Executor Estate Form With A Trust

Description

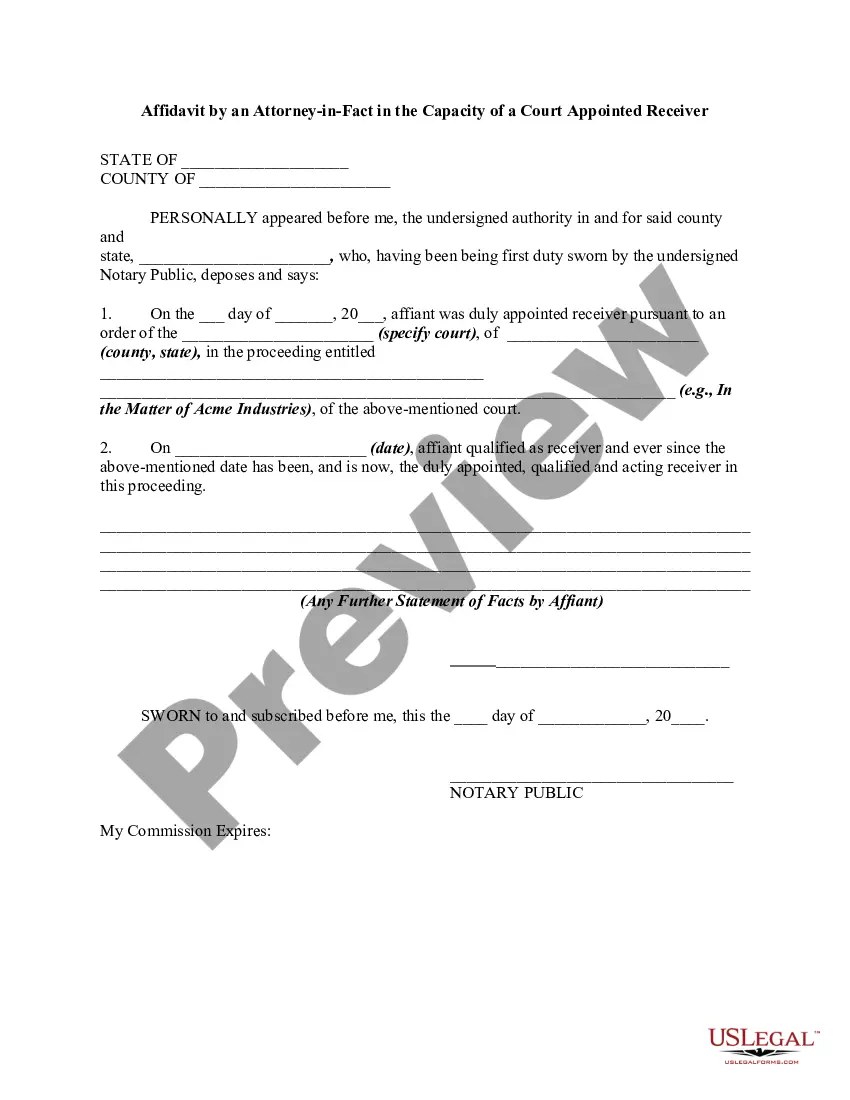

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

Creating legal documents from the ground up can frequently be daunting.

Some situations may require extensive investigation and substantial financial resources.

If you’re looking for a simpler and more cost-effective method of generating Executor Estate Form With A Trust or any other forms without encountering obstacles, US Legal Forms is always available to assist you.

Our online repository of more than 85,000 current legal papers addresses nearly every facet of your financial, legal, and personal issues.

However, before proceeding to download the Executor Estate Form With A Trust, keep these suggestions in mind: Check the document preview and descriptions to confirm that you have located the form you need. Verify that the form you choose meets the specifications of your state and county. Select the most appropriate subscription plan to access the Executor Estate Form With A Trust. Download the form, then complete, certify, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us today and make document handling a breeze!

- With just a few clicks, you can easily access state- and county-specific forms meticulously compiled for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can swiftly find and obtain the Executor Estate Form With A Trust.

- If you’re familiar with our website and have previously registered, simply Log In to your account, choose the template, and download it right away or re-download it anytime from the My documents section.

- Not registered yet? No worries. The registration process is quick and easy, allowing you to navigate the library.

Form popularity

FAQ

To manage an estate effectively, you'll need the executor estate form with a trust to begin the process. Generally, this includes the deceased's will, probate forms, and the death certificate. Additionally, you may require documents related to assets and debts, such as bank statements and property deeds. Utilizing US Legal Forms can simplify this process, providing you with the exact forms necessary to ensure that you fulfill your duties confidently and correctly.

