This form is a generic Bill of Sale for a Snowmobile from an individual rather than from a dealer. No warranty is being made as to its condition.

Bill Of Sale Form For Snowmobile In Bexar

Description

Form popularity

FAQ

States mandate specific title transfer processes for snowmobiles. Here's an overview of key states and their laws: California: Requires the seller to complete the title and provide a bill of sale. The buyer must then submit the application to the DMV within 10 days.

Bill of Sale for Car in Texas Date of sale: The exact date when the sale takes place. Seller details: Full name and address of the seller. Buyer details: Full name and address of the buyer. Vehicle details: Made, model, and year of vehicle, VIN, odometer reading, and (optional) license plate number.

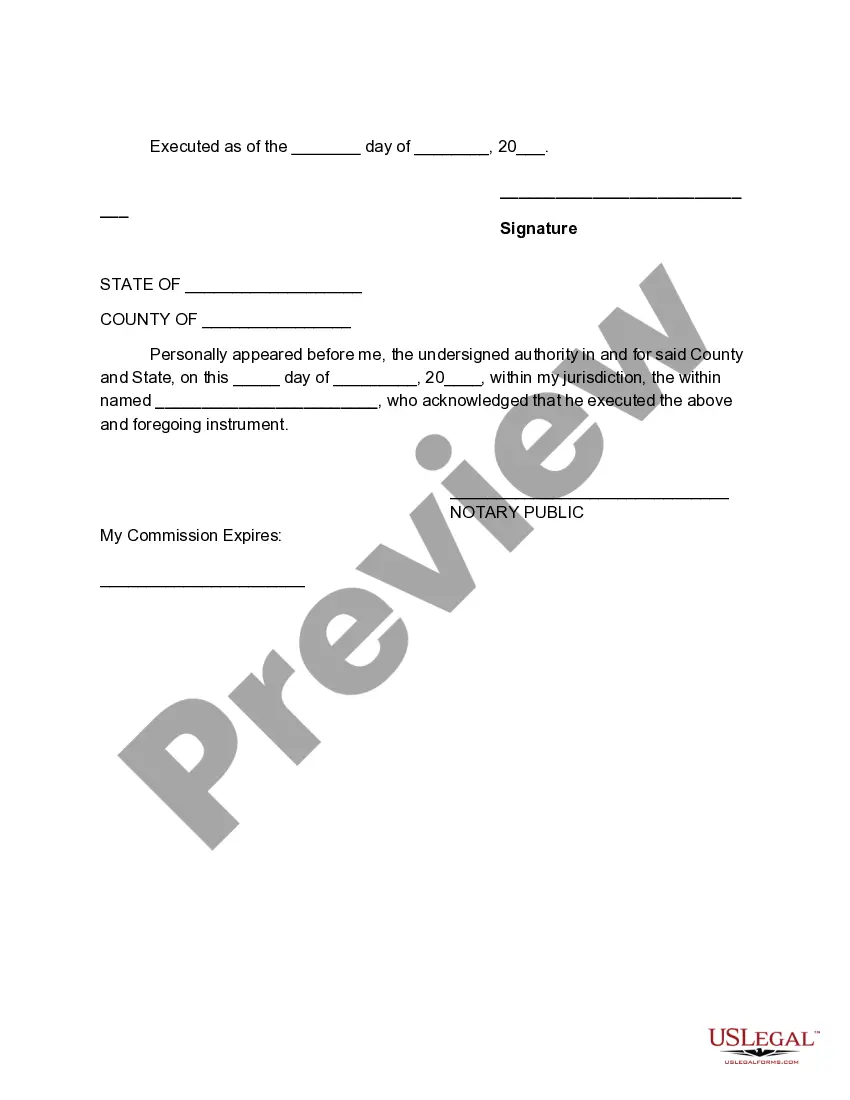

For extra security you can also notarize the form as an additional protection measure. If you needMoreFor extra security you can also notarize the form as an additional protection measure. If you need to be sure your snowmobile bill of sale is created in line with your state's laws and regulations.

Even though it is not a legal requirement in Texas, you have every reason to complete a bill of sale when selling your car.

Starts right here. It is with the sale date. And then signature of seller. And printed name ofMoreStarts right here. It is with the sale date. And then signature of seller. And printed name of seller make sure again you sign the back exactly as it appears on the front.

Sellers need to submit a Vehicle Transfer Notification (Form VTR-346) to make sure the state record shows the car or truck was sold. You must have the name and address of the buyer to complete the form. Submitting this form is important even if you sold or traded your vehicle to a dealer.

Texas refers to its bill of sale documents as Vehicle Transfer Notifications. The official document is called a Form VTR-346, and it includes details about the car, sale, seller, and buyer, specifically: Vehicle Identification Number, or VIN. Year, make, body style, and model of the vehicle.

A transfer of a motor vehicle without payment of consideration, that does not qualify as a gift, is a retail sale and is subject to the 6.25 percent motor vehicle tax.

Blanket exemption certificate. A purchaser may provide a blanket Motor Vehicle Sales Tax Exemption Certificate to a seller when purchasing motor vehicles to be used exclusively outside of Texas. The seller may rely on the blanket certificate until it is revoked in writing.

The Bexar County Tax office main office is located at: Vista Verde Plaza Building 233 N. Pecos La Trinidad San Antonio, Texas 78207 The main office is operated Monday through Friday 8a-pm with extended hours on Wednesdays from 8a-pm. They can be reached at (210) 335-2251.