Self Employed Injury Withdrawal

Description

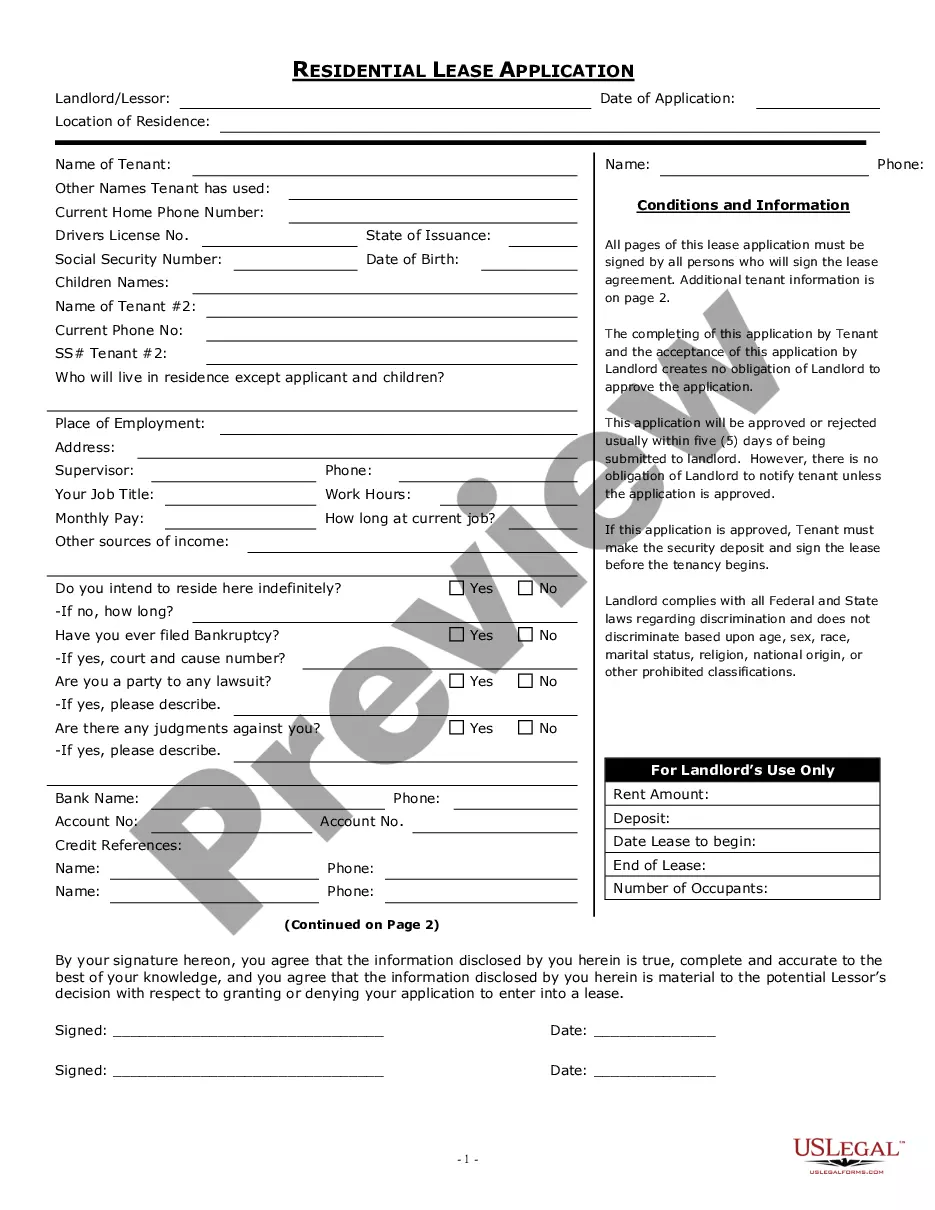

How to fill out Affidavit Of Self-Employed Independent Contractor Regarding Loss Of Wages As Proof Of Damages In Personal Injury Suit?