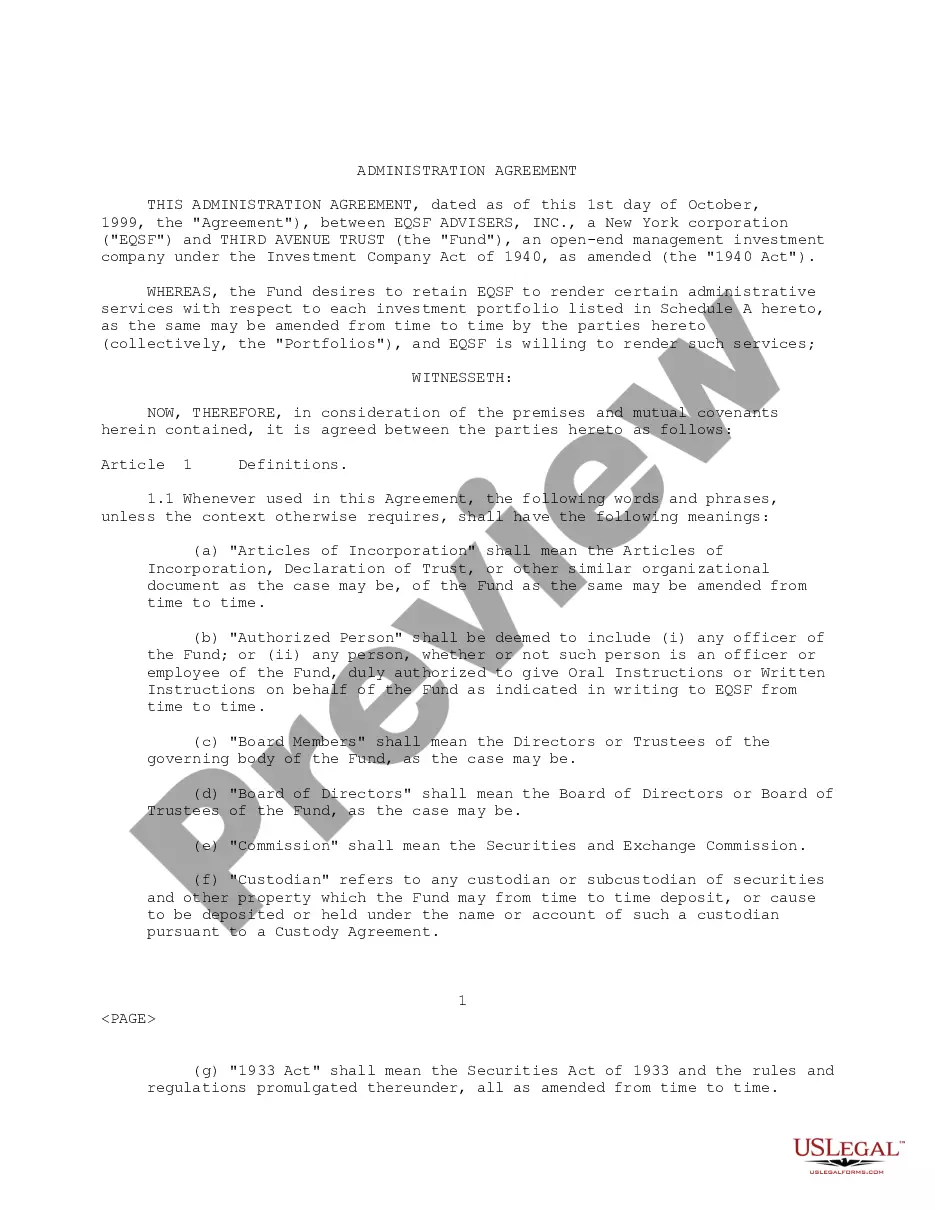

Yes, a trust can form part of a deceased estate, depending on its structure and the assets involved. When a person passes away, their trust assets may be included in the estate for settlement purposes if they do not have specified beneficiaries. Using an executor estate form with a trust helps clarify the status of these assets and ensures proper distribution according to the deceased's wishes. For comprehensive guidance, consider leveraging US Legal Forms, which provides accurate documentation and resources.

The election to combine trust and estate allows the executor to treat both entities as a single estate for tax purposes. This can simplify the management of assets, making it easier to handle distributions. By utilizing the executor estate form with a trust, you facilitate a streamlined process that can reduce administrative burdens and improve efficiency. Many find this option beneficial as it can sometimes lead to tax advantages.

Yes, there is usually an executor if a trust exists, but their roles may differ. In most cases, a trust has a trustee, not an executor, who manages the trust assets according to the trust document. However, if the estate contains assets not transferred into the trust, an executor may still be needed to settle these assets. Utilizing the right Executor estate form with a trust can help facilitate this process effectively.

If you have a trust, you generally do not need an executor as the trust allows for the management of assets outside of probate. However, a trustee, who manages the trust per its terms, may still need to handle certain matters related to the estate. Utilizing an Executor estate form with a trust can assist in clarifying roles and ensuring that affairs are conducted smoothly, should the need arise.

The primary document that shows who the executor is typically includes letters testamentary issued by the probate court. This document clearly outlines your authority and responsibilities. When you utilize an Executor estate form with a trust, it helps in establishing your position and validating your actions during the estate administration process.

Yes, in Alabama, an estate can be settled without probate under certain circumstances, such as when the total value of the estate is below a specific threshold. This process often involves using an Executor estate form with a trust, allowing heirs to transfer assets without a lengthy court process. However, always consult a legal expert to ensure compliance with state laws and procedures.

You can obtain executor of estate paperwork by contacting the probate court in the county where the deceased lived. They can provide you with the necessary forms and guide you through the process. Additionally, platforms like US Legal Forms offer templates for an Executor estate form with a trust, making it easier to prepare your documents and ensuring compliance with legal standards.

To prove you are an executor, you need to present the court documents that establish your role, typically letters testamentary. These documents confirm your authority to manage the deceased's affairs. Keep in mind that having an Executor estate form with a trust is crucial, as it helps clarify your responsibilities and rights. This will be beneficial in discussions with financial institutions and heirs.

To prove you are the executor of the estate without a will, you generally need to provide documentation that shows you have been appointed by the court. This may include a court order or letters testamentary that grants you authority. In some cases, you may also need to gather evidence of the deceased's assets and debts. Utilizing an Executor estate form with a trust can make this process smoother.