Vehicle Title Application Form Washington State

Description

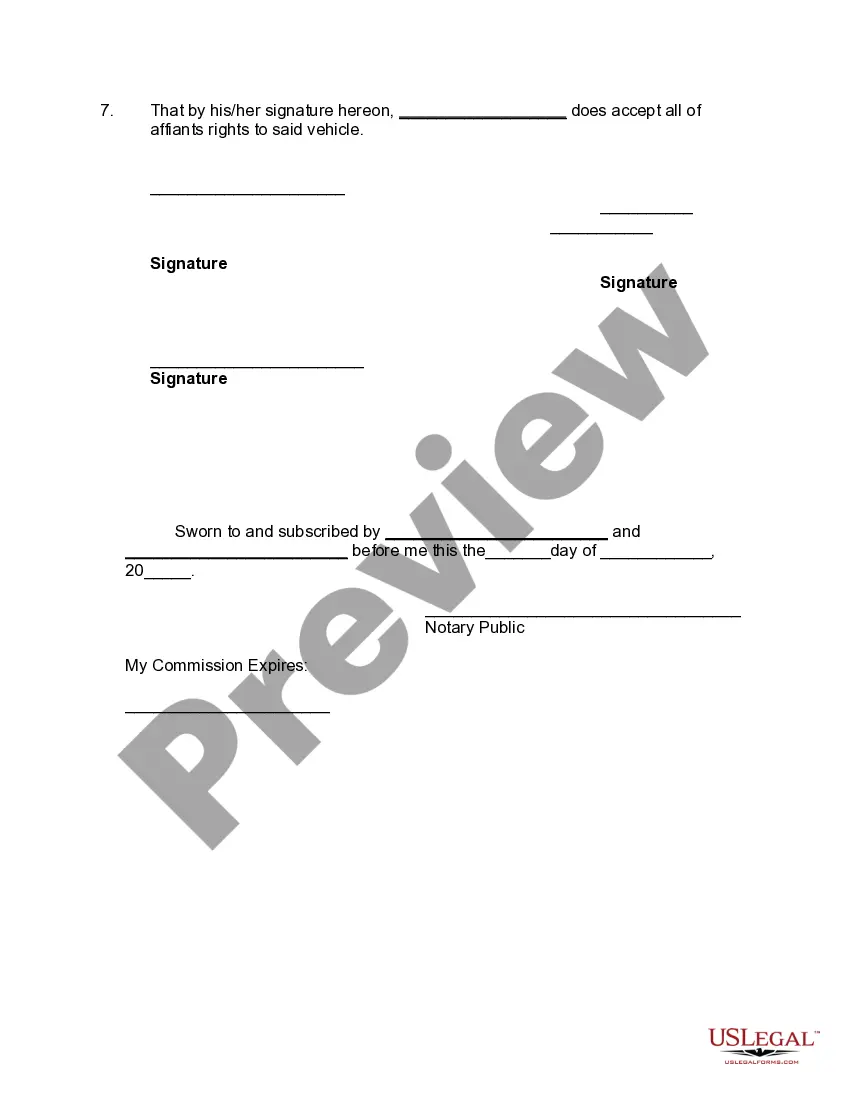

How to fill out Affidavit By Heirs Regarding Agreement As To Who Shall Inherit Motor Vehicle - To Obtain Transfer Of Title?

The Vehicle Title Application Document Washington State showcased on this site is a reusable official template crafted by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 validated, state-specific documents for any personal or business situation. It’s the quickest, most simple, and most reliable method to acquire the forms you require, as the service ensures the utmost level of data protection and anti-malware safety.

Register for US Legal Forms to have confirmed legal templates for every aspect of life at your fingertips.

- Search for the document you require and examine it.

- Review the sample you found and check it or go through the form description to make sure it meets your needs. If it doesn’t, utilize the search bar to locate the correct one. Hit Buy Now once you have identified the template you want.

- Opt-in and sign in.

- Select the pricing option that works for you and set up an account. Use PayPal or a credit card for a swift transaction. If you possess an existing account, Log In and verify your subscription to proceed.

- Acquire the fillable template.

- Select the format you prefer for your Vehicle Title Application Document Washington State (PDF, Word, RTF) and download the sample onto your device.

- Complete and sign the paperwork.

- Print the template to fill it out manually. Alternatively, use an online all-in-one PDF editor to quickly and accurately complete and sign your document with a legally binding electronic signature.

- Re-download your documents anytime.

- Access the same document again whenever necessary. Open the My documents tab in your profile to redownload any forms you’ve previously purchased.

Form popularity

FAQ

Your Entity Identification Number is assigned by the Maryland Department of Assessments and Taxation. It is an alpha-numeric identifier that appears on the acknowledgement received from that Department. The identifier can also be found on that Department's website at .dat.state.md.us.

You can apply for a FEIN online or download the form through the IRS' website, or can call them at 1-800-829-4933. Remember, you must have a Maryland SDAT Identification Number in order to apply for a Federal Employer Identification Number.

We offer several ways for you to obtain Maryland tax forms, booklets and instructions: Download them. You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

Applying for an EIN for your Maryland LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.

This is also sometimes referred to as an Employer Identification Number (EIN), or a Federal Tax ID Number. Some reasons for obtaining a FEIN include, but are not limited to: Paying federal and state taxes. Obtaining a Maryland Tax ID Number from the Maryland Comptroller's Office. Opening a business bank account.

Most Maryland businesses will need an EIN, since most will either be formed by multiple people, need to hire employees, or will apply for loans and bank accounts. However, you may also need a Maryland state tax ID.

Ask the IRS to search for your EIN by calling the Business & Specialty Tax Line at 800-829-4933. The hours of operation are a.m. - p.m. local time, Monday through Friday.

If you received UI benefits from the Maryland Division of Unemployment Insurance, the payer is the Maryland Department of Labor. The Maryland Department of Labor Federal ID # is: 52-2006962. You will use the same Payer's Identification Number for both your federal and state income tax returns.