:

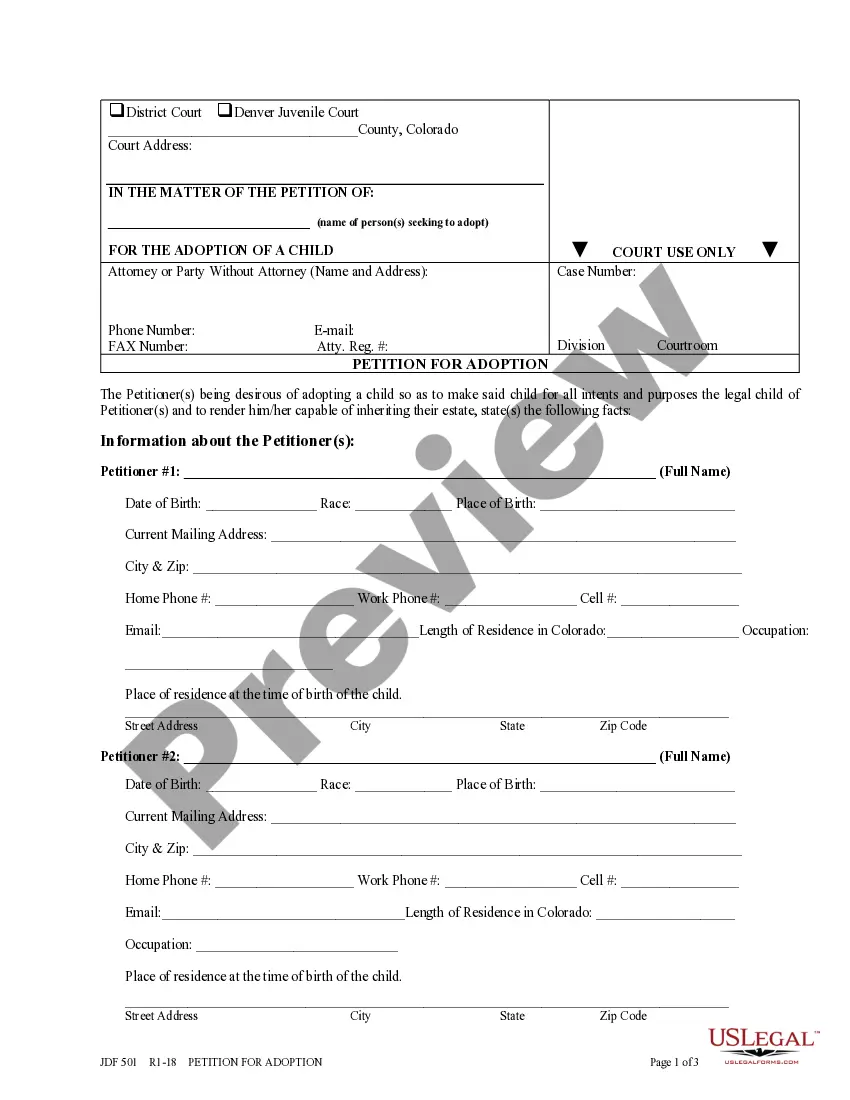

- Be sure you have found the right form using the Review option and reading the form description.

- Select Buy Now when ready, and select the monthly subscription plan that is right for you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience supporting consumers deal with their legal paperwork. Find the form you need today and streamline any operation without having to break a sweat.

Form popularity

FAQ

Mineral rights are property rights. Mineral rights can be conveyed or reserved only through a deed. If not specifically excluded in the deed, all real property rights, including the mineral rights, are automatically conveyed to the buyer.

