Atv Form With Retail Formula In Orange

Description

Form popularity

FAQ

You will be allowed to register the vehicle without an inspection. When your next annual registration renewal is due, you must have the vehicle inspected to renew your registration.

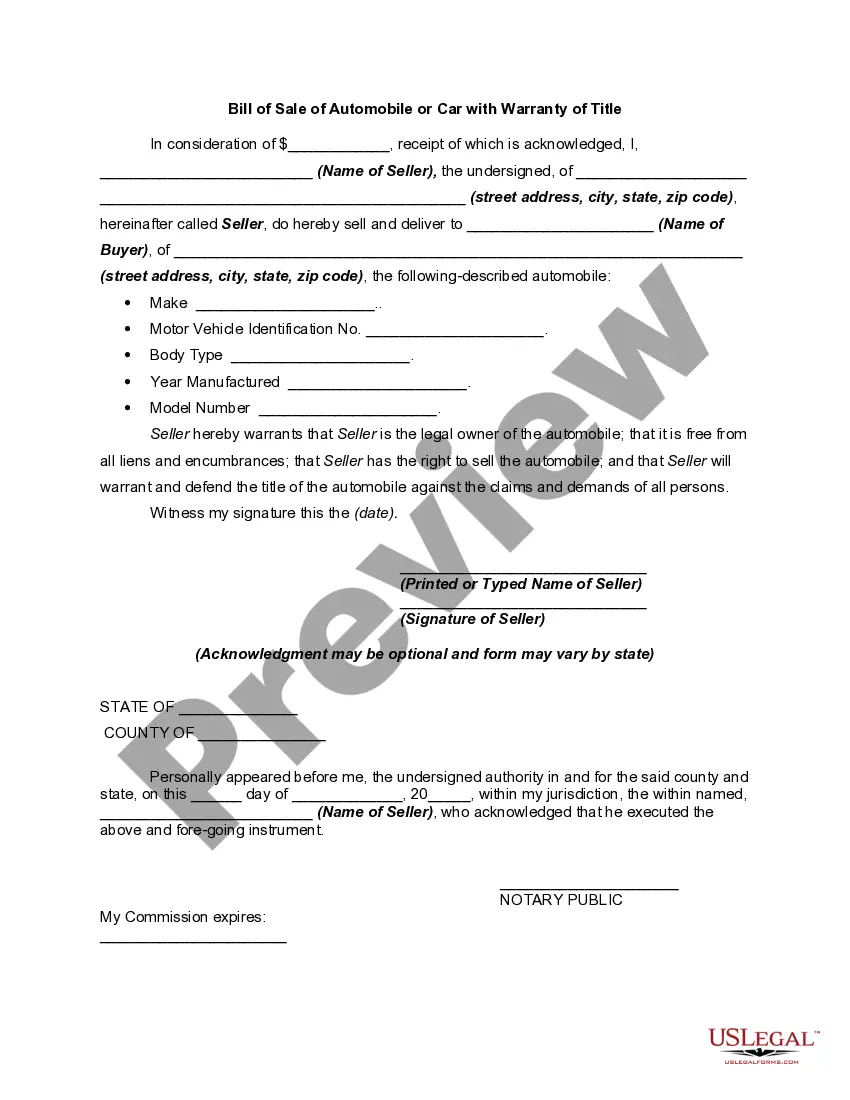

North Carolina A car can be titled in a minor's name as long as the owner can sign their name on the title application. However, a driver's license or plate cannot be issued without proof of liability insurance on the vehicle, and insurance companies rarely write policies for minors.

To transfer a vehicle title in North Carolina, you need a signed vehicle title, an odometer disclosure, a completed Title Application (MVR-1), proof of identity, and a Bill of Sale. For inherited vehicles, you'll also need a death certificate and legal proof of ownership.

To get a new North Carolina license plate, a vehicle must be titled and registered with the N.C. Division of Motor Vehicles and also pass a safety inspection, and if necessary, an emissions inspection. An individual must visit an NCDMV license plate agency when getting a license plate for the first time.

To get a new North Carolina license plate, a vehicle must be titled and registered with the N.C. Division of Motor Vehicles and also pass a safety inspection, and if necessary, an emissions inspection. An individual must visit an NCDMV license plate agency when getting a license plate for the first time.

The California 100 Initiative engaged a diverse set of Californians directly to create a vision for our state's future that is innovative, sustainable, and equitable for all. We worked to strengthen California's ability to collectively solve problems and shape our long-term future for the next generation.

The 15-Day Rule If you register your new business entity within the last 15 days of the year and do not conduct any business in California during that year, you are exempt from the Franchise Tax for that year.

CA 100 or 100 S California corporations and S corps are generally subject CA franchise tax. The California Minimum Franchise Tax of $800 will be automatically calculated for applicable corporate and S corp returns on CA Form 100, page 2, line 23 or CA Form 100S, page 2, line 21.

What Is CA Form 100? The California Corporation Franchise or Income Tax Return serves as a tax document for corporations functioning in California. Its purpose is to declare income, compute tax liability, and meet tax responsibilities to the state.

You can also calculate Average Transaction Value in excel by generating your sales data and entering them in an excel sheet and then using a simple divide function that divides the sales value by the number of transactions as shown here.