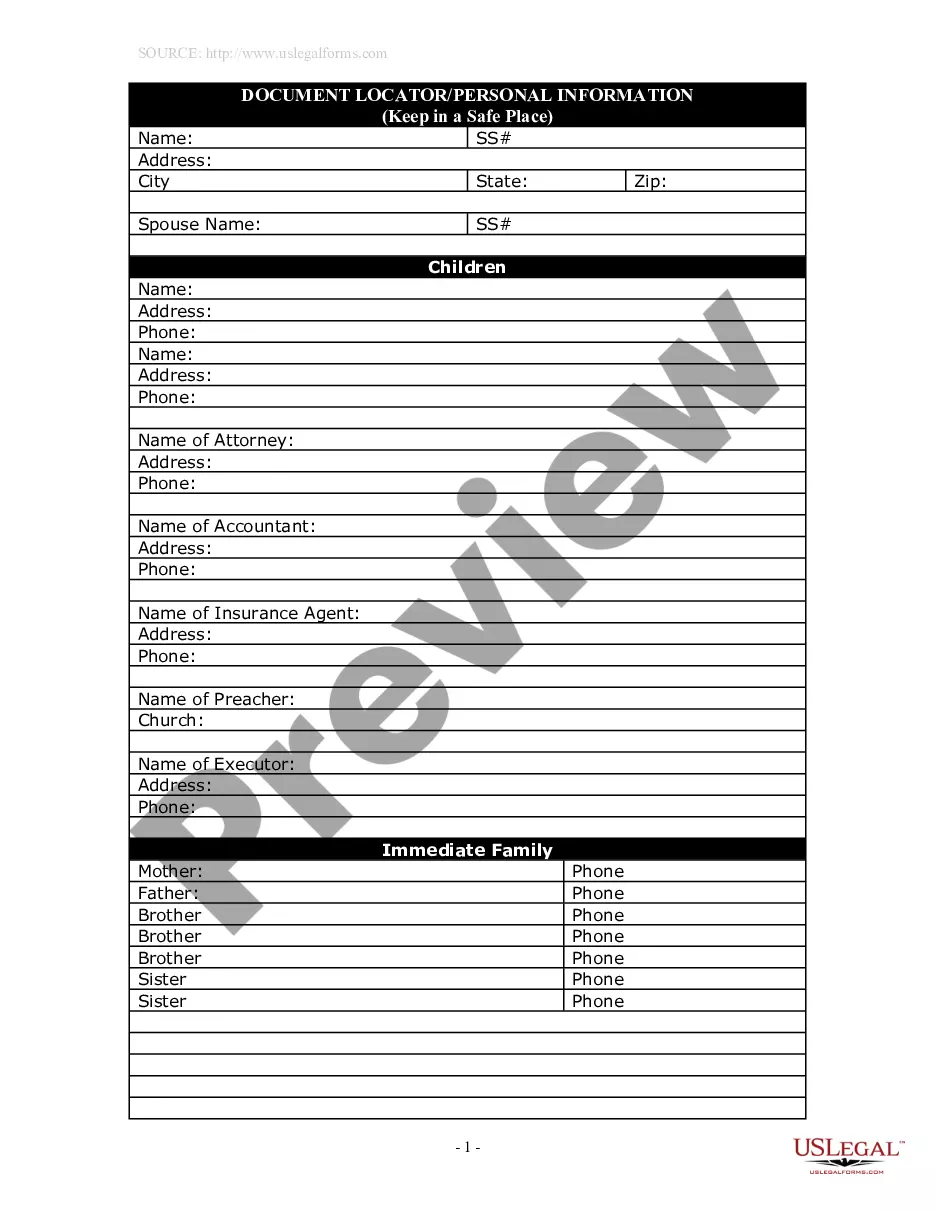

Financial Form Sample Format

Description

How to fill out Financial Statement Form - Husband And Wife Joint?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more cost-effective way of creating Financial Form Sample Format or any other documents without the need of jumping through hoops, US Legal Forms is always at your disposal.

Our online library of over 85,000 up-to-date legal forms covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-specific templates carefully put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can easily find and download the Financial Form Sample Format. If you’re not new to our services and have previously set up an account with us, simply log in to your account, locate the form and download it away or re-download it at any time in the My Forms tab.

Not registered yet? No problem. It takes little to no time to register it and navigate the library. But before jumping straight to downloading Financial Form Sample Format, follow these tips:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the form you choose complies with the requirements of your state and county.

- Choose the right subscription option to get the Financial Form Sample Format.

- Download the file. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of experience. Join us now and transform form completion into something simple and streamlined!

Form popularity

FAQ

It will help you to get a clear idea of the cost to run your home. Filling in the Financial Statement template. ... Enter your personal details. ... Enter your income. ... Enter your expenditure totals. ... Calculate how much you have left for all debts. ... Enter your debt details. ... Calculate how much you have left for secondary debts.

Here are five key steps for writing a finance report: Write community description and overview. First, write a brief synopsis of the business for whom you're writing the financial report. ... Include a letter from the CEO. ... Include analysis and data. ... Outline the company's management. ... Write the footnotes.

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. These three statements together show the assets and liabilities of a business, its revenues and costs, as well as its cash flows from operating, investing, and financing activities.

How to Write a Financial Report? Step 1 ? Make a Sales Forecast. Step 2 ? Create a Budget for Expenses. Step 3 ? Create a Cash Flow Statement. Step 4 ? Estimate Net Profit. Step 5 ? Manage Assets and Liabilities. Step 6 ? Find the Breakeven Point.