Any Damage Liability For Renters

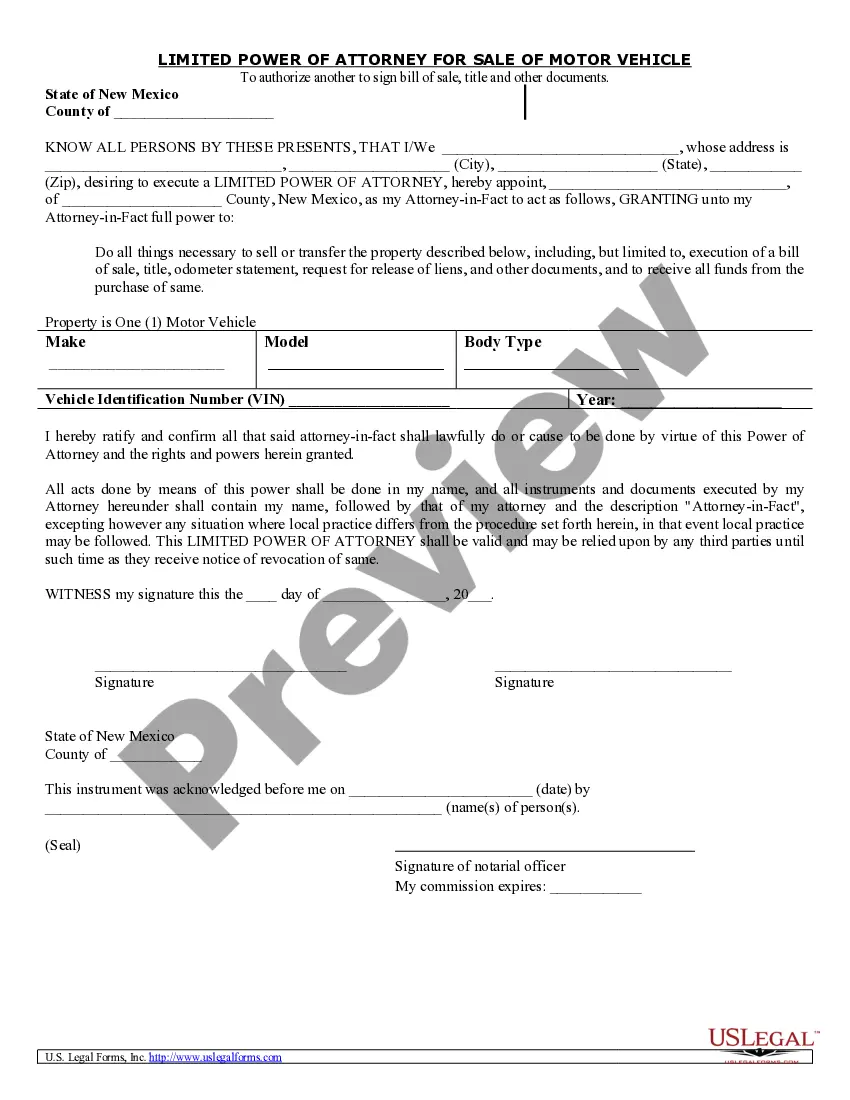

Description

How to fill out Release And Waiver Of Liability And Personal Injury For Using Automotive Repair Shop?

The Any Damage Liability For Renters displayed on this page is a reusable legal framework created by experienced attorneys in accordance with federal and state statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial and personal circumstance. It represents the fastest, most direct, and most reliable approach to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Register for US Legal Forms to access verified legal templates for all of life’s circumstances at your fingertips.

- Search for the document you require and examine it.

- Browse through the sample you looked for and preview it or review the form description to confirm it meets your requirements. If it doesn't, utilize the search feature to locate the correct one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a debit/credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the fillable template.

- Select the format you prefer for your Any Damage Liability For Renters (PDF, Word, RTF) and save the template onto your device.

- Complete and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form electronically.

- Redownload your documents when needed.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any forms you have previously purchased.

Form popularity

FAQ

How do I file an amended West Virginia return? Use the version of Form IT-140 that corresponds to the tax year to be amended and check the ?Amended Return? box. These forms and corresponding instructions are available on our website at Tax.WV.Gov on the Individuals page.

How do I file an amended West Virginia return? Use the version of Form IT-140 that corresponds to the tax year to be amended and check the ?Amended Return? box. These forms and corresponding instructions are available on our website at Tax.WV.Gov on the Individuals page.

If you are domiciled in West Virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to West Virginia.

Option 1: Sign into your eFile.com account, modify your Return and download/print WV Form IT-140 under My Account. Check the "Amended return" box to report that it's an amended tax return. Option 2: If you don't have an eFile.com account follow the step by step instruction on how to prepare a tax return/amendment.

The online tool includes an illustrated graphic that visually communicates where your amended return resides within the processing stages. As a reminder, amended returns take up to 16 weeks to process. It can take up to three weeks after filing it to show up in our system.

Use the IT-140 form if you are: A full-year resident of West Virginia. A full-year non-resident of West Virginia and have source income. Considered a part-year resident because you moved into or out of West Virginia.

West Virginia Tax Extension Form: To request a West Virginia extension, file Schedule L (Form IT-140) by the original due date of your return. However, Schedule L should not be filed if you have a Federal extension and you owe zero West Virginia income tax.