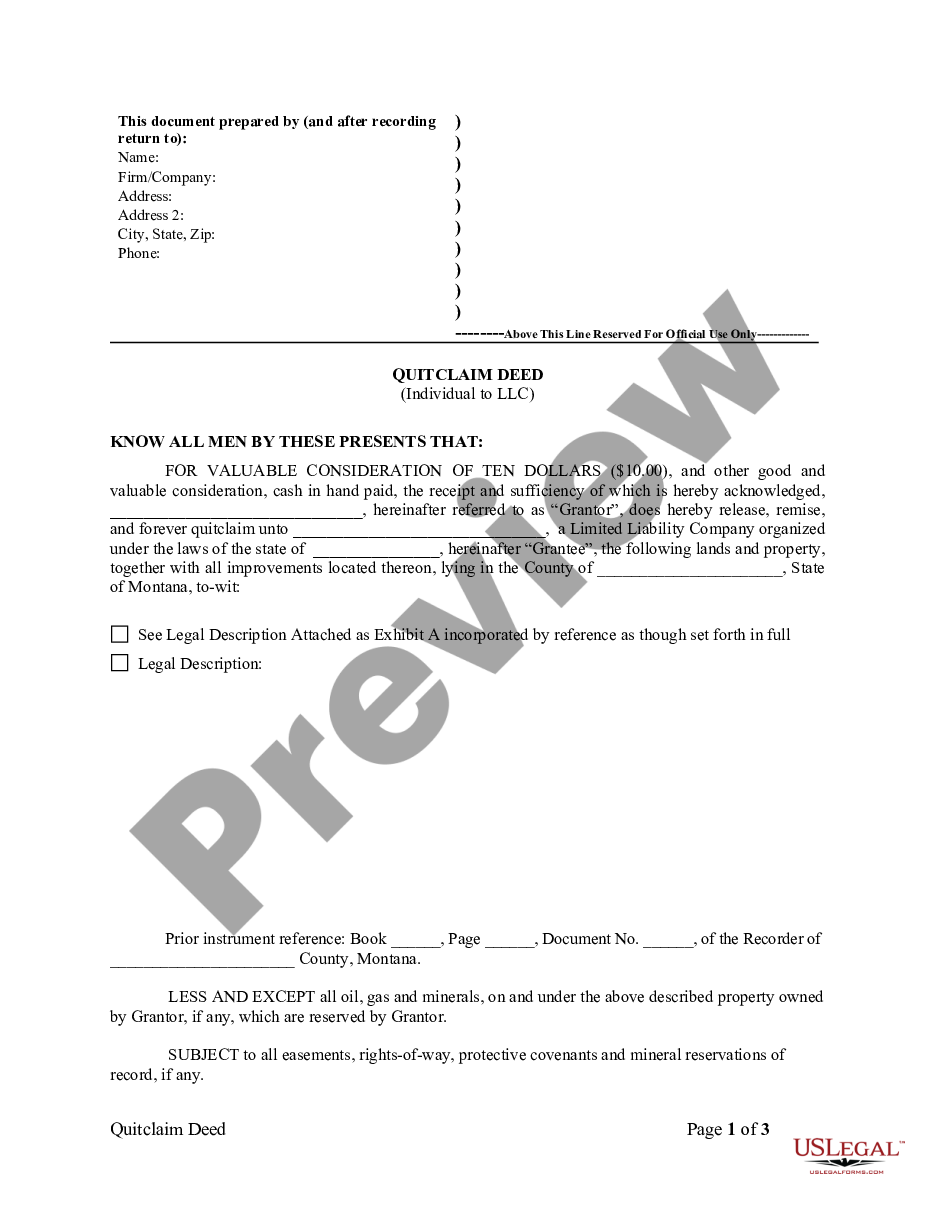

Transferring the royalties from one owner to the next is a two-step process. First, a deed is recorded in the county where the mineral estate is located, to convey the right to receive royalty. Second, the recorded deed is delivered to the operator, who prepares amended division orders.

Ohio law requires a change of owner form (Form 7) to be submitted to the Division of Oil and Gas Resources Management within thirty (30) days after the date of assignment or transfer of a well. This form is to be initiated by the assignor/transferor.

To transfer mineral rights: The grantor's lawyer has to come up with a deed of transfer to the grantee. The grantee accepts the deed of transfer and goes on to register themselves as the new rightful owner at the office of the Colorado State land board.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.