Construction Contract Cost Plus Withholding Tax In Illinois

Description

Form popularity

FAQ

Your Income Taxes Breakdown TaxMarginal Tax RateEffective Tax Rate Federal 22.00% 11.19% FICA 7.65% 7.65% State 4.95% 4.77% Local 0.00% 0.00%4 more rows •

If an Illinois resident employee has performed work for more than 30 working days from their home in Illinois for an out-of-state employer, the employer may be required to register with the Illinois Department of Revenue (IDOR) and withhold Illinois Income Tax from the employee.

Illinois has a flat 4.95 percent individual income tax rate. Illinois has a 9.5 percent corporate income tax rate. Illinois also has a 6.25 percent state sales tax rate and an average combined state and local sales tax rate of 8.86 percent.

An Illinois withholding exemption is the portion of your payments on which you do not withhold Illinois Income Tax. This amount is calculated based on the number of allowances claimed on Form IL-W-4, Employee's and other Payee's Illinois Withholding Allowance Certificate and Instructions.

Hours and days of rest in every consecutive seven-day period. (a) Every employer shall allow every employee except those specified in this Section at least twenty-four consecutive hours of rest in every consecutive seven-day period in addition to the regular period of rest allowed at the close of each working day.

The 70/30 rule is one that states a general-education class can only have 30 percent special education students. This rule was put in place as a protection for special education students.

Stay under 183 days: Illinois's tax authorities consider you a resident if you spend 183 days or more in the state during a calendar year. To avoid being classified as a resident, you should spend fewer than 183 days in Illinois each year. This includes any visits back to Illinois, so plan your travel carefully.

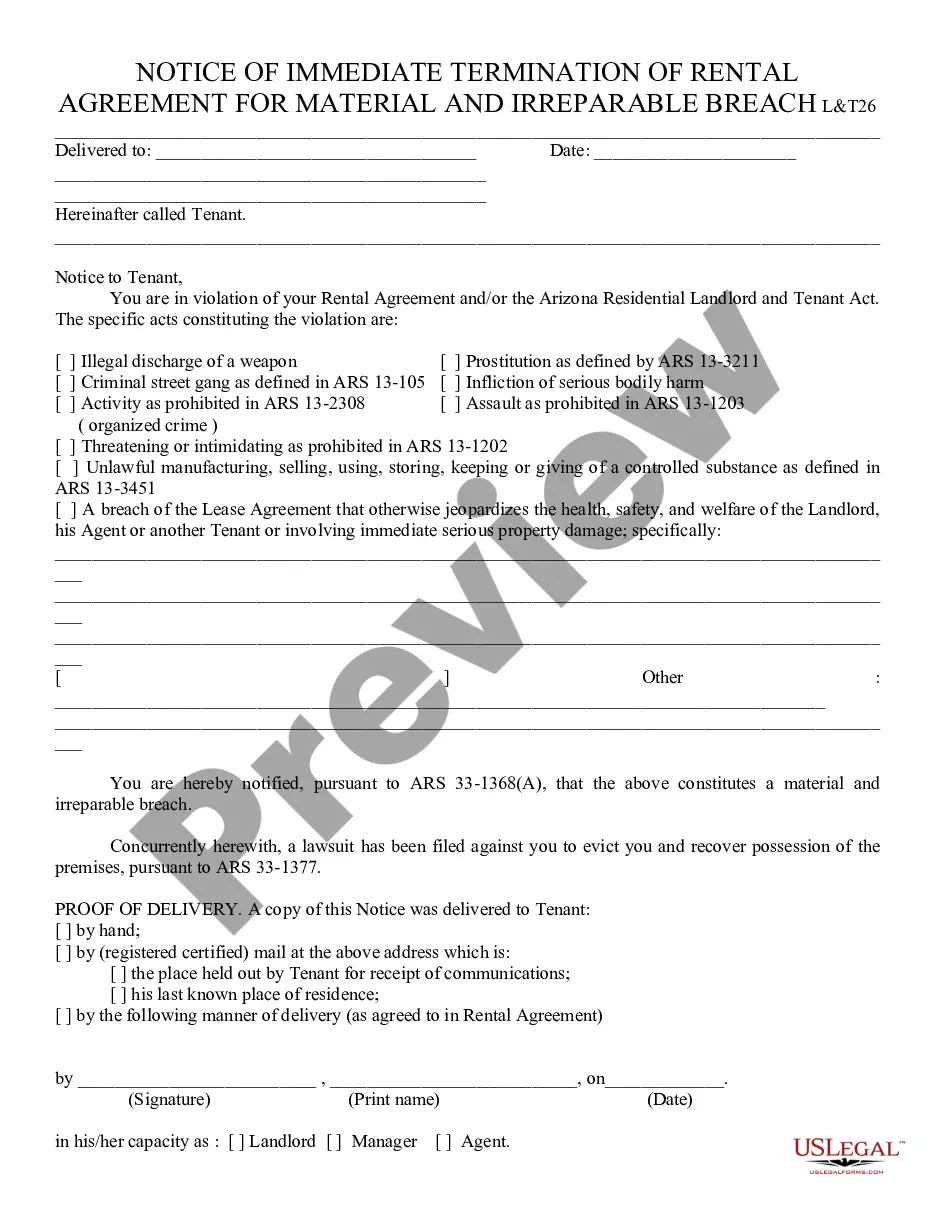

Your landlord must notify you in writing that he/she intends to terminate the lease. If you are renting month-to-month, you are entitled to a 30-day written notice. Leases running year-to-year require a 60-day written notice.

Charitable, religious, educational, or government organizations. However, exemptions for charitable organizations vary in scope and requirements.