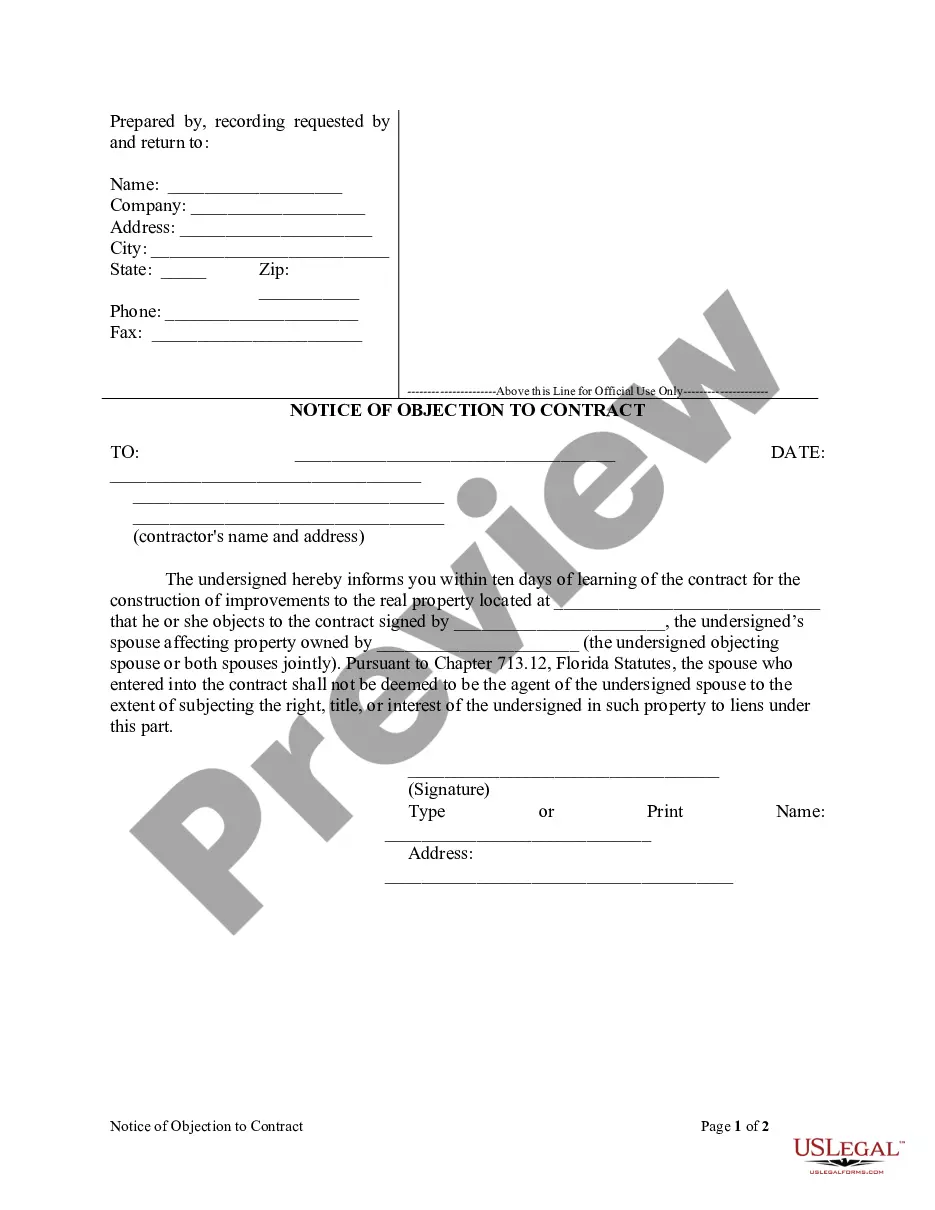

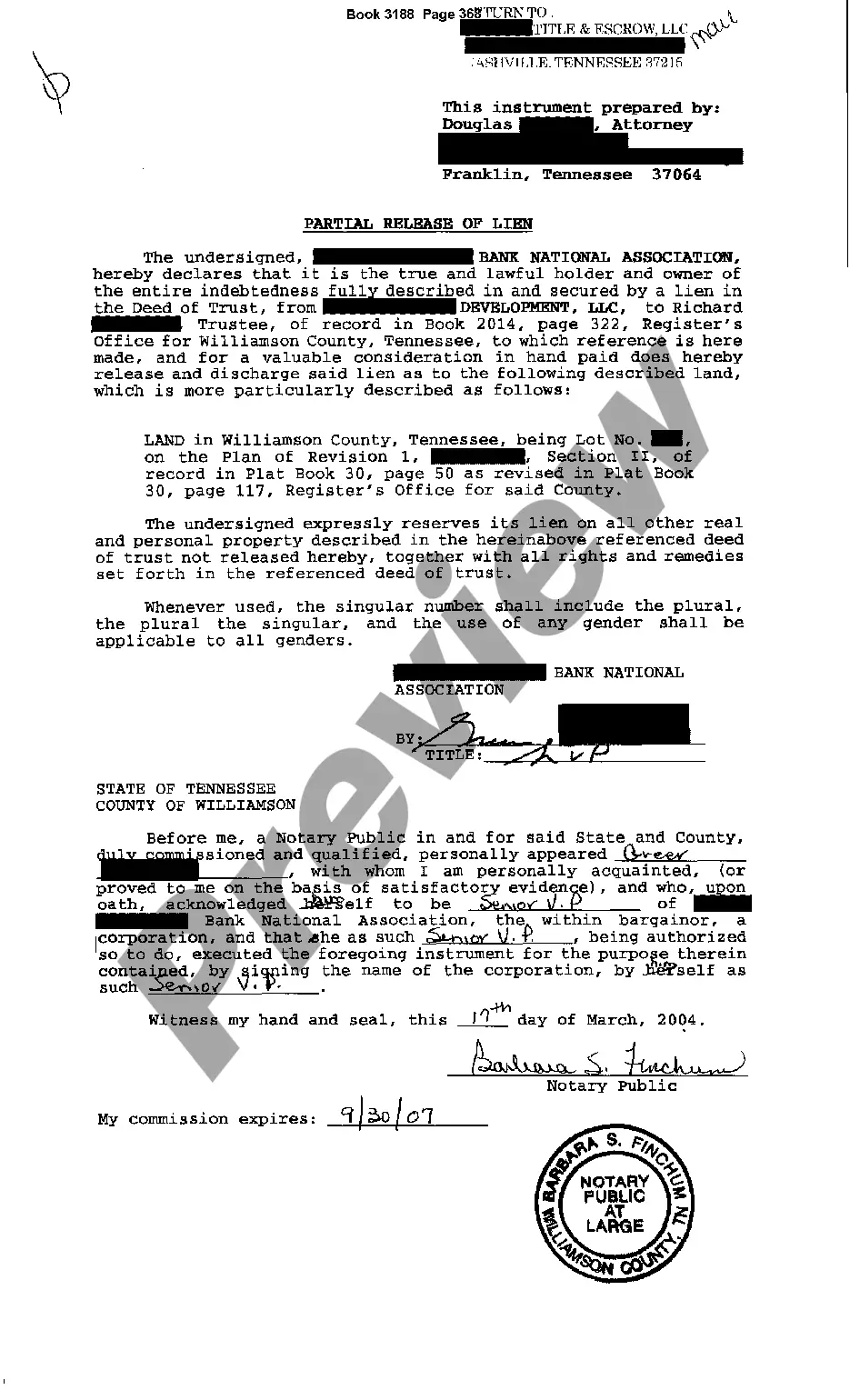

Locating a reliable source to obtain the latest and suitable legal forms is a significant part of navigating bureaucracy. Selecting the correct legal documents requires accuracy and careful consideration, which is why it is crucial to obtain samples of Self Employed Injury Withdrawal solely from reputable sources, such as US Legal Forms. An incorrect form will squander your time and delay the process you are facing. With US Legal Forms, you have minimal concerns. You can access and review all information regarding the document’s application and relevance to your situation and in your state or county.

Follow the outlined steps to finalize your Self Employed Injury Withdrawal: Utilize the catalog navigation or search tool to find your sample. Open the form’s description to determine if it aligns with the requirements of your state and area. Preview the form, if available, to confirm that it is indeed the form you are looking for. Return to the search and find the correct template if the Self Employed Injury Withdrawal does not meet your needs. If you are confident about the form’s applicability, download it. If you are a registered user, click Log in to verify and access your chosen templates in My documents. If you do not have an account yet, click Buy now to purchase the template. Select the pricing plan that meets your needs. Proceed to registration to complete your order. Finalize your transaction by selecting a payment method (credit card or PayPal). Choose the file format for downloading Self Employed Injury Withdrawal. Once you have the form on your device, you can edit it with the editor or print it out and complete it manually.

Eliminate the stress associated with your legal paperwork. Explore the vast US Legal Forms library where you can find legal templates, assess their relevance to your situation, and download them instantly.

- Locate a reliable source for legal templates.

