S Corporation With No Employees In Clark

Description

Form popularity

FAQ

Wyoming, Delaware, and Nevada are among the top states for forming holding companies due to their favorable business environments, asset protection, and low taxes.

The following 10 states are among those most frequently cited as the best states to start a business in America. Texas. North Carolina. Indiana. South Dakota. Nevada. 1.17% General Business Modified Business Tax rate. Montana. 6.75% corporate tax rate. Alaska. 9.4% corporate tax rate. New Hampshire. 7.5% corporate tax rate.

If you run an LLC, it's automatically taxed as a sole proprietorship or partnership, but you can elect to be taxed as a corporation instead. S Corp is the more likely choice for an LLC, while C Corps are usually corporations.

The appeal of Delaware and Nevada Some potential advantages of forming your corporation or LLC in Delaware include: Delaware's corporation and LLC laws are considered the most flexible in the country. The Court of Chancery has expertise in business law and uses judges instead of juries.

FL, SD and WY are typically the best for no personal/business taxes. Nexus rules still apply to other states.

Disadvantage #1: Not Making Enough Taxable Income If your business is not earning enough income, the costs of an S-Corporation may outweigh the benefits. Many tax advisors believe that business income should exceed $40,000 before considering an S-Corporation.

Yes, a single member LLC can form an S Corp. This structure is popular among solo entrepreneurs who want to benefit from the tax advantages of an S Corporation and the liability protection of an LLC. Remember, while you're the only owner, your LLC is a separate legal entity from yourself for legal purposes.

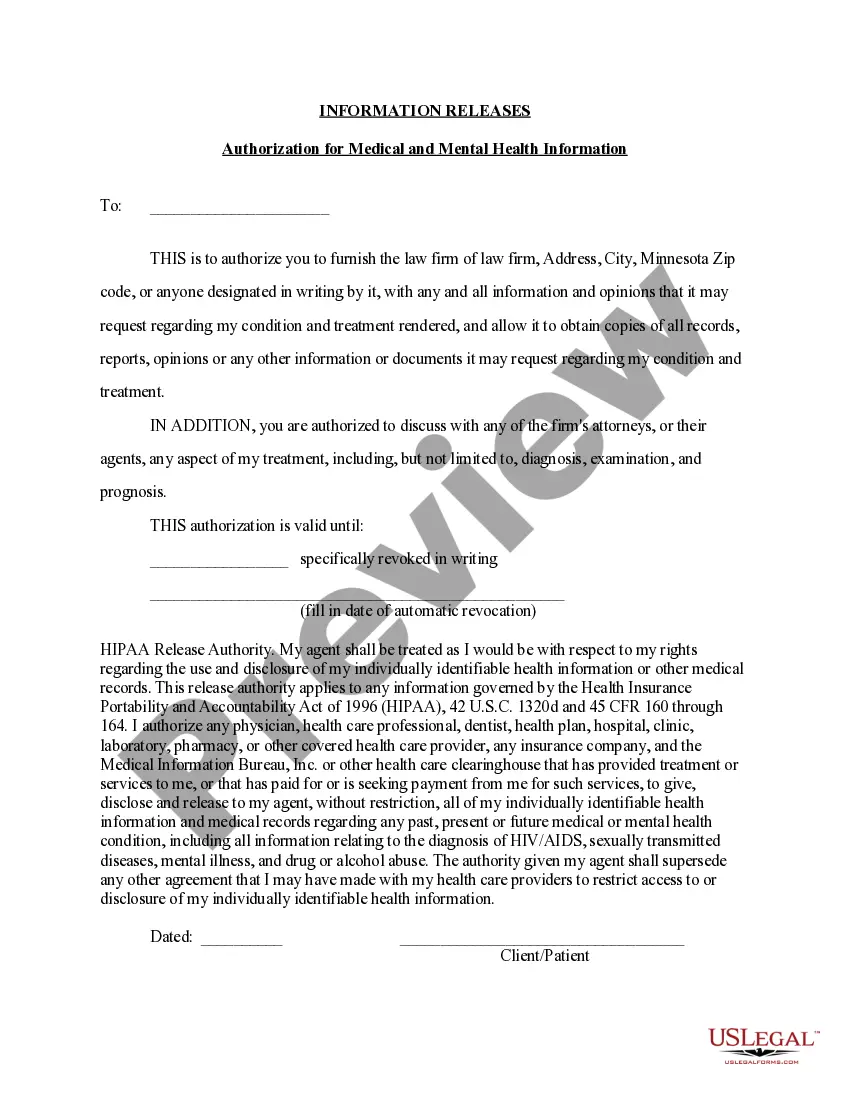

In principle, an S corporation can have no employees. However, in practice payments to its officers may be classified as wages, with tax implications.

As distinct legal entities, corporations have a variety of legal rights, including the ability to hire employees. This means that a corporation can have zero employees or can hire hundreds, or even thousands, of people. Existence in Perpetuity: A corporation exists once it has filed the Articles of Incorporation.

S Corporation All corporations must file a tax return, even if it was inactive or didn't receive income. An S-corporation or LLC taxed as an S-corporation will file Form 1120-S and Schedule K-1 for federal income tax purposes.