Credit Agreement With Customers

Description

How to fill out Credit Agreement?

Precisely formulated official documentation is a crucial safeguard for preventing complications and legal disputes, but obtaining it without a lawyer's help may require time.

Whether you need to swiftly locate an updated Credit Agreement With Customers or other forms for employment, family, or business needs, US Legal Forms is always available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the selected document. Moreover, you can access the Credit Agreement With Customers at any time later, as all documents obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official documents. Try US Legal Forms now!

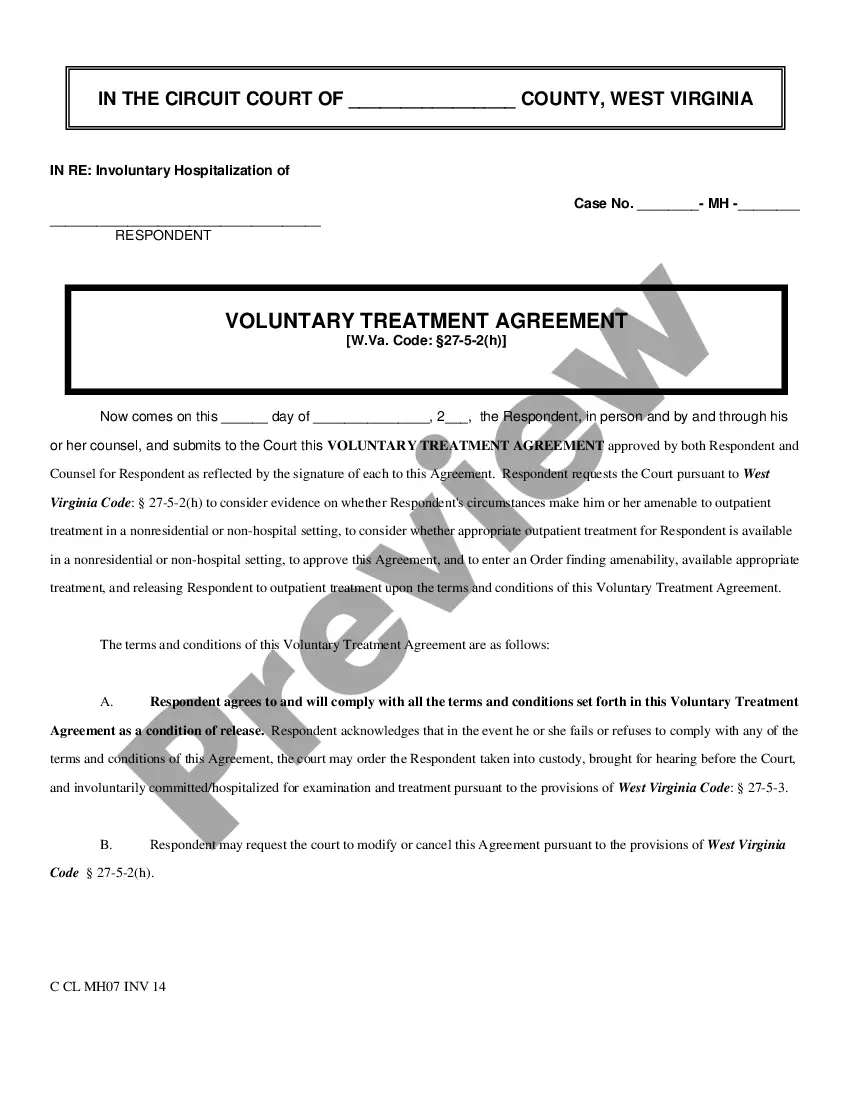

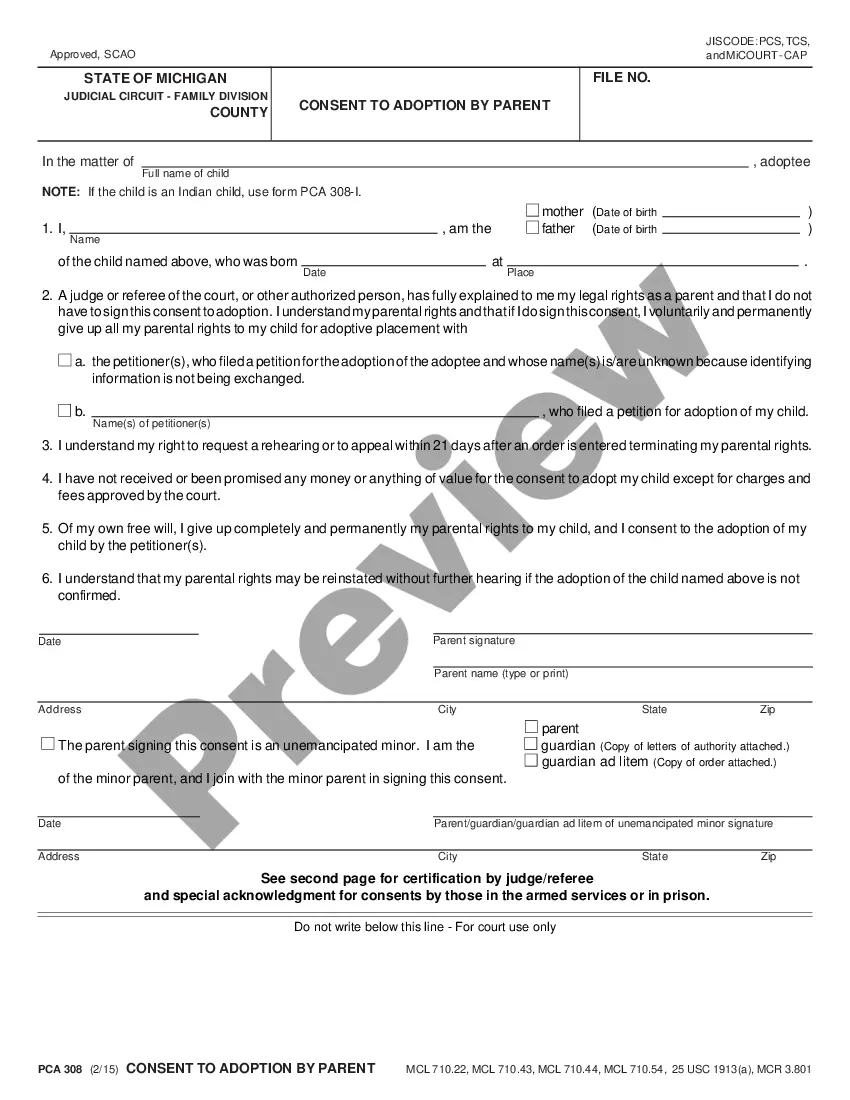

- Ensure that the form is appropriate for your situation and region by reviewing the description and preview.

- Search for another template (if necessary) through the Search bar located in the page header.

- Click Buy Now when you find the relevant template.

- Choose the pricing option, Log In to your account, or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Choose PDF or DOCX file format for your Credit Agreement With Customers.

- Click Download, and then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

A credit agreement is a legally binding agreement entered into between a lender and a borrower. It outlines all of the terms of the borrowing relationship, such as the interest rate, costs of originating the loan, and other borrower and lender rights and obligations.

A loan agreement spells out the details of the transaction, including the loan amount, the interest rate, and the terms. Lenders expect business borrowers to meet certain reporting and financial requirements; if you don't, they can recall your loan.

Most credit agreements are covered by the Consumer Credit Act and must include your rights when entering into the agreement. Your creditor must give you a written copy of the agreement clearly outlining: Details on the nature of the agreement. The total cost of the credit, including interest and other fees.

Giving Your Customers Credit: Do's and Don'tsDo check references. Call your customers' vendors and find out if they pay their bills on time.Do use a credit application.Do get a credit report.Do establish a credit policy.Don't extend too much credit.Don't extend credit informally.Do consider the company type.

Important lending terms included in the credit agreement include the annual interest rate, how the interest is applied to outstanding balances, any fees associated with the account, the duration of the loan, the payment terms, and any consequences for late payments.