S Corporation With Foreign Shareholder In Nevada

Description

Form popularity

FAQ

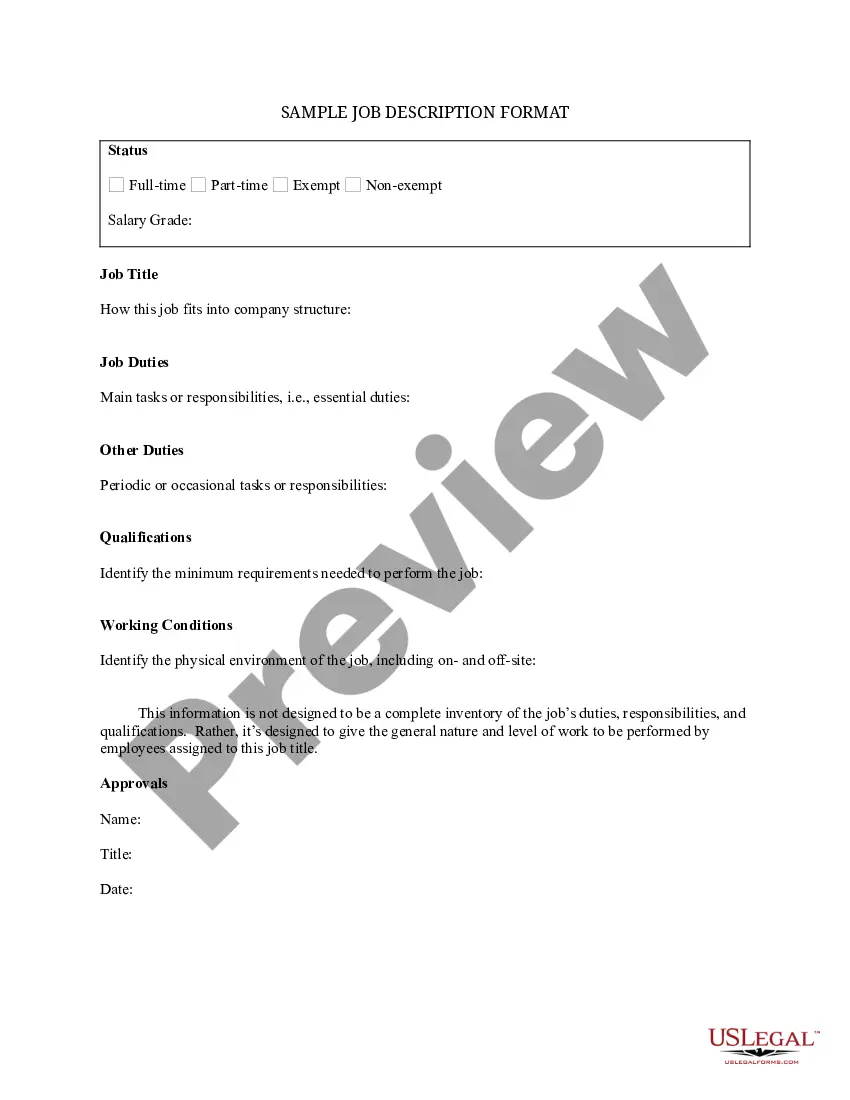

Is there a minimum salary for S Corp shareholder-employees? No — the IRS can't require a minimum salary for self-employed workers. The requirement only comes into play if you're paying distributions to shareholders.

