Educational Assistance Employees Form 109 In Fulton

Category:

State:

Multi-State

County:

Fulton

Control #:

US-00451BG

Format:

Word;

Rich Text

Instant download

Description

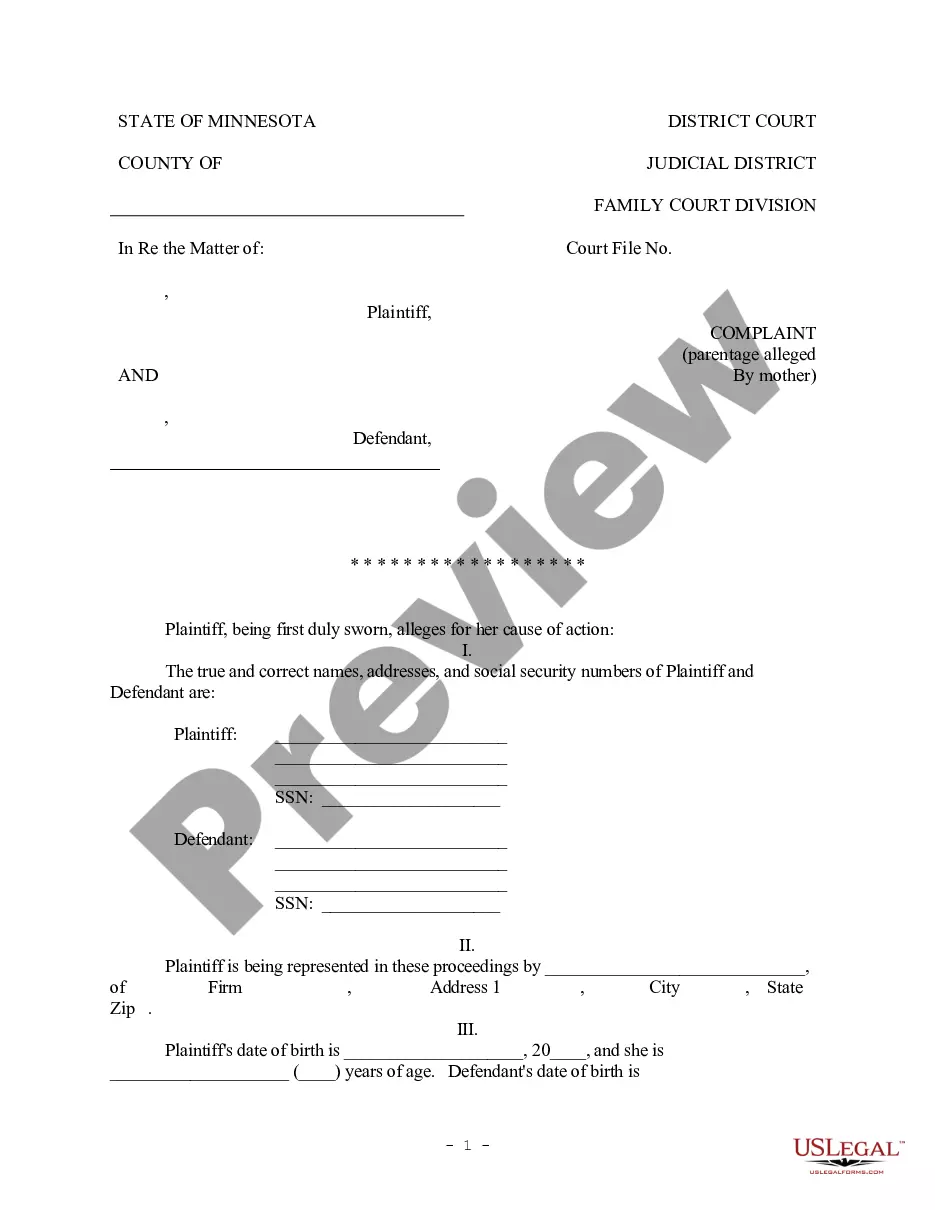

The Educational Assistance Employees Form 109 in Fulton serves as a formal agreement between an employer and an employee regarding educational support. This program allows eligible full-time employees, who have completed at least one year of service, to pursue approved courses at accredited institutions. Key features include reimbursement for tuition and registration fees based on grades received, with specific percentages outlined for each grade. Employees must seek prior approval for courses and submit necessary documentation for reimbursement, including a transcript and payment proof. If an employee leaves the company within two years of receiving reimbursement, they must repay the employer. This form is particularly useful for attorneys, partners, owners, associates, paralegals, and legal assistants as it encourages skill development while clarifying eligibility and reimbursement terms.

Free preview

Form popularity

FAQ

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a predetermined amount of continuing education credits or college coursework to be applied toward a degree.

Create a Strong Pitch for Tuition Reimbursement Approach your request like a formal negotiation. Be prepared with a clear, well-structured case outlining the skills you'll gain and how they'll benefit your team and company. If possible, gather supporting documents to make the process as easy as possible.