- Ensure the document meets your state requirements.

- Preview the form to confirm its relevance.

- Search for a different template if needed.

- Download the form if it fits your needs.

- Log in to access your templates if registered.

- Purchase the template if you do not have an account.

- Select a suitable pricing plan.

- Complete your registration to finalize the purchase.

- Choose a payment method to complete your transaction.

- Select the format for downloading the form.

Form popularity

FAQ

Chapter 4 withholding requires a withholding agent to withhold 30% on withholdable payments made to an entity that is an FFI unless the withholding agent is able to treat the FFI as a participating FFI, deemed-compliant FFI, or exempt beneficial owner.

A Notice of Assessment ? Chapter 4 will be issued by Revenue to parent(s)/ guardian(s) who file a paper tax return to Revenue and who do not complete a self- assessment on that return. The majority of self-employed Revenue customers receive a Self-Assessment ? Chapter 4.

Self-Employment Tax Deduction. The self-employment tax refers to the Medicare and Social Security taxes that self-employed people must pay. ... Home Office Deduction. ... Internet and Phone Bills Deduction. ... Health Insurance Premiums Deduction. ... Meals Deduction. ... Travel Deduction. ... Vehicle Use Deduction. ... Interest Deduction.

A Notice of Assessment ? Chapter 4 will be issued by Revenue to parent(s)/ guardian(s) who file a paper tax return to Revenue and who do not complete a self- assessment on that return. The majority of self-employed Revenue customers receive a Self-Assessment ? Chapter 4.

In some years you may find that your expenses exceed your gross business income, which means that you have a loss for the year. You may be able to deduct this loss against any other income you or your spouse may have, or carry it over to other years in which you have more income, provided you meet certain requirements.