Contract Cost Plus Form With Decimals In Ohio

Description

Form popularity

FAQ

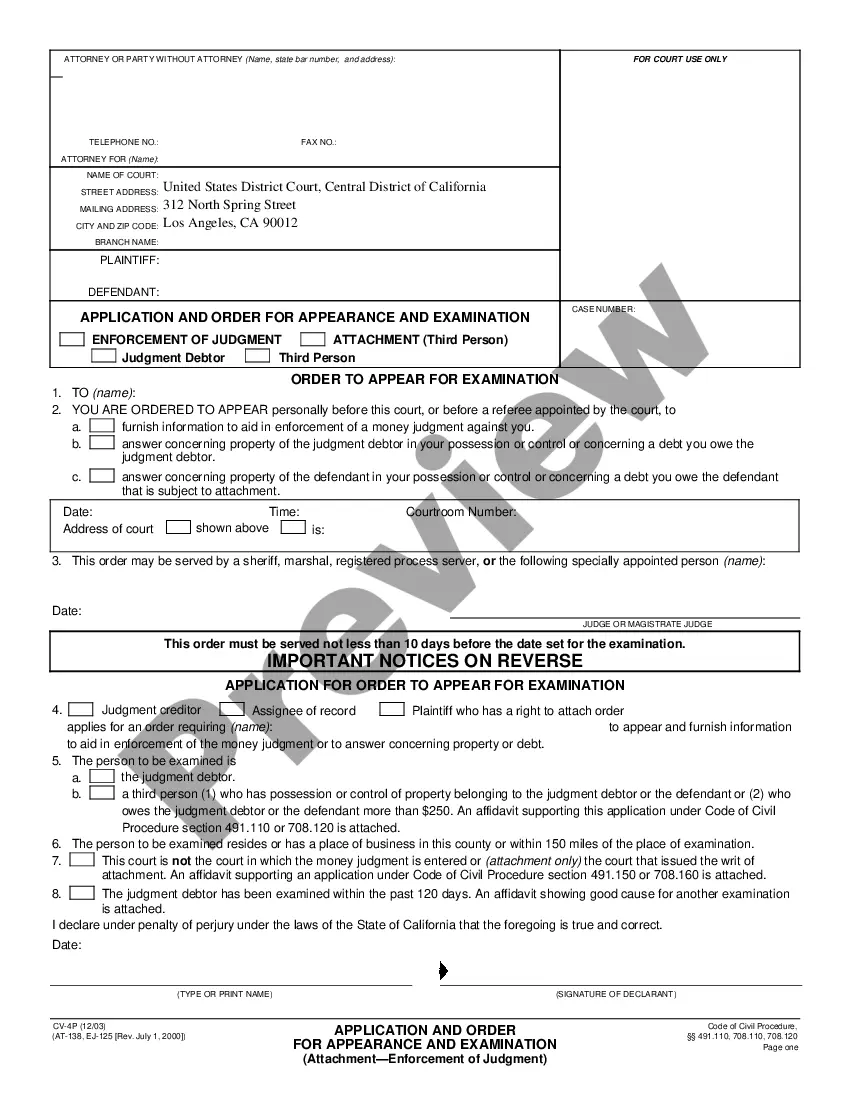

The apportionment formula calculates the percentage of the property, payroll and sales of the unitary business, which are attributable to California. The total business income of the unitary business is multiplied by this percentage to derive the amount of business income apportioned to this state.

Basic Concepts of Apportionment: An important concept is that the number of seats a state has is proportional to the population of the state. In other words, states with large populations get lots of seats and states with small populations only get a few seats.

Form IT-1140, Schedule E or Form 4708, Schedule V calculating for all partners: 1065 Ohio (OH) . The composite return can be filed for all partner types except C-corporations.

Calculate Ohio adjusted gross income by applying Ohio additions and deductions to federal adjusted gross in come, as reported on the federal form 1040. Calculate Ohio taxable income by subtracting personal and dependent exemptions from Ohio adjusted gross income.

