S Corporation Without Payroll In Utah

Description

Form popularity

FAQ

An S corporation is not subject to Utah income tax. However, shareholders are liable for Utah income tax in their separate or individual capacities.

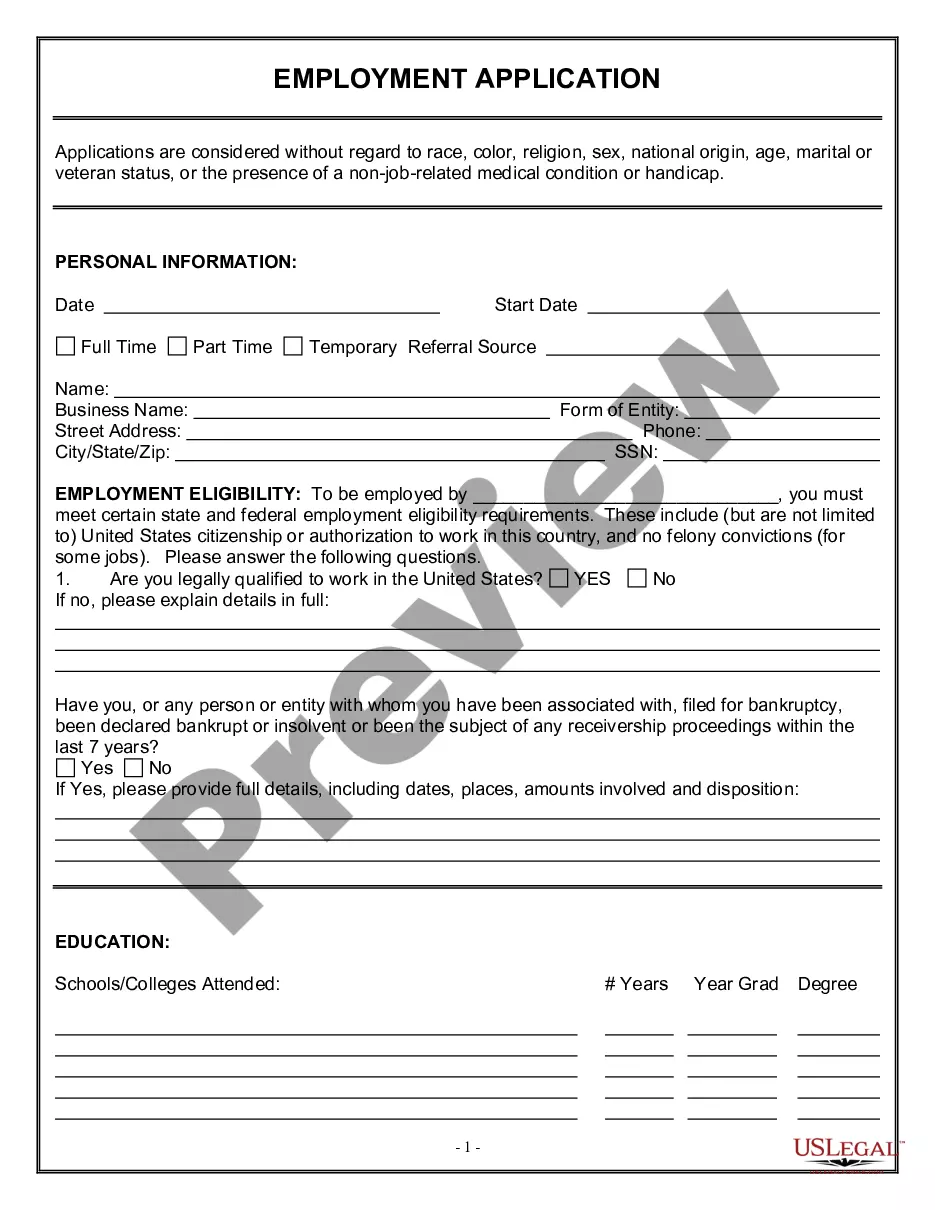

Choose a business name for your S corp. File articles of incorporation. Issue stock for your S corp. Elect a board of directors and appoint officers. Meet other S corp eligibility requirements. Obtain an employer identification number. Elect S corp status. Apply for state and local S corp business licenses.

An S corporation is not subject to Utah income tax. However, shareholders are liable for Utah income tax in their separate or individual capacities.

You maintain a place of abode (i.e., the place where you usually live) in Utah and spent 183 or more days of the tax year in Utah. You or your spouse did not vote in Utah during the tax year but voted in Utah in any of the three prior years and were not registered to vote in another state during those three years.

How to Start A Corporation In Utah Name Your Corporation. Designate a Registered Agent. Submit Articles of Incorporation. Get an EIN. File the Beneficial Ownership Information Report. Write Corporate Bylaws. Hold an Organizational Meeting. Open a Corporate Bank Account.

Closing UT Withholding Account: To close your Utah Withholding account please complete form TC-69c. In section A1, input the closure date as the day before your premiere date with Justworks. To send the completed form to the state, there is both a fax number and a mailing address listed near the bottom of the document.

Closing UT Withholding Account: To close your Utah Withholding account please complete form TC-69c. In section A1, input the closure date as the day before your premiere date with Justworks. To send the completed form to the state, there is both a fax number and a mailing address listed near the bottom of the document.

Corp Election teps for Corporations tep 1 Name your Utah corporation. tep 2 Appoint directors. tep 3 Choose a Utah registered agent. tep 4 File the Utah Articles of Incorporation. tep 5 Create corporate bylaws. tep 6 Draft a shareholder agreement. tep 7 Issue shares of stock.

One class of stock An S corporation may issue only one type of stock. A corporation will not be treated as having more than one class of stock purely because there is some discrepancy in the voting rights among the shares of the common stock.