Business Status Forfeited In Clark

Description

Form popularity

FAQ

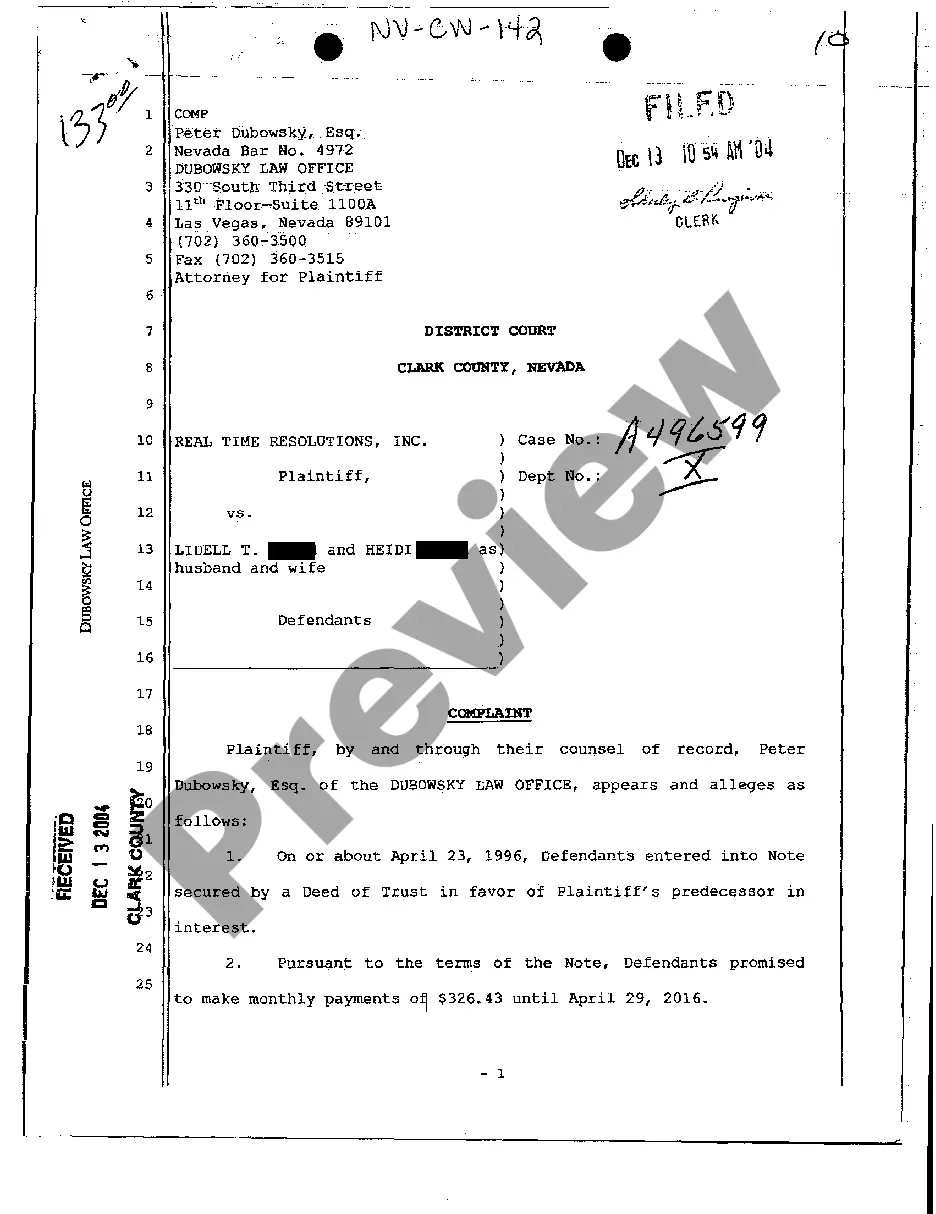

So, you've got a forfeited LLC. Under Maryland law, your entity does not legally exist. That is, until you get sued. Many LLC members do not realize that they can be forced to defend a lawsuit against the LLC even after forfeiture.

In order to maintain Good Standing status, it is important that you file required annual reports and maintain compliance with any applicable Maryland laws. Failing to do so means your entity may be “Not in Good Standing,” which eventually leads to forfeiture.

“Forfeited” means the right of the entity to conduct business in the State of Maryland has been relinquished and it has no right to use its name. For domestic corporations, this also means that the business has no existence under the laws of the State of Maryland.

Forfeiture is the process that allows the Department to remove inactive entities that have not legally terminated their authority to do business in Maryland or to notify active entities of an existing oversight in meeting legal filing requirements.

Complete the Out of Business Form and email, mail, fax, or delivered in person to the Department. Email: Complete and scan the Out of Business Form and email to chap@ClarkCountyNV. Please make sure that there are no outstanding fees prior to closing a business.

File online at .nvsilverflume or return the completed form to the Secretary of State by fax to (775) 684-5725; by email to newfilings@sos.nv; or, by mail to 202 North Carson Street, Carson City, Nevada 89701-4201.

An inactive LLC is a company that has not engaged in any business activities during a given tax year. This could mean the LLC has not generated income, incurred expenses, or engaged in transactions. Despite being inactive, the LLC remains legal until it is formally dissolved.

Any ad account that hasn't run ads within the last 15 months may be closed due to inactivity. When an ad account is closed, your primary payment method is removed, your ads are turned off, and the closed account won't be able to publish new ads.

If a corporation or LLC is inactive by means of revocation or administrative dissolution, it cannot legally transact business in a state. This can impact the entire organization's ability to engage with clients, creditors, and other government agencies.

Reinstating a business requires filing with the Secretary of State, and often with the Department of Revenue or Taxation. Researching your business' unique requirements, and preparing all of the filings takes hours of your executives' time.