The amount of business income and deductions apportioned to Ohio is determined by multiplying the net business income by an Ohio apportionment ratio, which is the sum of the property, payroll and sales factors (please refer to the business income worksheet on Ohio IT 2023, Part III).

Apportionment is the determination of the percentage of a business' profits subject to a given jurisdiction's corporate income or other business taxes. U.S. states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders.

An amended Ohio form IT 4708, which the pass-through entity files as a result of an adjustment to the federal tax return, form 1065 or 1120S, is deemed a report subject to assessment.

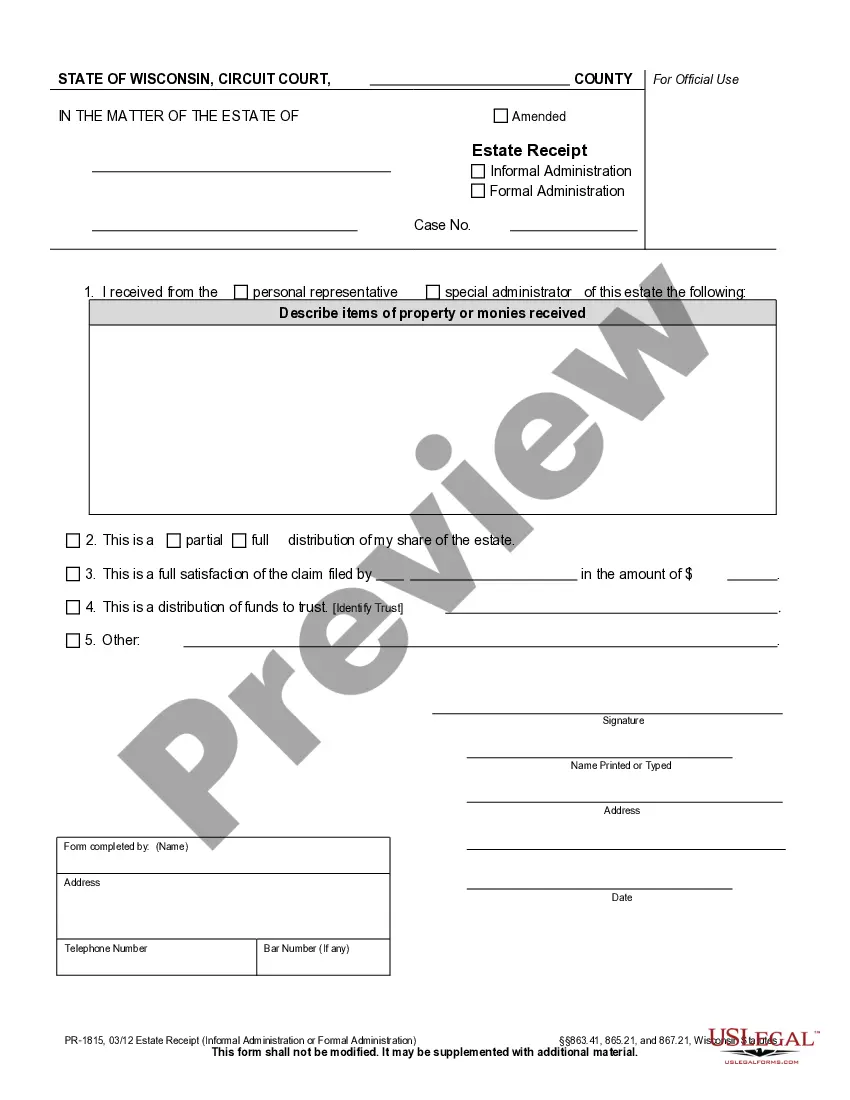

Who Has To File a Return? All estates not excluded above, residing in Ohio or earning or receiving income in Ohio, must file an Ohio Fiduciary Income Tax Return (Ohio form IT 1041) for the taxable year.