Mineral Rights For Sale

Description

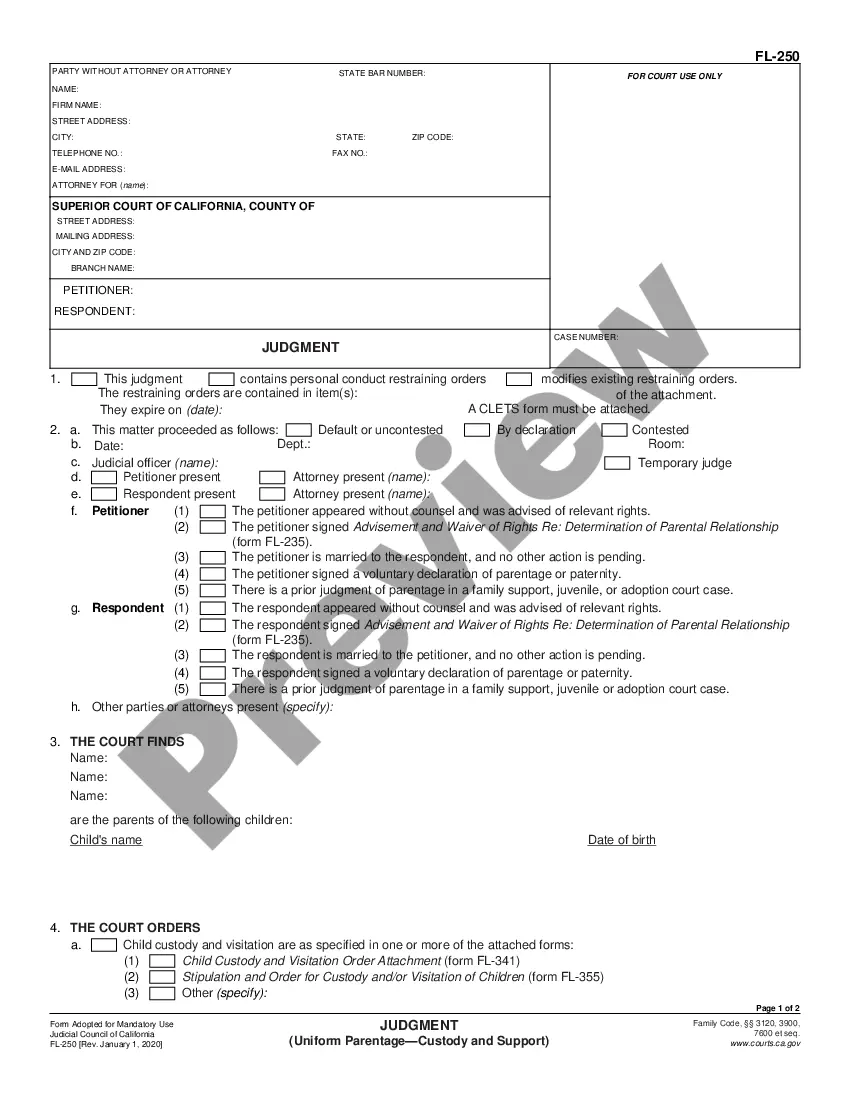

How to fill out Oil, Gas And Mineral Royalty Transfer?

Whether for corporate intentions or personal matters, everyone encounters legal circumstances at some stage in their life.

Completing legal documentation requires meticulous care, beginning with selecting the appropriate form template.

With a broad US Legal Forms catalog available, you won’t need to waste time searching for the right sample online. Take advantage of the library’s easy navigation to find the suitable template for any circumstance.

- Locate the example you require using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your situation, jurisdiction, and area.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search function to find the Mineral Rights For Sale template you need.

- Acquire the form once it suits your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved forms in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: you can utilize a credit card or PayPal account.

- Choose the document format you prefer and download the Mineral Rights For Sale.

- Once downloaded, you can complete the form using editing software or print it and finish it manually.

Form popularity

FAQ

You can find mineral rights ownership through county records, land registries, and title companies. These resources often contain detailed information on who owns the mineral rights to a specific property. Additionally, you can use online platforms like US Legal Forms to access tools and forms that help you investigate and understand ownership more thoroughly.

Buying mineral rights can be a worthwhile investment, depending on several factors. The potential for revenue from oil, gas, or other minerals can provide significant returns over time. Additionally, owning mineral rights allows you to benefit from the sale or lease of those rights. It’s prudent to conduct research and consult experts, such as those available through US Legal Forms, to assess the value effectively.

Yes, you can buy the mineral rights to your property if they are not already owned by someone else. Many property owners may not realize that mineral rights can be separated from the surface rights. It's essential to check your local laws and titles to confirm ownership. Using platforms like US Legal Forms can help you navigate this process smoothly.

The best way to sell mineral rights involves thorough research on market conditions and finding potential buyers. Listing your mineral rights for sale with a reputable company or on a dedicated marketplace can increase visibility. It’s also advisable to consult legal or industry experts to ensure you make informed decisions during the selling process.

Valuing mineral rights involves assessing the potential revenue from the minerals and considering factors like location and extraction costs. One way to estimate this value is to analyze similar mineral rights for sale in your area. Professional appraisals can also provide accurate valuations tailored to your circumstances.

Yes, mineral rights can increase the overall value of your property. When buyers see mineral rights for sale, they recognize the potential for future income from resource extraction. This added value can make your property more attractive, leading to higher offers.

To buy mineral rights in the USA, start by researching available properties and listings. Real estate agencies and online marketplaces, such as US Legal Forms, offer listings for mineral rights for sale. Always conduct due diligence, including title searches and assessments of the land's mineral potential, before making any purchases. Understanding these factors can significantly impact your investment decision and overall success.

To report the sale of mineral rights, you need to notify your local government agency responsible for property records. This could be the county recorder's office or the appropriate state department. It's essential to provide them with accurate details of the transaction, as it ensures the new owner is recognized, and your records are updated properly. Reporting mineral rights for sale protects both you and the buyer in any future legal situations.

To obtain mineral rights on your property, you should first check your property's title documents. This will help you determine if you already own those rights or if they are held by someone else. If your rights are not included, you may need to negotiate with the current owner or explore purchasing mineral rights for sale from other parties.