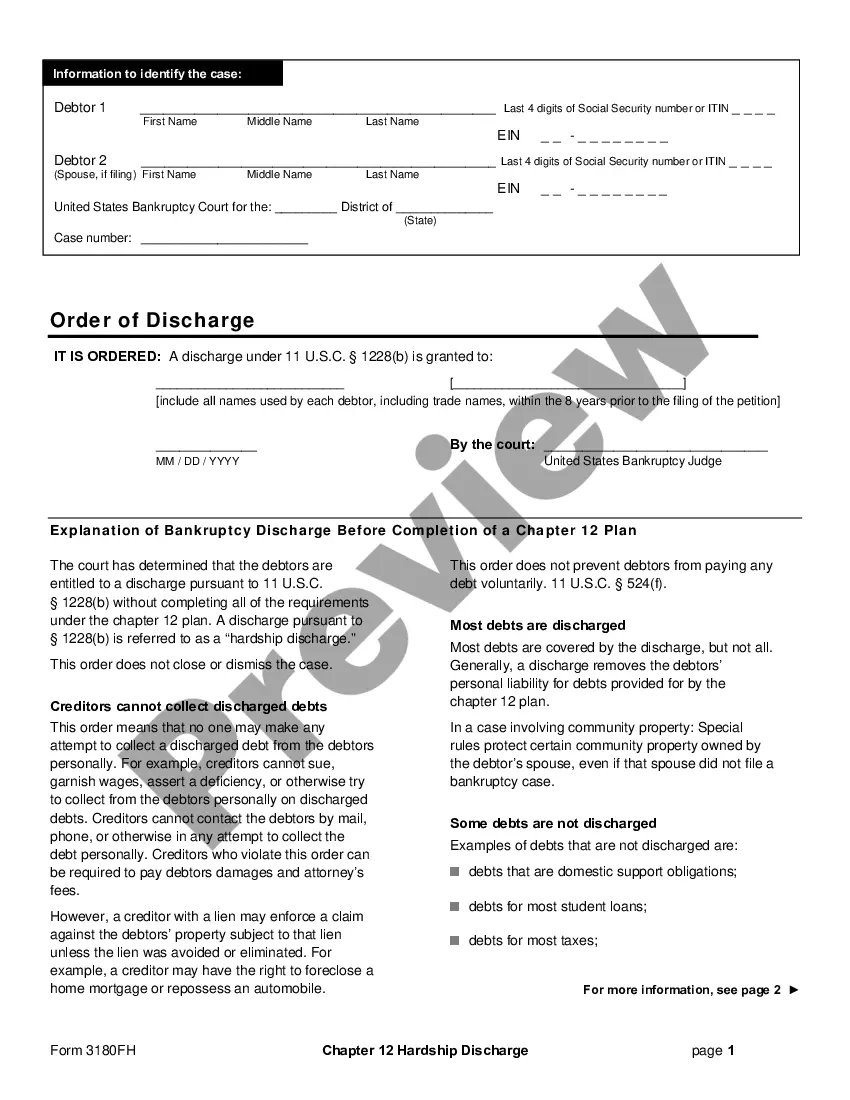

FL, SD and WY are typically the best for no personal/business taxes. Nexus rules still apply to other states.

If you're not a citizen, you must qualify as a resident alien to own a stake in an S Corp. Resident aliens are those who have moved to the United States and have residency but aren't citizens. Of the below, only permanent residents can own an S Corp.

You must file a Nevada Foreign Corporation Qualification Application (NRS 80) in order to be registered as a foreign corporation in Nevada. It costs at least $75 to file. The information you'll need to have on hand in order to complete the application is as follows: Name of corporation.

How to Start an S-Corp in Nevada Step 1 – Choose a name. Step 2 – Choose a registered agent. Step 3 – File Nevada Articles of Organization. Step 4 – Create an operating agreement. Step 5 – Apply for an EIN. Step 6 – Apply for S Corp status with IRS Form 2553.

Pass-Through Taxation: Unlike C corporations, where the business itself is subject to taxation on its profits and shareholders are taxed again on dividends, S corps can avoid double taxation. Profits and losses “pass-through” to the individual shareholders, who report them on their personal income tax returns.

Nevada does not recognize the federal S corporation election because there is no state income tax. For this same reason, Nevada does not require a state-level S corporation election.

If you're not a citizen, you must qualify as a resident alien to own a stake in an S Corp. Resident aliens are those who have moved to the United States and have residency but aren't citizens. Of the below, only permanent residents can own an S Corp.

To qualify for s corp status in Nevada, a business must be an LLC with no more than 100 shareholders and offer only one form of stock. All S corp shareholders must be U.S. citizens or resident aliens.